Seasons Limited would like to estimate the month end inventory by using the sales revenue earned during the month. It has the following sales and purchases information for the month of September to consider. Inventory, 1 September $500,000 1,300,000 50,000 Purchase Freight-in Sales 2,100,000 Sales returns 40,000 Purchase discounts 90,000

Seasons Limited would like to estimate the month end inventory by using the sales revenue earned during the month. It has the following sales and purchases information for the month of September to consider. Inventory, 1 September $500,000 1,300,000 50,000 Purchase Freight-in Sales 2,100,000 Sales returns 40,000 Purchase discounts 90,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.2BE: Perpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as...

Related questions

Topic Video

Question

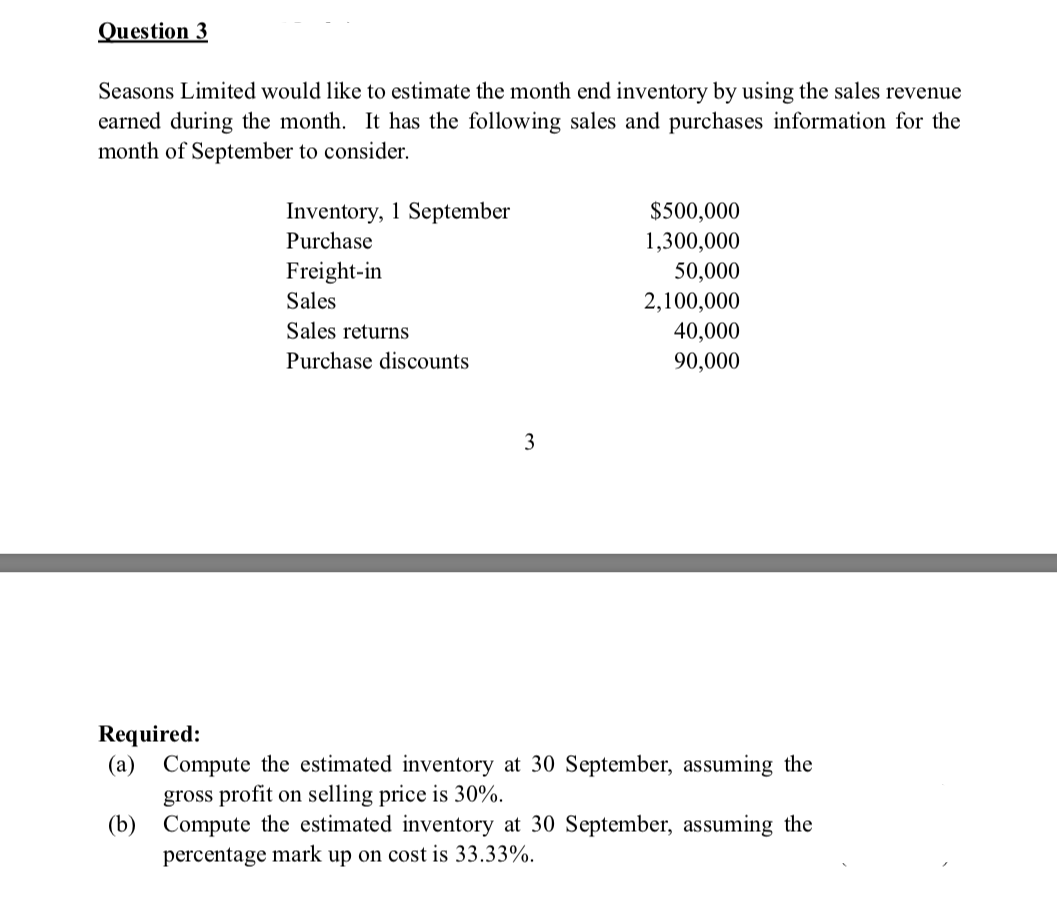

Transcribed Image Text:Question 3

Seasons Limited would like to estimate the month end inventory by using the sales revenue

earned during the month. It has the following sales and purchases information for the

month of September to consider.

Inventory, 1 September

$500,000

Purchase

1,300,000

Freight-in

50,000

2,100,000

40,000

Sales

Sales returns

Purchase discounts

90,000

3

Required:

(a) Compute the estimated inventory at 30 September, assuming the

gross profit on selling price is 30%.

(b) Compute the estimated inventory at 30 September, assuming the

percentage mark up on cost is 33.33%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning