Select all that are true regarding credit risk for a bank. OThis risk is an estimate of future uncollectibility that results in a provision expense on the bank's income statement. O Changes in the business cycle affect all firms the same, so credit risk is pro-cyclical. O Despite it's significance to banks, the housing market is a small part of the economy and has little effect elsewhere so there is no impact to credit risk. O Material changes in the housing market impacts banks and their credit risk significantly due to the relative size of the mortgage portfolios. O Business cycles create variations in this risk, but affect each borrower differently.

Select all that are true regarding credit risk for a bank. OThis risk is an estimate of future uncollectibility that results in a provision expense on the bank's income statement. O Changes in the business cycle affect all firms the same, so credit risk is pro-cyclical. O Despite it's significance to banks, the housing market is a small part of the economy and has little effect elsewhere so there is no impact to credit risk. O Material changes in the housing market impacts banks and their credit risk significantly due to the relative size of the mortgage portfolios. O Business cycles create variations in this risk, but affect each borrower differently.

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 23QTD

Related questions

Question

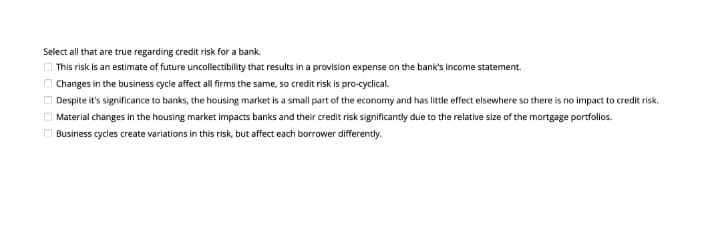

Transcribed Image Text:Select all that are true regarding credit risk for a bank.

O This risk is an estimate of future uncollectibility that results in a provision expense on the bank's income statement.

O Changes in the business cycle affect all firms the same, so credit risk is pro-cyclical.

O Despite it's significance to banks, the housing market is a small part of the economy and has little effect elsewhere so there is no impact to credit risk.

Material changes in the housing market impacts banks and their credit risk significantly due to the relative size of the mortgage portfollos.

O Business cycles create variations in this risk, but affect each borrower differently.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage