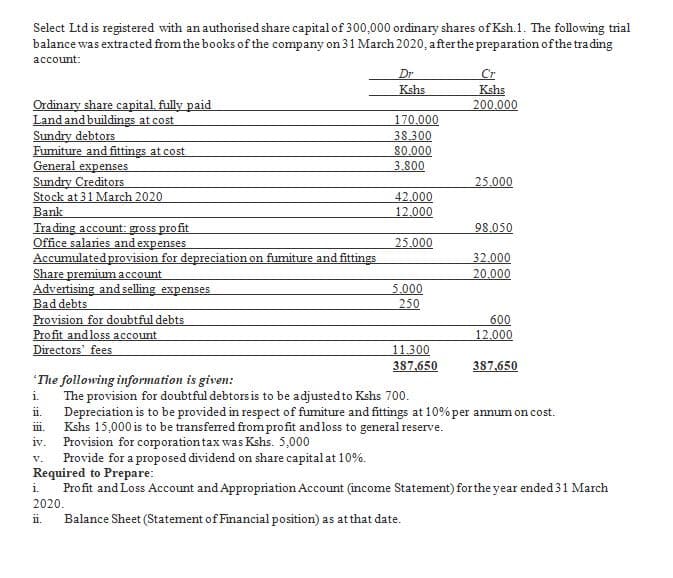

Select Ltd is registered with an authorised share capital of 300,000 ordinary shares of Ksh.1. The following trial balance was extracted from the books of the company on 31 March 2020, after the preparation of the tra ding account: Dr Cr Kshs 200.000 Kshs Ordinary share capital, fully paid Land and buildings at cost Sundry debtors Fumiture and fittings at cost General expenses Sundry Creditors Stock at 31 March 2020 Bank Trading account: gross profit Office salaries and expenses Accumulated provision for depreciation on fumiture and fittings Share premium account Advertising and selling expenses Bad debts Provision for doubtful debts Profit andloss account Directors' fees 170.000 38.300 80.000 3.800 25.000 42.000 12.000 98.050 25.000 32.000 20.000 5.000 250 600 12.000 11.300 387,650 387,650 'The following information is given: i. The provision for doubtful debtors is to be adjusted to Kshs 700. Depreciation is to be provided in respect of fumiture and fittings at 10% per annum on cost. Kshs 15,000 is to be transferred from profit and loss to general reserve. iv. Provision for corporation tax was Kshs. 5,000 Provide for a proposed dividend on share capital at 10%. Required to Prepare: i. Profit and Loss Account and Appropriation Account (income Statement) for the year ended 31 March i. 1. v. 2020. ii. Balance Sheet (Statement of Financial position) as at that date.

Select Ltd is registered with an authorised share capital of 300,000 ordinary shares of Ksh.1. The following trial balance was extracted from the books of the company on 31 March 2020, after the preparation of the tra ding account: Dr Cr Kshs 200.000 Kshs Ordinary share capital, fully paid Land and buildings at cost Sundry debtors Fumiture and fittings at cost General expenses Sundry Creditors Stock at 31 March 2020 Bank Trading account: gross profit Office salaries and expenses Accumulated provision for depreciation on fumiture and fittings Share premium account Advertising and selling expenses Bad debts Provision for doubtful debts Profit andloss account Directors' fees 170.000 38.300 80.000 3.800 25.000 42.000 12.000 98.050 25.000 32.000 20.000 5.000 250 600 12.000 11.300 387,650 387,650 'The following information is given: i. The provision for doubtful debtors is to be adjusted to Kshs 700. Depreciation is to be provided in respect of fumiture and fittings at 10% per annum on cost. Kshs 15,000 is to be transferred from profit and loss to general reserve. iv. Provision for corporation tax was Kshs. 5,000 Provide for a proposed dividend on share capital at 10%. Required to Prepare: i. Profit and Loss Account and Appropriation Account (income Statement) for the year ended 31 March i. 1. v. 2020. ii. Balance Sheet (Statement of Financial position) as at that date.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

Transcribed Image Text:Select Ltd is registered with an authorised share capital of 300,000 ordinary shares of Ksh.1. The following trial

balance was extracted from the books of the company on 31 March 2020, afterthe preparation of the tra ding

асcount:

Dr

Kshs

Kshs

200.000

Ordinary share capital, fully paid

Land and buildings at cost

Sundry debtors

Fumiture and fittings at cost

General expenses

Sundry Creditors

Stock at 31 March 2020

Bank

Trading account: gross profit

Office salaries and expenses

Accumulated provision for depreciation on fumiture and fittings

Share premium account

Advertising and selling expenses

Bad debts

Provision for doubtful debts

Profit andloss account

Directors' fees

170.000

38.300

80.000

3.800

25.000

42.000

12.000

98.050

25.000

32.000

20.000

5.000

250

600

12.000

11.300

387,650

387,650

The following information is given:

The provision for doubtful debtors is to be adjusted to Kshs 700.

i.

i.

Depreciation is to be provided in respect of fumiture and fittings at 10% per annum on cost.

Kshs 15,000 is to be transferred from profit andloss to general reserve.

iv.

111

Provision for corporationtax was Kshs. 5,000

Provide for a proposed dividend on share capital at 10%.

Required to Prepare:

Profit and Loss Account and Appropriation Account (income Statement) forthe year ended 31 March

v.

i.

2020.

ii.

Balance Sheet (Statement of Financial position) as atthat date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College