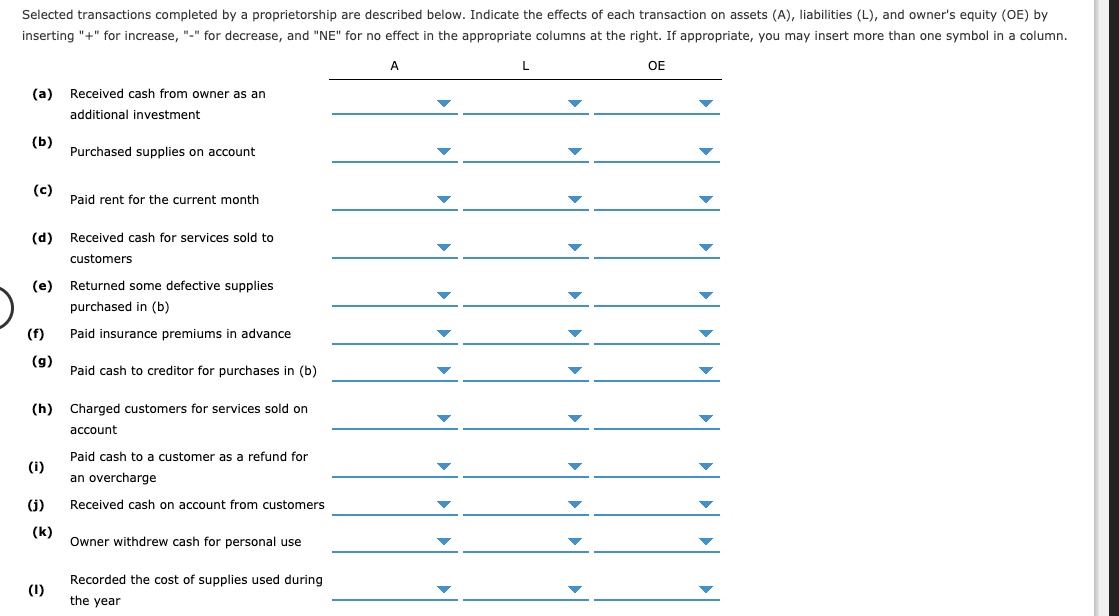

Selected transactions completed by a proprietorship are described below. Indicate the effects of each transaction on assets (A), liabilities (L), and owner's equity (OE) by inserting "+" for increase, "-" for decrease, and "NE" for no effect in the appropriate columns at the right. If appropriate, you may insert more than one symbol in a column. OE Received cash from owner as an (a) additional investment (b) Purchased supplies on account (c) Paid rent for the current month (d) Received cash for services sold to customers Returned some defective supplies (e) purchased in (b) (f) Paid insurance premiums in advance (g) Paid cash to creditor for purchases in (b) (h) Charged customers for services sold on account Paid cash to a customer as a refund for (i) an overcharge Received cash on account from customers (j) (k) Owner withdrew cash for personal use Recorded the cost of supplies used during (1) the year (m) Received invoice for electricity used (n) Paid wages (0) Purchased a truck for cash

Selected transactions completed by a proprietorship are described below. Indicate the effects of each transaction on assets (A), liabilities (L), and owner's equity (OE) by inserting "+" for increase, "-" for decrease, and "NE" for no effect in the appropriate columns at the right. If appropriate, you may insert more than one symbol in a column. OE Received cash from owner as an (a) additional investment (b) Purchased supplies on account (c) Paid rent for the current month (d) Received cash for services sold to customers Returned some defective supplies (e) purchased in (b) (f) Paid insurance premiums in advance (g) Paid cash to creditor for purchases in (b) (h) Charged customers for services sold on account Paid cash to a customer as a refund for (i) an overcharge Received cash on account from customers (j) (k) Owner withdrew cash for personal use Recorded the cost of supplies used during (1) the year (m) Received invoice for electricity used (n) Paid wages (0) Purchased a truck for cash

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 2EA: In which section of the statement of cash flows would each of the following transactions be...

Related questions

Question

Transcribed Image Text:Selected transactions completed by a proprietorship are described below. Indicate the effects of each transaction on assets (A), liabilities (L), and owner's equity (OE) by

inserting "+" for increase, "-" for decrease, and "NE" for no effect in the appropriate columns at the right. If appropriate, you may insert more than one symbol in a column.

OE

Received cash from owner as an

(a)

additional investment

(b)

Purchased supplies on account

(c)

Paid rent for the current month

(d)

Received cash for services sold to

customers

Returned some defective supplies

(e)

purchased in (b)

(f)

Paid insurance premiums in advance

(g)

Paid cash to creditor for purchases in (b)

(h)

Charged customers for services sold on

account

Paid cash to a customer as a refund for

(i)

an overcharge

Received cash on account from customers

(j)

(k)

Owner withdrew cash for personal use

Recorded the cost of supplies used during

(1)

the year

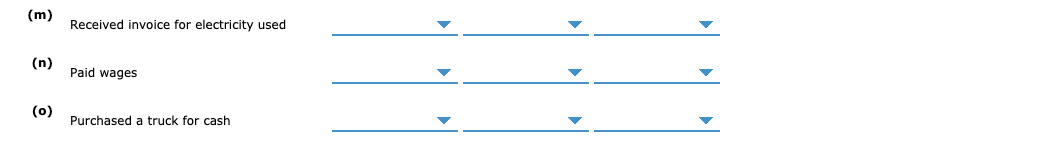

Transcribed Image Text:(m)

Received invoice for electricity used

(n)

Paid wages

(0)

Purchased a truck for cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,