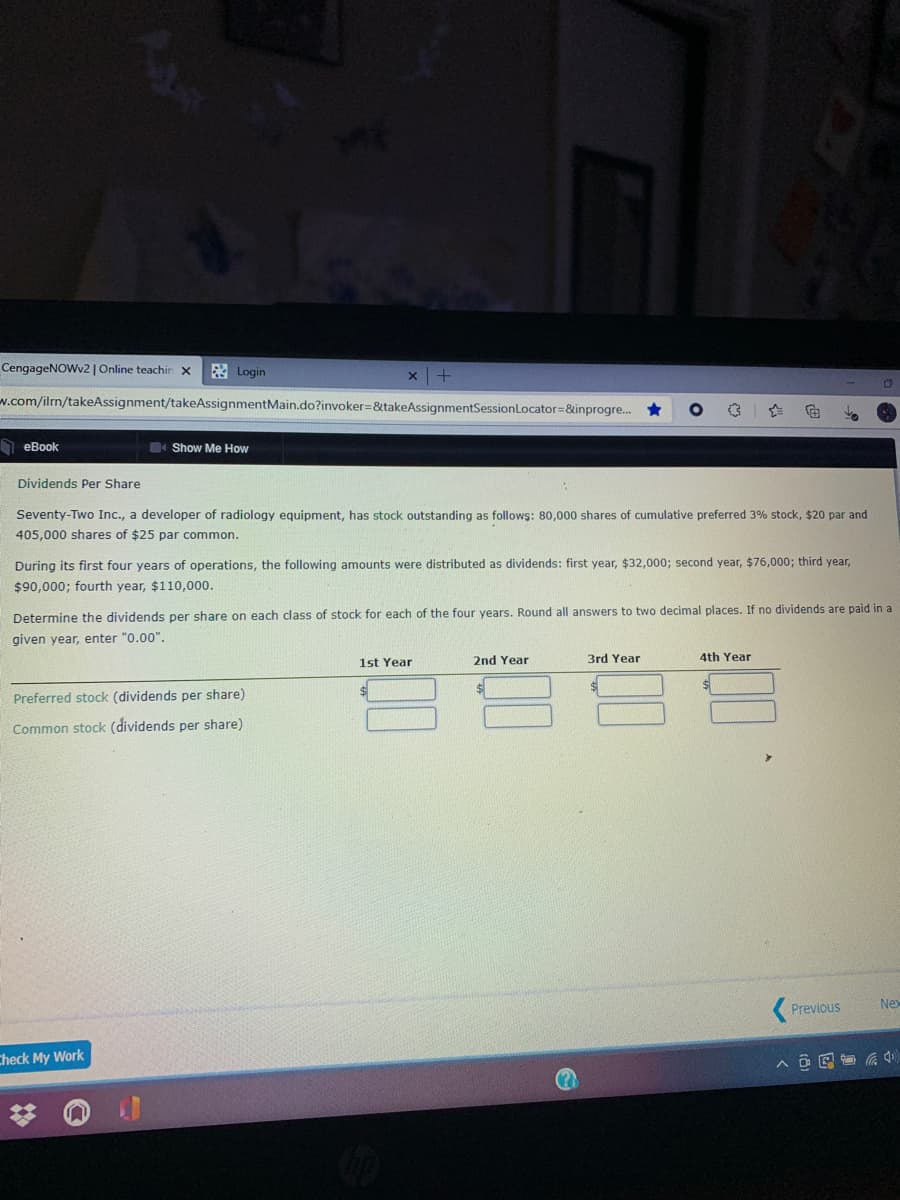

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $32,000; second year, $76,000; third year, $90,000; fourth year, $110,000. Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividends per share) Common stock (dividends per share)

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $32,000; second year, $76,000; third year, $90,000; fourth year, $110,000. Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividends per share) Common stock (dividends per share)

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter11: Investment Planning

Section: Chapter Questions

Problem 9FPE

Related questions

Question

Transcribed Image Text:CengageNOWv2 | Online teachin x

3 Login

w.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogre. *

I eBook

Show Me How

Dividends Per Share

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000 shares of cumulative preferred 3% stock, $20 par and

405,000 shares of $25 par common.

During its first four years of operations, the following amounts were distributed as dividends: first year, $32,000; second year, $76,000; third year,

$90,000; fourth year, $110,000.

Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a

given year, enter "0.00".

1st Year

2nd Year

3rd Year

4th Year

Preferred stock (dividends per share)

Common stock (dividends per share)

Previous

Nex

Check My Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning