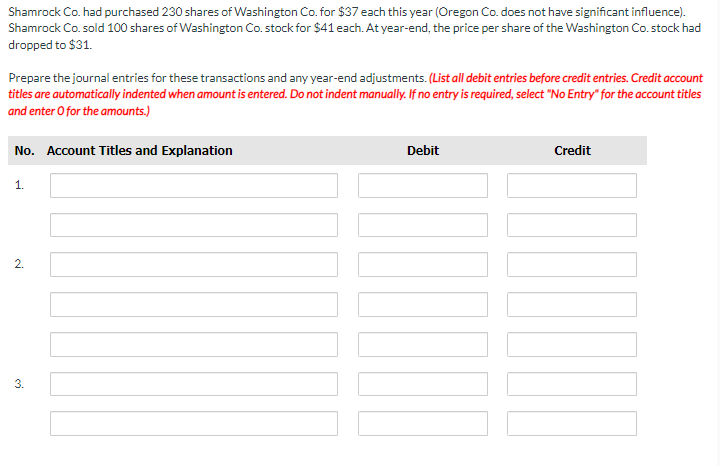

Shamrock Co. had purchased 230 shares of Washington Co. for $37 each this year (Oregon Co. does not have significant influence). Shamrock Co. sold 100 shares of Washington Co. stock for $41 each. At year-end, the price per share of the Washington Co. stock had dropped to $31. Prepare the journal entries for these transactions and any year-end adjustments. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit 1. 2. 3.

Shamrock Co. had purchased 230 shares of Washington Co. for $37 each this year (Oregon Co. does not have significant influence). Shamrock Co. sold 100 shares of Washington Co. stock for $41 each. At year-end, the price per share of the Washington Co. stock had dropped to $31. Prepare the journal entries for these transactions and any year-end adjustments. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit 1. 2. 3.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 31E

Related questions

Question

Transcribed Image Text:Shamrock Co. had purchased 230 shares of Washington Co. for $37 each this year (Oregon Co. does not have significant influence).

Shamrock Co. sold 100 shares of Washington Co. stock for $41 each. At year-end, the price per share of the Washington Co. stock had

dropped to $31.

Prepare the journal entries for these transactions and any year-end adjustments. (List all debit entries before credit entries. Credit account

titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts.)

No. Account Titles and Explanation

Debit

Credit

1.

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT