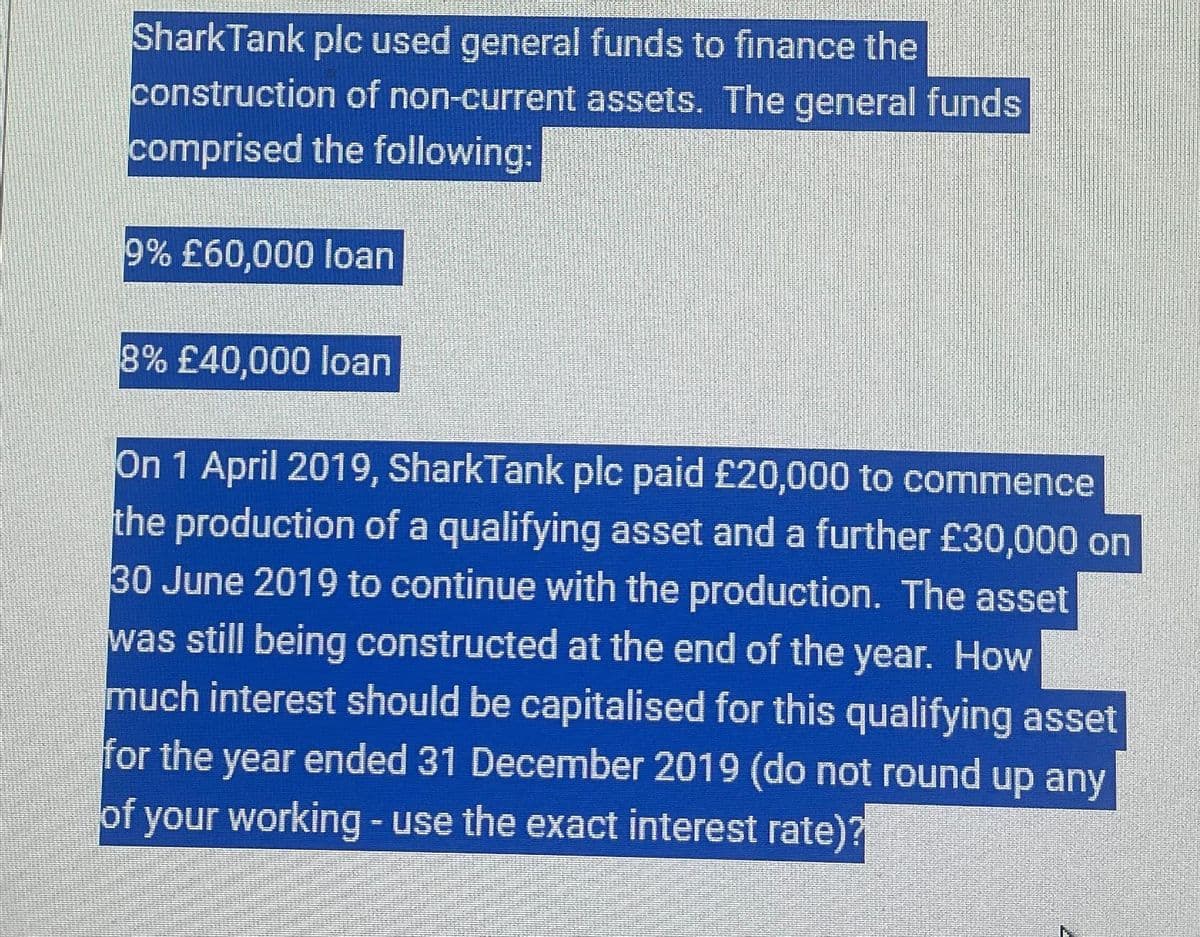

Shark Tank plc used general funds to finance the construction of non-current assets. The general funds comprised the following: 9% £60,000 loan 8% £40,000 loan On 1 April 2019, SharkTank plc paid £20,000 to commence the production of a qualifying asset and a further £30,000 on 30 June 2019 to continue with the production. The asset was still being constructed at the end of the year. How much interest should be capitalised for this qualifying asset or the year ended 31 December 2019 (do not round up any f your working - use the exact interest rate)?

Shark Tank plc used general funds to finance the construction of non-current assets. The general funds comprised the following: 9% £60,000 loan 8% £40,000 loan On 1 April 2019, SharkTank plc paid £20,000 to commence the production of a qualifying asset and a further £30,000 on 30 June 2019 to continue with the production. The asset was still being constructed at the end of the year. How much interest should be capitalised for this qualifying asset or the year ended 31 December 2019 (do not round up any f your working - use the exact interest rate)?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:Shark Tank plc used general funds to finance the

construction of non-current assets. The general funds

comprised the following:

9% £60,000 loan

8% £40,000 loan

On 1 April 2019, SharkTank plc paid £20,000 to commence

the production of a qualifying asset and a further £30,000 on

30 June 2019 to continue with the production. The asset

was still being constructed at the end of the year. How

much interest should be capitalised for this qualifying asset

for the year ended 31 December 2019 (do not round up any

of your working - use the exact interest rate)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning