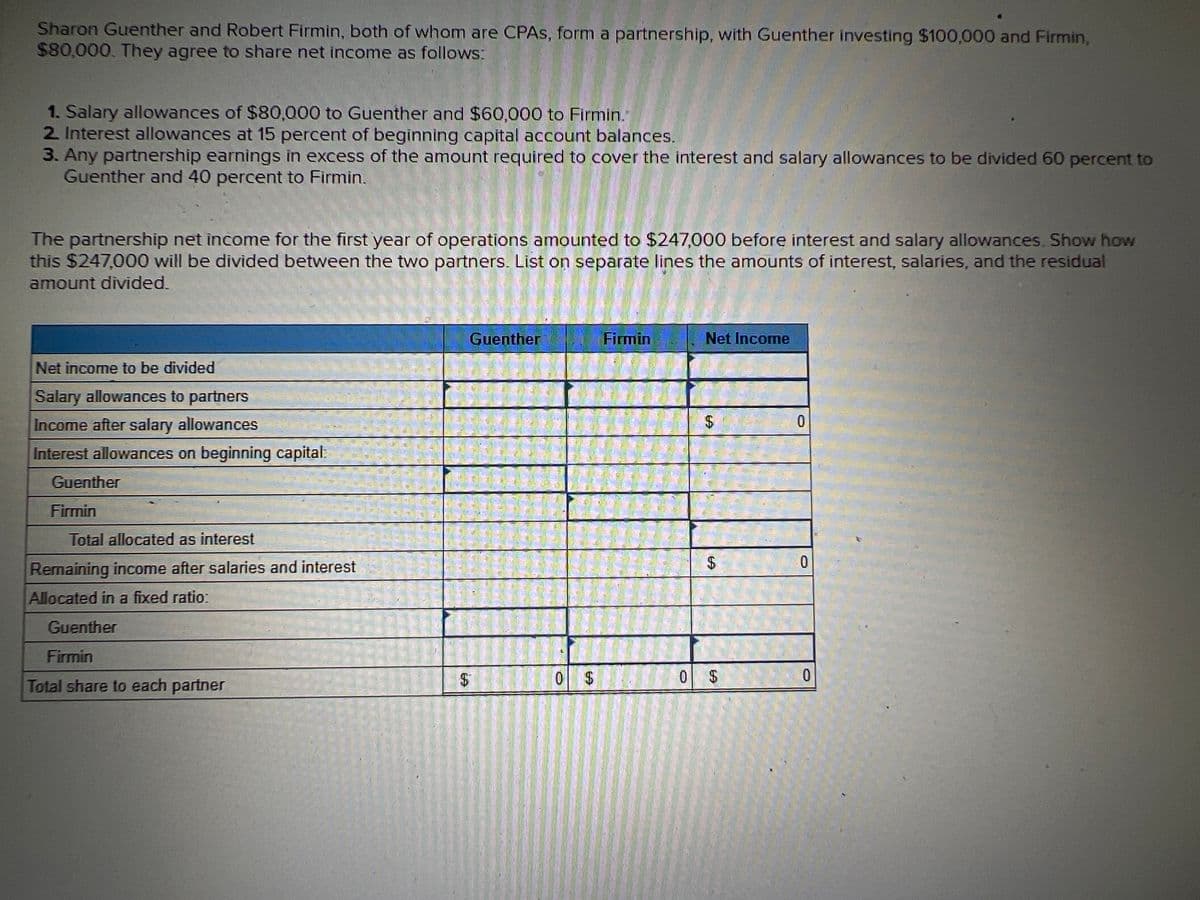

Sharon Guenther and Robert Firmin, both of whom are CPAS, form a partnership, with Guenther investing $100,000 and Firmin, $80,000. They agree to share net income as follows: 1. Salary allowances of $80,000 to Guenther and $60,000 to Firmin. 2. Interest allowances at 15 percent of beginning capital account balances. 3. Any partnership earnings in excess of the amount required to cover the interest and salary allowances to be divided 60 percent to Guenther and 40 percent to Firmin. The partnership net income for the first year of operations amounted to $247,000 before interest and salary allowances. Show how this $247,000 will be divided between the two partners. List on separate lines the amounts of interest, salaries, and the residual amount divided. Guenther Firmin Net Income Net income to be divided Salary allowances to partners Income after salary allowances 24 Interest allowances on beginning capital: Guenther Firmin Total allocated as interest 2$ Remaining income after salaries and interest Allocated in a fixed ratio:

Sharon Guenther and Robert Firmin, both of whom are CPAS, form a partnership, with Guenther investing $100,000 and Firmin, $80,000. They agree to share net income as follows: 1. Salary allowances of $80,000 to Guenther and $60,000 to Firmin. 2. Interest allowances at 15 percent of beginning capital account balances. 3. Any partnership earnings in excess of the amount required to cover the interest and salary allowances to be divided 60 percent to Guenther and 40 percent to Firmin. The partnership net income for the first year of operations amounted to $247,000 before interest and salary allowances. Show how this $247,000 will be divided between the two partners. List on separate lines the amounts of interest, salaries, and the residual amount divided. Guenther Firmin Net Income Net income to be divided Salary allowances to partners Income after salary allowances 24 Interest allowances on beginning capital: Guenther Firmin Total allocated as interest 2$ Remaining income after salaries and interest Allocated in a fixed ratio:

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 43P

Related questions

Question

ACCT 102

Transcribed Image Text:Sharon Guenther and Robert Firmin, both of whom are CPAS, form a partnership, with Guenther investing $100,000 and Firmin,

$80,000. They agree to share net income as follows:

1. Salary allowances of $80,000 to Guenther and $60,000 to Firmin.

2. Interest allowances at 15 percent of beginning capital account balances.

3. Any partnership earnings in excess of the amount required to cover the interest and salary allowances to be divided 60 percent to

Guenther and 40 percent to Firmin.

The partnership net income for the first year of operations amounted to $247,000 before interest and salary allowances. Show how

this $247,000 will be divided between the two partners. List on separate lines the amounts of interest, salaries, and the residual

amount divided.

Guenther

Firmin

Net Income

Net income to be divided

Salary allowances to partnerS

Income after salary allowances

三

Interest allowances on beginning capital:

TATH

Guenther

Firmin

Total allocated as interest

0.

Remaining income after salaries and interest

Allocated in a fixed ratio:

Guenther

Firmin

Total share to each partner

$.

2$

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning