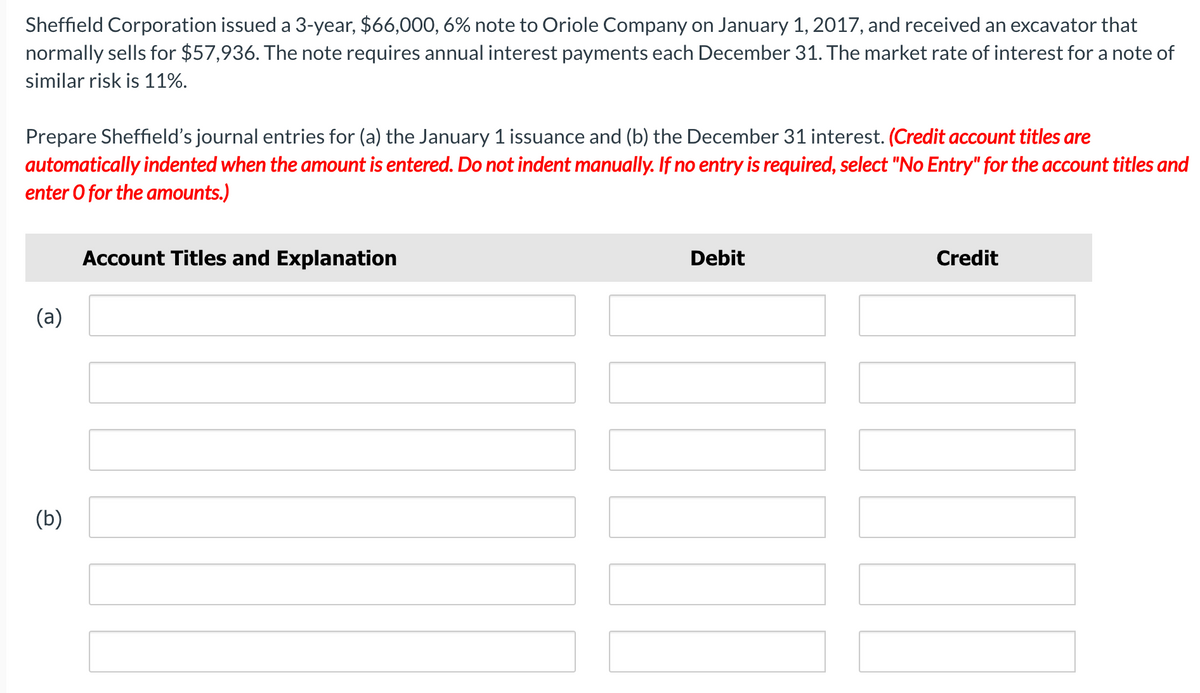

Sheffield Corporation issued a 3-year, $66,000, 6% note to Oriole Company on January 1, 2017, and received an excavator that normally sells for $57,936. The note requires annual interest payments each December 31. The market rate of interest for a note of similar risk is 11%. Prepare Sheffield's journal entries for (a) the January 1 issuance and (b) the December 31 interest. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Sheffield Corporation issued a 3-year, $66,000, 6% note to Oriole Company on January 1, 2017, and received an excavator that normally sells for $57,936. The note requires annual interest payments each December 31. The market rate of interest for a note of similar risk is 11%. Prepare Sheffield's journal entries for (a) the January 1 issuance and (b) the December 31 interest. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 11E

Related questions

Question

Transcribed Image Text:Sheffield Corporation issued a 3-year, $66,000, 6% note to Oriole Company on January 1, 2017, and received an excavator that

normally sells for $57,936. The note requires annual interest payments each December 31. The market rate of interest for a note of

similar risk is 11%.

Prepare Sheffield's journal entries for (a) the January 1 issuance and (b) the December 31 interest. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

(a)

(b)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT