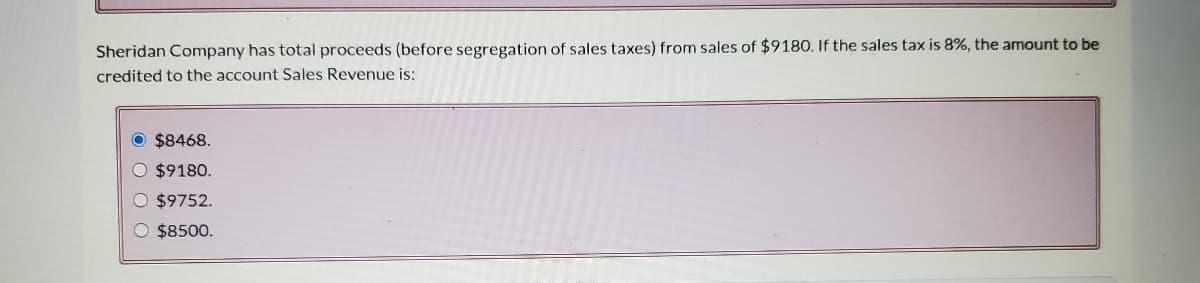

Sheridan Company has total proceeds (before segregation of sales taxes) from sales of $9180. If the sales tax is 8%, the amount to be credited to the account Sales Revenue is: O $8468. O $9180. O $9752. O $8500.

Q: A company's trial balance shows a debit balance of $2.1 million brought forward on current tax and a…

A: A company's trial balance shows a debit balance of $2.1 million brought forward on current tax and a…

Q: Kipay Co. had the following account balances: Sales - P120,000; Cost of goods sold - P60,000; Salary…

A: Income before tax means the profit earned before paying any taxes to the government authorities. It…

Q: w accounts will be uncollectible en and selling costs are 78%, am me income taxes of 30% and a…

A: The company gives more credit period to increase the sales but the new credit policy will be cost…

Q: amounted to P126,700. The foods and drinks b nightclub are being served by Tiberio, a non-VA uring…

A: Amusement tax refers to the form of tax levied on any source of commercial entertainment services…

Q: Grace has the following transactions. Gross sales-840,000 php Sales discounts- 25,000 php Cost of…

A: Taxable Income: Taxable income is the amount of money earned that is subject to taxation. Amounts…

Q: In July 20X2, a company sold goods at standard sales tax rate with a net value of $200,000, goods…

A: Computation of Output tax is as follows: Output tax =$200000 ×15%=$30000 Computation of Input tax is…

Q: National Co. has just ended the calendar year making a sale in the amount of P250,000 of merchandise…

A: Net Profit = Sales - Cost of inventory purchased = P 250,000 - P 150,000…

Q: TireCo is a retail store in a state that imposes a 6 percentsales tax. Would you expect to find…

A: Statement of profit and loss is the income statement of a company showing the net profit calculated…

Q: Which of the following represents the correct journal entry to record a taxable cash sale of $400 if…

A: Introduction:- At the time of record received sales tax from customers, journal entry will be, debit…

Q: Grotto Ltd has already sent $19,600 to the ATO in respect to PAYG, and this figure shown as a debit…

A: PAYG stands for "Pay as you Go", it is a installment method of paying income tax to…

Q: A VAT Taxpayer had the following data on sales and purchases of a month, value-added tax not…

A: VAT refundable states that the taxpayer has paid in excess amount of money during the tax period as…

Q: Rainy-day Ltd is a company registered for Value Added Tax (VAT) in the United Kingdom. The following…

A: Note 1 : Dear student as it is a multipart questions as per norms we will solve 3. Inconvinience…

Q: The expenses other than interest expense of Ratio Company for the current year is 40% of cost of…

A: The question is based on the concept of Financial Management.

Q: If Ayayai Corp. has net sales of $523000 and cost of goods sold of $350000, Ayayai gross profit rate…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: The following are the data extracted from the books of a retailer and registered with the National…

A: VAT is the indirect form of tax which is levied by the government on the goods and services. VAT is…

Q: Thornton, Inc., had taxable income of $129632 for the year. The company's marginal tax rate was 34…

A: A company’s tax due is calculated on the basis of the average tax rate and not the marginal tax…

Q: Sales (including sales tax) amounted to $27,612.50, and purchases (excluding sales tax) amounted to…

A: We have the following information: Sales (including sales tax) amounted to $27,612.50 Purchases…

Q: ABC Corporation has the following sales during the 1ª quarter of 2021: Sale to private entities…

A:

Q: NYFG, Inc.l has sales including sales taxes for the month of $445,200. If the sales tax rate is…

A: Sales = Total sales / (1 + sales tax rate) = $445,200 / (1 + 0.06) = $420,000

Q: Determine the carrying value of SLR’s inventory assuming that the lower of cost or net realizable…

A:

Q: ABCD Corp celebrated its 10th yr anniversary this yr. It provided you with the following…

A: Income tax is a direct tax charged by the central or state government authority on the total income…

Q: The accounting records of the Meadowbrook Company show the following: / Los records contables de…

A: The question is multiple choice question Required Choose the Correct Option.

Q: Blossom's Salon has total receipts for the month of $Unresolved including sales taxes. If the sales…

A: Sales for the month = Total sales / ( 1 + Sales tax rate ) * 100

Q: A company sells 180,000 (sale price) of goods and collect sales tax of 8%. What current liability…

A: Current liability means the amount which the business has the obligation to pay within short term…

Q: Fara Corporation has accounts receivable of P400,000. Its manufacturing cost approximates 35 percent…

A: Manufacturing cost = accounts receivable X 35% = 400000 x 35% = P140,000

Q: In the tax period, Red Co., who apply credit method, purchased goods and services for production…

A: VAT refers to the value added tax implied on the sale of products and services by the government.…

Q: EFG & Co. started its business at the beginning of the current year. By end of first year…

A: Deferred tax liability = future taxable amount x tax rate = P400,000 x 30% = P120,000

Q: A sales tax registered business in its first period of trading charges $8,000 of sales tax on its…

A: A sales tax is a tax paid to a government (whether State of Central Government) for the sale of…

Q: What was the net FUTA tax of Truson Company?

A: Given information is: Taxable wages for SUTA = $108,500 SUTA tax rate = 4% Taxable wages for FUTA =…

Q: On July 10, Kelt Company, a business located in Alberta, purchased $45,000 of inventory for resale…

A: Journal Entry It is used to record the transactions of a business in records of the business. These…

Q: Posner Co. is a retail store operating in a state with a 7% retail sales tax. Posner made credit…

A: Sales Tax:- It is a tax which sellers pay to the government at the rate prescribed in law for the…

Q: Koop Company has total proceeds (before segregation of sales taxes) from sales of $9,540. If the…

A: Solution:- Amount to be credited to sales revenue as follows under:-

Q: Mahigos owns the following businesses: Annual Gross Receipts Annual Gross Sales Restaurant…

A: The annual Sales are exceeding 3millions hence the 12 VAT is payable on output taxable supply…

Q: XYZ Pawnshop Corp. reported the following information in preparation of its quarterly percentage tax…

A: Pawnshops generate money by lending money, reselling merchandise, and providing ancillary services…

Q: hornton, Inc., had taxable income of $129632 for the year. The company's marginal tax rate was 34…

A: A tax is a mandatory fee or financial charge levied by any government on an individual or an…

Q: Dillons Corporation made credit sales of S30,000 which are subject to 6% sales tax The corporation…

A: Given information is: Cash sales amount = $20670 Sales tax = 6%

Q: Thornton, Inc., had taxable income of $130,022 for the year. The company's marginal tax rate was 34…

A: A company’s tax due is calculated on the basis of the average tax rate and not the marginal tax…

Q: Excise and Sales Tax Calculations Barnes Company has just billed a customer for $1,010 an amount…

A: Journal entries refer to the recording of transactions in an appropriate way. With the help of…

Q: Nu Company reported the following pretax data for its FIRST year of operations: Net Sales…

A: First-in-First-Out (FIFO): In this method, items purchased initially are sold first. So, the value…

Q: SCC Corporation sells its merchandise at a gross profit of 30%. if the total sales are P 1,200,000…

A: Formula: Gross profit = Sales - Cost of goods sold

Q: During the fiscal year 20x4, the initial inventory of the goods of company A is 15.000 €, purchases…

A: Cost of sales = Beginning inventory + Purchases - Closing inventory

Q: The following information is available for Hunt Company after its first year of operations: Income…

A: Given that differed income tax = ($4000) Tax rate is 40% Hence = $4000 / 40% = $10000

Q: The Rollings Company had sales of $1,000 with cost of goods sold (COGS) equal to 30% of sales.…

A: Introduction: Net income refers to the after-tax income of an individual. Net income can also be…

Q: ABC Corporation has the following sales during the 1st quarter of 2021: Sale to private entities…

A: GIVEN ABC Corporation has the following sales during the 1st quarter of 2021: Sale to private…

Q: At 30 June 20X3, the gross amount of the accounts receivable of Atom Ltd (Atom) was $10 000. At the…

A: Tax base of an asset = Carrying amount + Future deductible amounts − Future assessable amounts =…

Q: Windsor's Boutique has total receipts for the month of $27510 including sales taxes. If the sales…

A: Let Sale value is 100 and receipt value is 100 + 5 i.e 105 (inclusive of tax rate)

Q: A VAT Taxpayer had the following data on sales and purchases of a month, value-added tax not…

A: In the Philippines, the Value-added Tax Rate is 12%. The Export sale is a Zero rated tax supply. The…

Q: ABC Corporation has the following sales during the 1st quarter of 2021: Sale to private entities…

A: The central tax (CGST), state tax (SGST), integrated tax (IGST), or union territory tax (UTGST)…

Q: Brush Company has the following income before income tax and estimated effective annual income tax…

A: Income tax payable is an obligation by the tax payer to the government on the taxable income.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- In the quarter ended 31 March 20X2, C had sales taxable outputs, net of sales tax, of $90,000 and taxable inputs, net of sales tax, of $72,000. If the rate of sales tax is 10%, how much sales tax is due? A $1,800 receivable B $2,000 receivable C $1,800 payable D $2,000 payableNYFG, Inc.l has sales including sales taxes for the month of $445,200. If the sales tax rate is 6%, how much does NYFG owe for sales tax? Select one: a. $31,200 b. $26,712 c. $25,200 d. $45,200 e. $445,200In July 20X2, a company sold goods at standard sales tax rate with a net value of $200,000, goods exempt from sales tax with a value of $50,000 and goods at zero sales tax rate with a net value of $25,000. The purchases in July 20X2, which were all subject to sales tax, were $161,000, including sales tax. Assume that the rate of sales tax is 15%. The difference between sales tax input tax and sales tax output tax is A Dr $9,000 B Cr $5,850 C Cr $9,000 D None of these

- Sales (including sales tax) amounted to $27,612.50, and purchases (excluding sales tax) amounted to $18,000. What is the balance on the sales tax account, assuming all items are subject to sales tax at 17.5%?The Rollings Company had sales of $1,000 with cost of goods sold (COGS) equal to 30% of sales. Rollings also had total other operating expenses of $400, interest expense of $125, and is subject to a flat 40% of its pre-tax income in income taxes. What is Rollings’ net income?ABC Corporation has the following sales during the month of October: Sales to a private company, VAT exc; of P 100,000 Sales to private companies, 0% VAT rate; P 100,000 Sales of exempt goods; P 100,000 Sales to Govt; subject to 5% final VAT withholding tax; P100,000 The following input taxes were passed on by its suppliers: Input tax on taxable goods at 12%; P 6,000 Input tax on zero-rated sales of P 3,000 Input tax on sales to Govt of P 7,000 Input tax on depreciable asset- Not attributable to any specific activity (amortization) of P 20,000 Input tax on exempt sales of P 1,000 Compute the VAT Payable below: VAT output: Total VAT output Less: VAT input VAT payable (Excess VAT input)

- Based on the following amounts, how much is the income tax due based on the 25% regular corporate income tax rate? Gross sales 4,000,000.00 Sales discounts, returns and allowances 100,000.00 Cost of sales 1,500,000.00 Itemized deductions 800,000.00 Group of answer choices P975,000.00 P400,000.00 P600,000.00 P425,000.00FGH Corporation had the following in 2021: Sales P 3.4M; Cost of sales P 1.2M; Admin expense P 0.3M; Selling expenses P .5M; other taxable income from operations P .1M. What is deductible expense if the company uses OSD?* a. 920,000 b. 1,360,000 c. 880,000 d. 800,000 Using the problem above, what is the income tax payable?* a. 330,000 b. 375,000 c. 575,000 d. 525,000Labrador Inc. sold 350 oil drums to Tesla Manufacturing for $75 each. In addition to the $75 sale price per drum, there is a $1 per drum federal tax and a 7% provincial sales tax. What journal entry should be made to record this sale? a. Debit Accounts Receivable 28,438; credit Sales Revenue 28,438. b. Debit Accounts Receivable 26,250; credit Sales Revenue 26,250. c. Debit Accounts Receivable 28,438; credit Federal Sales Taxes Payable 350; credit Provincial Sales Taxes Payable 1,838; credit Sales Revenue 26,250. d. Debit Accounts Receivable 26,250; debit Taxes Expense 2,188; credit Federal Sales Taxes Payable 350; credit Provincial Sales Taxes Payable 1,838; credit Sales Revenue 26,250.

- A VAT taxpayer had the following data on its operations for he month of January 2018:Sales, total invoice price P 592,480Purchases of goods, VAT not included:From VAT registered persons 100,000From nonVAT registered persons 8,000From persons subject to percentage taxes 10,000Salaries of employees 60,000Other operating expenses 12,000This is the first month of being liable to value added tax. Data in inventories at the beginning of the period bought from VAT registeredpersons follow:Inventory at cost P 44,800Inventory at realizable value 49,000Value added tax paid on beginning inventory 4,80016. How much is the input tax?17. How much is the value added tax payable?Grace has the following transactions. Gross sales-840,000 php Sales discounts- 25,000 php Cost of sales- 250,000 php Operating Expenses-190,000 php Interest income on bank deposit-BDO Part time employment- 410,000 php, 105,00 is excluded in taxation What is the taxable income which is subject to regular income tax?870,000; 680,000; 690,000; 705,000In the tax period, Red Co., who apply credit method, purchased goods and services for production product C, which is taxable and product D, which is an exempt item. Total VAT input written on added value invoices legible VND 50,000,000, in which for C is VND 20,000,000, for D is VND10,000,000. The company cannot separate the remain input tax for each item. Turnover of selling product C in the period is VND 400,000,000, product D is VND 100,000,000. The deductible input VAT amount is: * VND 50,000,000 VND 40,000,000 VND 36,000,000 VND 20,000,000