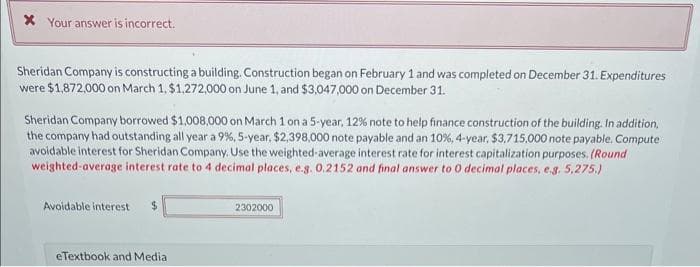

Sheridan Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,872,000 on March 1, $1,272,000 on June 1, and $3,047,000 on December 31. Sheridan Company borrowed $1,008,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,398,000 note payable and an 10%, 4-year, $3,715,000 note payable. Compute avoidable interest for Sheridan Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted average interest rate to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest $ 2302000

Sheridan Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,872,000 on March 1, $1,272,000 on June 1, and $3,047,000 on December 31. Sheridan Company borrowed $1,008,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,398,000 note payable and an 10%, 4-year, $3,715,000 note payable. Compute avoidable interest for Sheridan Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted average interest rate to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) Avoidable interest $ 2302000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 2EA: Jada Company had the following transactions during the year: Purchased a machine for $500,000 using...

Related questions

Topic Video

Question

29.

Transcribed Image Text:* Your answer is incorrect.

Sheridan Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures

were $1,872,000 on March 1, $1,272,000 on June 1, and $3,047,000 on December 31.

Sheridan Company borrowed $1,008,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition,

the company had outstanding all year a 9%, 5-year, $2,398,000 note payable and an 10%, 4-year, $3,715,000 note payable. Compute

avoidable interest for Sheridan Company. Use the weighted-average interest rate for interest capitalization purposes. (Round

weighted average interest rate to 4 decimal places, e.g. 0.2152 and final answer to 0 decimal places, e.g. 5,275.)

Avoidable interest $

eTextbook and Media

2302000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College