Sheridan Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Cost Old Equipment Accumulated depreciation Remaining life Current salvage value Salvage value in 8 years Annual cash operating costs $80,000 $40,000 8 years $9,800 $0 Annual rate of return $35,000 Your answer is incorrect. Cost New Equipment Estimated useful life Salvage value in 8 years Annual cash operating costs Depreciation is $10,000 per year for the old equipment. The straight-line depreciation method wor over an eight-year period with salvage value of $4,400. $39,000 8 years $4,400 $29,000 Calculate the annual rate of return. (Round answer to 2 decimal places, e.g. 15.25%.) % used for the new equipment

Sheridan Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The following information has been collected on this investment: Cost Old Equipment Accumulated depreciation Remaining life Current salvage value Salvage value in 8 years Annual cash operating costs $80,000 $40,000 8 years $9,800 $0 Annual rate of return $35,000 Your answer is incorrect. Cost New Equipment Estimated useful life Salvage value in 8 years Annual cash operating costs Depreciation is $10,000 per year for the old equipment. The straight-line depreciation method wor over an eight-year period with salvage value of $4,400. $39,000 8 years $4,400 $29,000 Calculate the annual rate of return. (Round answer to 2 decimal places, e.g. 15.25%.) % used for the new equipment

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.6DC

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

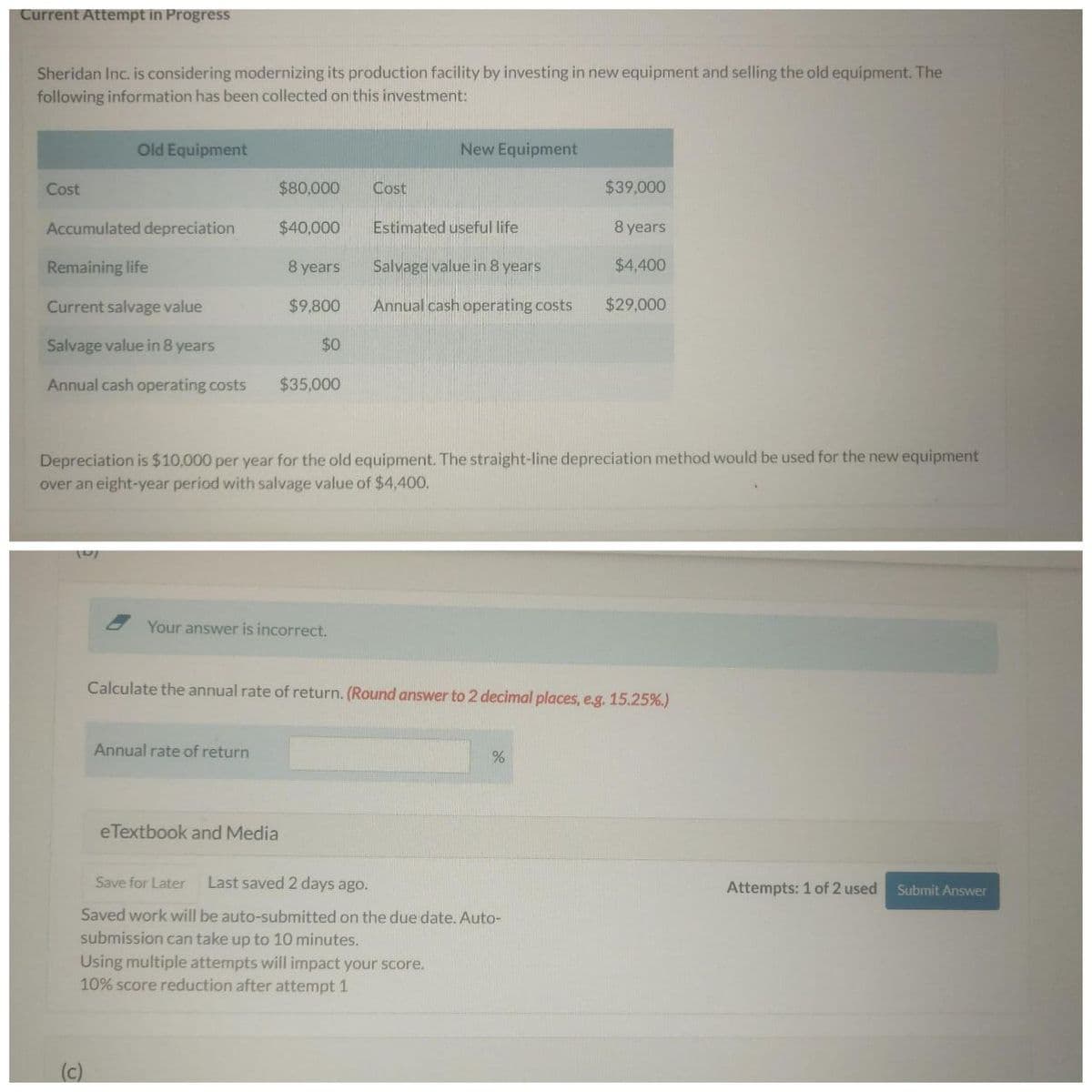

Sheridan Inc. is considering modernizing its production facility by investing in new equipment and selling the old equipment. The

following information has been collected on this investment:

Cost

Old Equipment

Accumulated depreciation

Remaining life

Current salvage value

Salvage value in 8 years

Annual cash operating costs

$80,000

$40,000

8 years

$9,800

Annual rate of return

$0

eTextbook and Media

$35,000

Your answer is incorrect.

Cost

New Equipment

Estimated useful life

Salvage value in 8 years

Annual cash operating costs

Depreciation is $10,000 per year for the old equipment. The straight-line depreciation method would be used for the new equipment

over an eight-year period with salvage value of $4,400.

Calculate the annual rate of return. (Round answer to 2 decimal places, e.g. 15.25%.)

$39,000

%

8 years

$4,400

$29,000

Save for Later Last saved 2 days ago.

Saved work will be auto-submitted on the due date. Auto-

submission can take up to 10 minutes.

Using multiple attempts will impact your score.

10% score reduction after attempt 1

Attempts: 1 of 2 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning