Sherlock Sports Authority purchased inventory costing $24,000 by signing a 9% short-term, one-year note payable. The purchase occurred on July 31, 2021. Sherlock pays annual interest each year on July 31. Read the requirements. First, journalize the company's (a) purchase of inventory. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Jul Date 2021 31 Accounts Debit Credit Requirements Journalize the company's (a) purchase of inventory: (b) accrual of interest expense on April 30 2022 which is the company's fiscal year-end; and (c) payment of the X

Sherlock Sports Authority purchased inventory costing $24,000 by signing a 9% short-term, one-year note payable. The purchase occurred on July 31, 2021. Sherlock pays annual interest each year on July 31. Read the requirements. First, journalize the company's (a) purchase of inventory. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Jul Date 2021 31 Accounts Debit Credit Requirements Journalize the company's (a) purchase of inventory: (b) accrual of interest expense on April 30 2022 which is the company's fiscal year-end; and (c) payment of the X

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 2RE: Use the same information in RE9-1 except that the note is not interest bearing. Assume that the note...

Related questions

Question

attached in ss below thankx for hlp

l24py42lpy2

y42p24pu

24up42

2

tp

4t4p

t

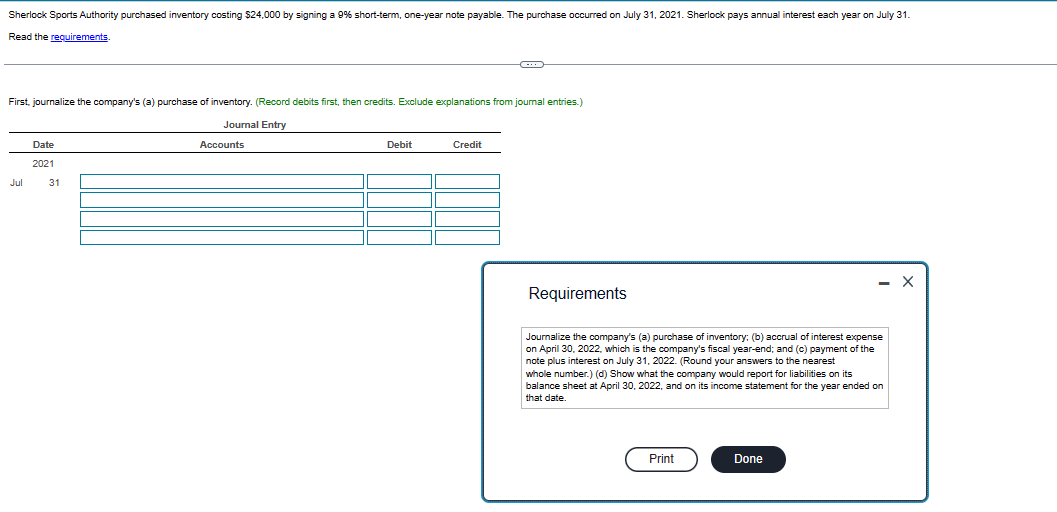

Transcribed Image Text:Sherlock Sports Authority purchased inventory costing $24,000 by signing a 9% short-term, one-year note payable. The purchase occurred on July 31, 2021. Sherlock pays annual interest each year on July 31.

Read the requirements.

First, journalize the company's (a) purchase of inventory. (Record debits first, then credits. Exclude explanations from journal entries.)

Journal Entry

Jul

Date

2021

31

Accounts

Debit

C

Credit

Requirements

Journalize the company's (a) purchase of inventory; (b) accrual of interest expense

on April 30, 2022, which is the company's fiscal year-end; and (c) payment of the

note plus interest on July 31, 2022. (Round your answers to the nearest

whole number.) (d) Show what the company would report for liabilities on its

balance sheet at April 30, 2022, and on its income statement for the year ended on

that date.

Print

Done

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College