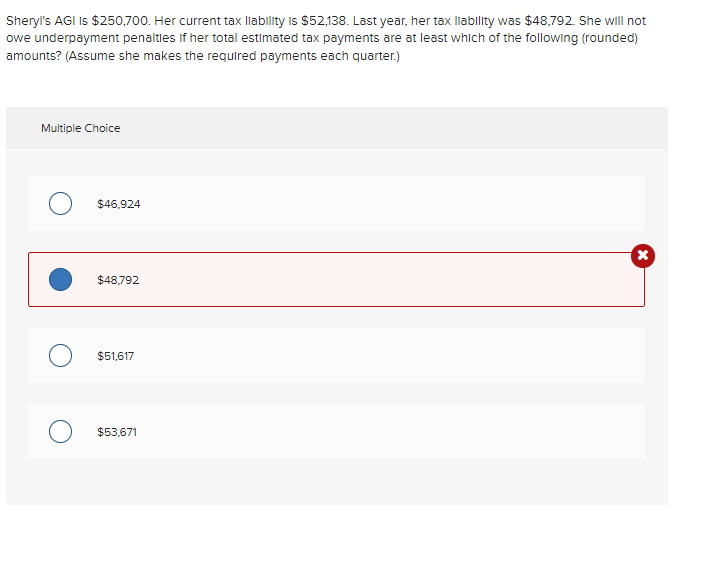

Sheryl's AGI Is $250,700. Her current tax liability is $52,138. Last year, her tax liability was $48,792. She will not owe underpayment penalties if her total estimated tax payments are at least which of the following (rounded) amounts? (Assume she makes the required payments each quarter.)

Sheryl's AGI Is $250,700. Her current tax liability is $52,138. Last year, her tax liability was $48,792. She will not owe underpayment penalties if her total estimated tax payments are at least which of the following (rounded) amounts? (Assume she makes the required payments each quarter.)

Chapter17: Tax Practice And Ethics

Section: Chapter Questions

Problem 34P

Related questions

Question

Transcribed Image Text:Sheryl's AGI is $250,700. Her current tax liability is $52,138. Last year, her tax liability was $48,792. She will not

owe underpayment penalties if her total estimated tax payments are at least which of the following (rounded)

amounts? (Assume she makes the required payments each quarter.)

Multiple Choice

$46,924

$48,792

$51,617

$53,671

x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT