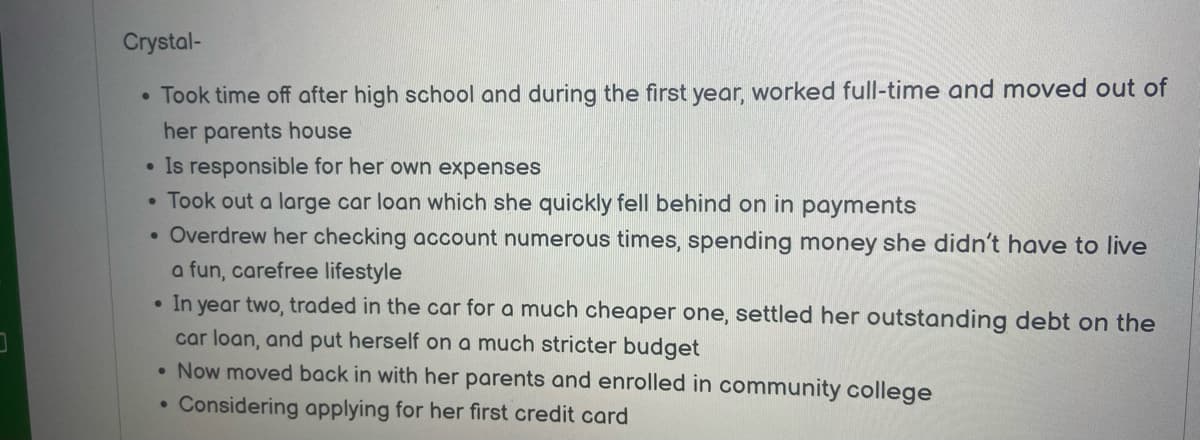

Should this person open a credit card account? If they do decide to open the new credit card account, what’s one thing this individual should monitor or use caution?

Q: As of 2015, farms were taxed at 10 percent for income up to $46,000; at 24 percent for income…

A: Tax is computed at a certain rate on different slabs of income . In a progressive tax system, the…

Q: What is the percentage margin of a margin call if an investor has purchased $10,000 worth of…

A: A margin money under margin call is an important concept in capital market or stock market trading.…

Q: What are the prices of a call option and a put option with the following characteristics? Stock…

A: An option is a type of financial instrument that is based on the value of underlying securities,…

Q: Storico Co. just paid a dividend of $2.00 per share. The company will increase its dividend by 20…

A: The Dividend Discount Model (DDM) is a valuation method used to estimate the intrinsic value of a…

Q: Graystone bonds have a maturity value of RM100. The bonds carry a coupon rate of 10 percent.…

A: The face value of the bond (FV) is RM100. The coupon rate is 10%. The market price of the bond (PV)…

Q: A 7.50 percent coupon bond with 14 years left to maturity is priced to offer a yield to maturity of…

A: Bonds are the instrument used as an investment alternative for securing the amount of money at a…

Q: A $1,000 bond originally issued at par maturing in exactly ten years bears a coupon rate of 8%…

A: Yield To Maturity: It represents the expected rate of return on the bond for the bondholders…

Q: Your boss hands you the following information about two mutually exclusive projects. She adds the…

A: NPV is calculated as the present value of cash inflows minus initial investment. IRR is the discount…

Q: You are an investor buying an existing office building. You determine that year 1 NOI will be…

A: The value of a real estate building has to be determined under two different approaches.…

Q: A young executive is going to purchase a vacation property for investment purposes. She needs to…

A: Present value = pv =$84,000 Total Installments =28*12 = 336 months Interest rate = r = 5.7/12 =…

Q: Mike and Beth would like to have an opportunity to buy a home in the next five years. They…

A: Future Value: It represents the expected value of the present cash flows compounded over the period…

Q: 2. If the expected return of Apple stock is 25% and the risk-free rate is 5%. If the standard…

A: Explanation : Sharpe ratio is used for measuring the risk adjusted relative return. Sharpe ratio…

Q: You are considering investing in Ford Motor Company. Which of the following are examples of…

A: Diversifiable risk is that risk which firm specific and its impact only the price of the particular…

Q: An investor plans to save 45 years for his retirement with $500 monthly deposits. He plans to live…

A: Savings period = 45 years Periodic savings, P = $500 Interest rate = 9% Number of monthly…

Q: Robert Jones and his wife Suzie recently opened an investment account with the intention of saving…

A: Future value (FV) is the value of an asset or investment at a specified date in the future, based on…

Q: Sally is invested in a MLP that has just paid an annual dividend. The energy, oil, and gas industry…

A: Dividend Discounted Model: It represents a quantitative model that is applied to the prediction of…

Q: EE printing is in the evaluation process for the acquisition of a new computer system. The total…

A: Payback period is a financial metric used to evaluate the length of time it takes to recoup the…

Q: a. What is the price of a share of HNH stock? b. Assume that management makes a surprise…

A: Price of the stock is the PV of future dividends. Now, dividends distributed are taxed at 15%.…

Q: you would like to combine a risky stock with a beta of 1.94 with US treasury bills in such a way…

A: percentage of the portfolio should be invested in the risky stock = 1 / Beta of risky stock The…

Q: Pasqually Mineral Water, Inc., will pay a quarterly dividend per share of $1.10 at the end of each…

A: Stock Price: The price of a stock in the market represents the current value to the buyer and…

Q: You hold a zero coupon bond when there is a sudden change in interest rates. It has 18 years to…

A: The formula for the price of zero-coupon bond is Bond Price=Face Value(1+i)n Where, i = Interest…

Q: A stock has an expected return of 0.12, its beta is 1.36, and the risk-free rate is 0.03. What must…

A: Expected return on stock = 0.12 Beta = 1.36 Risk-free rate = 0.03 We will use the CAPM equation…

Q: Five years ago, Teresa purchased an investment property for $189,795. He sold it today for…

A: Annualized rate of return is calculated using following equation Annualized rate of return = Ending…

Q: Gary wants to save $555,000 in 8 ears, he currently has $225,000 in an investment. Due to financial…

A: We will calculate interest rate using RATE function in excel for accurate results as nothing is…

Q: I need help using the present value of a bond calculator at…

A: Bond: The price of a bond is estimated by discounting the par value and the coupon payments using…

Q: A firm currently depreciates €100 per year on its fixed assets, and will continue to do so forever.…

A: This question is asking for the present value of an infinite stream of tax shields resulting from…

Q: Indicate whether each of the following statements is true or false. Support your answers with the…

A: Dividend policy refers to the set of guidelines and principles that a company uses to determine how…

Q: A 20-year annuity pays $1,200 per month, and payments are made at the end of each month. The…

A: The concept of time value of money will be used and applied here. An annuity is a stream of…

Q: REQUIRED a. Is it an example of fraudulent financial reporting? b. What procedures could reduce the…

A: Fraudulent financial reporting, also known as financial statement fraud, is the intentional…

Q: Your firm has a target debt ratio of 30%. Cost of debt (Rb) is 6%. The risk-free rate is 3% and the…

A: Fist we need to calculate cost of equity by using CAPM model. Cost of equity =Risk free rate…

Q: A young executive is going to purchase a vacation property for investment purposes. She needs to…

A: The sum borrowed to meet the personal or business needs is recognized as mortgage. The loan is…

Q: Limitless Ltd. is planning to buy a new warehouse to store its production output. The investment…

A: Net Present Value is also known as NPV. It is a capital budgeting techniques which help in decision…

Q: Darrel buys a home for $314,945 and he outs 25% down. He finances the remainder at 3% for 15 years.…

A: Purchase value of house = $314,945 Down payment = 25% Compound = monthly = 12 Interest rate = r =…

Q: Mr. Mogi borrowed $9000 for 10 years to make home improvements. If he repaid a total of $20,000 at…

A: Explanation : Future Value is that which includes the interest and principal amount which was…

Q: Alexandra took out a mortgage of $791,000 for a house and just made the 79th end of month payment.…

A: A mortgage is a borrowing taken such that regular payments are made to repay the loan. The…

Q: Consider the project balances in the table below for a typical investment project with a service…

A: Interest rate is the rate that is used to calculate the cost to be paid by the borrower for taking a…

Q: You have just been offered a commercial paper with a face value of ¢45,000,000 which bears a…

A: Commercial paper is a type of short-term, unsecured debt instrument that is issued by corporations,…

Q: Find the term of the following ordinary general annuity. State your answer in years and months (from…

A: Present value = pv = $11,000 Monthly payment = p = $220 Interest rate = 5.15% quarterly interest…

Q: The issuance of new securities occurs in the:

A: A company issues different types of financial securities to raise capital. The security being…

Q: A BBB-rated corporate bond has a yield to maturity of 8.2%. A U.S. Treasury security has a yield to…

A: A treasury bill is a kind of debt security issued by the government and private companies for…

Q: A leasing contract calls for an immediate payment of $118,000 and nine subsequent $118,000…

A: The concept of time value of money will be used and applied here. This is a case of annuity due as…

Q: Suppose that you have $1 million and the following two opportunities from which to construct a…

A: Expected rate of return of Portfolio: The total return that the investor anticipates under various…

Q: The following certificate of deposit (CD) was released from a particular bank. Find the compound…

A: A certificate of deposit(CD) is a type of savings account that offers a higher interest rate than a…

Q: A non-interest bearing eight year note for $5000 issued August 1, 2008 is discounted April 1, 2011…

A: To find the compound discount, we need to determine the present value of the note on April 1, 2011.…

Q: Calculate the standard deviation of the following returns. Year Return 1 -0.14 2 -0.1 3 4 5 -0.12…

A: Standard deviation is calculated using the formula: Standard deviation=∑Return-Average…

Q: Trashia has a mortgage of $474,000 through her bank for property purchased. The loan is repaid by…

A: Solution : Loan Amount = $ 474000 Loan Term = 23 Year or 276 month Interest…

Q: an attempt to manage economic exposure, the following are examples of diversifying operating cash…

A: Cash flow is an important financial statement and matrix which help us to understand the total…

Q: After completing your Bachelor of Business (Accounting) degree, suppose you secure a permanent…

A: With a specific rate of return, or discount rate, an annuity's present value is the current worth of…

Q: Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln…

A: Installation Costs: The costs that are incurred to bring a newly purchased equipment to make it fit…

Q: 6. Assume you are planning to invest $3,000 each year for five years at 10% per anum. Determine the…

A: Step 1 The future value of an annuity, when assuming a particular rate of return or discount rate,…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- What kind of obligation are the following? 1.1. Rosalie agreed to pay her tuition fee in five monthly installments. 1.2. Gino promised to give Rhino a puppy husky four months from now. 1.3. Ivy is buying a pair of headlights for her car but requested that she will buy one piece at a time because her money is insufficient for both pieces. 1.4. The parents donated a farm lot to their children Josie, Jojo, and Joey. 1.5. The teacher opted for “blended” teaching where she can meet students face to face for 10 hours and give them e-learning materials for 40 hours.Read the case and analyze. Identify which part of the case refers to the 5C’s of credit. Mr. Cruz is a scholar in one of the charitable organizations in the town. He is in 2nd year college and took up Bachelor of Science in Management. Even though he is receiving P10,000.00 per semester, Mr. Cruz realize that the money from his scholarship is not enough to provide his needs that is why he work as a part time worker in a computer shop as an encoder and earns P4,000.00 a month. During pandemic, Mr. Cruz was not able to earn from his sideline and was informed that his scholarship allowance will be delayed for one month. Mr. Cruz is really dedicated in enrolling; what do you think should Mr. Cruz do?Dimi wants to start up his own business. Unfortunately, he doesn’t have a lot of money. That’s why his bank is offering him a credit cards on December 1, 2015. This allows him to spend money and only pay it back when it suits him. On January 1, 2016 Dimi spends 3,000 and then on April 1, 2017 another 5,000 euros. On January 1, 2018, he spends 150 euros every month during one year. Off course a credit card is not cheap. Dimi will need to pay an annual effective interest rate of 3.2% for the first 12 months and an annual effective interest rate of 16.8% for the period after. What does Dimi need to repay the credit card company on December 1, 2018? (I will send you another question that related to this answered after you provide the solution) please answer in paper its easy to understand

- Henri quit his job as a teacher earning AUD 70,000 per year to start his own food kiosk business. To save on rent, Henri utilized his own property. He normally earned AUD 50,000 annual rent from this property. Also, to start the business, Henri used AUD 60,000 from his own savings which he earned 4% interest per year. Further in order to start the business, Henri borrowed $40,000.00 from the bank and was paying 6% interest per year. Henri’s first year of business can be summarized as follows: Item Amount $ Revenue- Food section 250,000 Revenue- Liquor 180,000 Revenue-Soft drinks 40,000 2 Cashiers expense (wages per worker) (30,000) Food van (100,000) Manager wages (60,000) Food preservatives (30,000) Equipment expense (60,000) Motorcycle expense to ease movement in city (30,000) 2 food freezers (cost per freezer) (5000) Based on your calculations of accounting profit and economic profit, would you advise Henri to return to his teaching job or continue…Maria will be a college sophomore next year, and she is determined to have her own credit card. She will not be employed during the school year but is convinced that she can pay for credit card expenses based on her summer earnings. Maria's parents have read a number of articles about the problems of credit cards and college students, including examples of students leaving school after a downward spiral of credit cards, overspending, working to pay bills, worrying about bills, working more hours to pay bills, and eventually withdrawing from school. When Maria showed up with a handful of applications including Visa, a Gold MasterCard, Discover, a Visa sponsored by her university, an American Express, a secured MasterCard, and a gas company card her parents were overwhelmed. Maria admitted she didn't want them all. "I'm not stupid," she declared. Since Maria obviously needed to learn about credit cards, her parents agreed to co-sign her application on one condition. She…Maria will be a college sophomore next year, and she is determined to have her own credit card. She will not be employed during the school year but is convinced that she can pay for credit card expenses based on her summer earnings. Maria's parents have read a number of articles about the problems of credit cards and college students, including examples of students leaving school after a downward spiral of credit cards, overspending, working to pay bills, worrying about bills, working more hours to pay bills, and eventually withdrawing from school. When Maria showed up with a handful of applications including Visa, a Gold MasterCard, Discover, a Visa sponsored by her university, an American Express, a secured MasterCard, and a gas company card her parents were overwhelmed. Maria admitted she didn't want them all. "I'm not stupid," she declared. Since Maria obviously needed to learn about credit cards, her parents agreed to co-sign her application on one condition. She…

- Maria will be a college sophomore next year, and she is determined to have her own credit card. She will not be employed during the school year but is convinced that she can pay for credit card expenses based on her summer earnings. Maria's parents have read a number of articles about the problems of credit cards and college students, including examples of students leaving school after a downward spiral of credit cards, overspending, working to pay bills, worrying about bills, working more hours to pay bills, and eventually withdrawing from school. When Maria showed up with a handful of applications including Visa, a Gold MasterCard, Discover, a Visa sponsored by her university, an American Express, a secured MasterCard, and a gas company card her parents were overwhelmed. Maria admitted she didn't want them all. "I'm not stupid," she declared. Since Maria obviously needed to learn about credit cards, her parents agreed to co-sign her application on one condition. She…Ansm Audrey worked a part-time job during college to help pay for various expenses. She also set aside $200 each month and invested it into the stock market. During that time, the stock market retumed 10.6 % annually. If she did this each month for the four years she was in college, how much will her account be worth when she graduates? Enter your answer as a numerical value (no labels), rounded to the nearest dollarJamie Lee Jackson, age 27, full-time student and part-time bakery employee, has just moved into a bungalow-style, unfurnished home of her own. The house is only a one-bedroom, but the rent is manageable and has plenty of room for Jamie Lee. She decided to give notice to her roommate that she would be leaving the apartment and the shared expenses after the incident with the stolen checkbook and credit cards a few weeks back. Jamie had to dip in to her emergency savings account to help cover the deposit and moving expenses, as she had not planned to move out of the apartment and be on her own this soon. Jamie is in need of a few appliances, as there is a small laundry room, but no washer or dryer, nor is there a refrigerator in the kitchen. She will also need a living room set and a television because the only furniture she currently has is a bedroom suite. Jamie is so excited to finally have the say in how she will furnish the bungalow, and she began shopping for her home as soon as the…

- Clara Hammond persuaded her daughter, Never-Do-Well to give up her secretarial work and read BSc (Accounting Option) at Ghana Communication Technology University by promising to pay her GH¢1,500 maintenance fee per month. After the daughter had begun the course, the mother bought a house at Tesano, so that the daughter could live there rent-free. Eventually, after the daughter had had more than three unsuccessful attempt at passing business law examinations, the mother and daughter fell out. The mother sought to gain possession of the house, and the daughter refused. Advise Clara Hammond and Never-Do-Well. what is the legal issue or law?Clara Hammond persuaded her daughter, Never-Do-Well to give up her secretarial work and read BSc (Accounting Option) at Ghana Communication Technology University by promising to pay her GH¢1,500 maintenance fee per month. After the daughter had begun the course, the mother bought a house at Tesano, so that the daughter could live there rent-free. Eventually, after the daughter had had more than three unsuccessful attempt at passing business law examinations, the mother and daughter fell out. The mother sought to gain possession of the house, and the daughter refuse.what is the area of law?Clara Hammond persuaded her daughter, Never-Do-Well to give up her secretarial work and read BSc (Accounting Option) at Ghana Communication Technology University by promising to pay her GH¢1,500 maintenance fee per month. After the daughter had begun the course, the mother bought a house at Tesano, so that the daughter could live there rent-free. Eventually, after the daughter had had more than three unsuccessful attempt at passing business law examinations, the mother and daughter fell out. The mother sought to gain possession of the house, and the daughter refused. Advise Clara Hammond and Never-Do-Well. with conclusion advice both parties?