Should you refinance your mortgage? If you have an adjustable rate mortgage and plan on keeping your house, yes. If you can reduce your fixed interest rate by 1-2%, yes. If you have a high interest rate second mortgage and the balance is large, yes. Brett Gardner and Nellie Viner are remodeling their home. They took out a second mortgage for $120,000 at 4.5% for 10 years. Their first mortgage is $390,000 at 3% for 25 years. Should they refinance both mortgages into one 30-year mortgage at 2.875% ? ( Use the Table 15.1) Note: Do not round intermediate calculations. Round your answers to the nearest cent. Interest option 1 Interest option 2 Should you refinance your mortgage?

Should you refinance your mortgage? If you have an adjustable rate mortgage and plan on keeping your house, yes. If you can reduce your fixed interest rate by 1-2%, yes. If you have a high interest rate second mortgage and the balance is large, yes. Brett Gardner and Nellie Viner are remodeling their home. They took out a second mortgage for $120,000 at 4.5% for 10 years. Their first mortgage is $390,000 at 3% for 25 years. Should they refinance both mortgages into one 30-year mortgage at 2.875% ? ( Use the Table 15.1) Note: Do not round intermediate calculations. Round your answers to the nearest cent. Interest option 1 Interest option 2 Should you refinance your mortgage?

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 2DTM

Related questions

Question

Transcribed Image Text:Should you refinance your mortgage? If you have an adjustable rate mortgage and plan on keeping your house, yes. If you can reduce

your fixed interest rate by 1-2%, yes. If you have a high interest rate second mortgage and the balance is large, yes. Brett Gardner and

Nellie Viner are remodeling their home. They took out a second mortgage for $120,000 at 4.5% for 10 years. Their first mortgage is

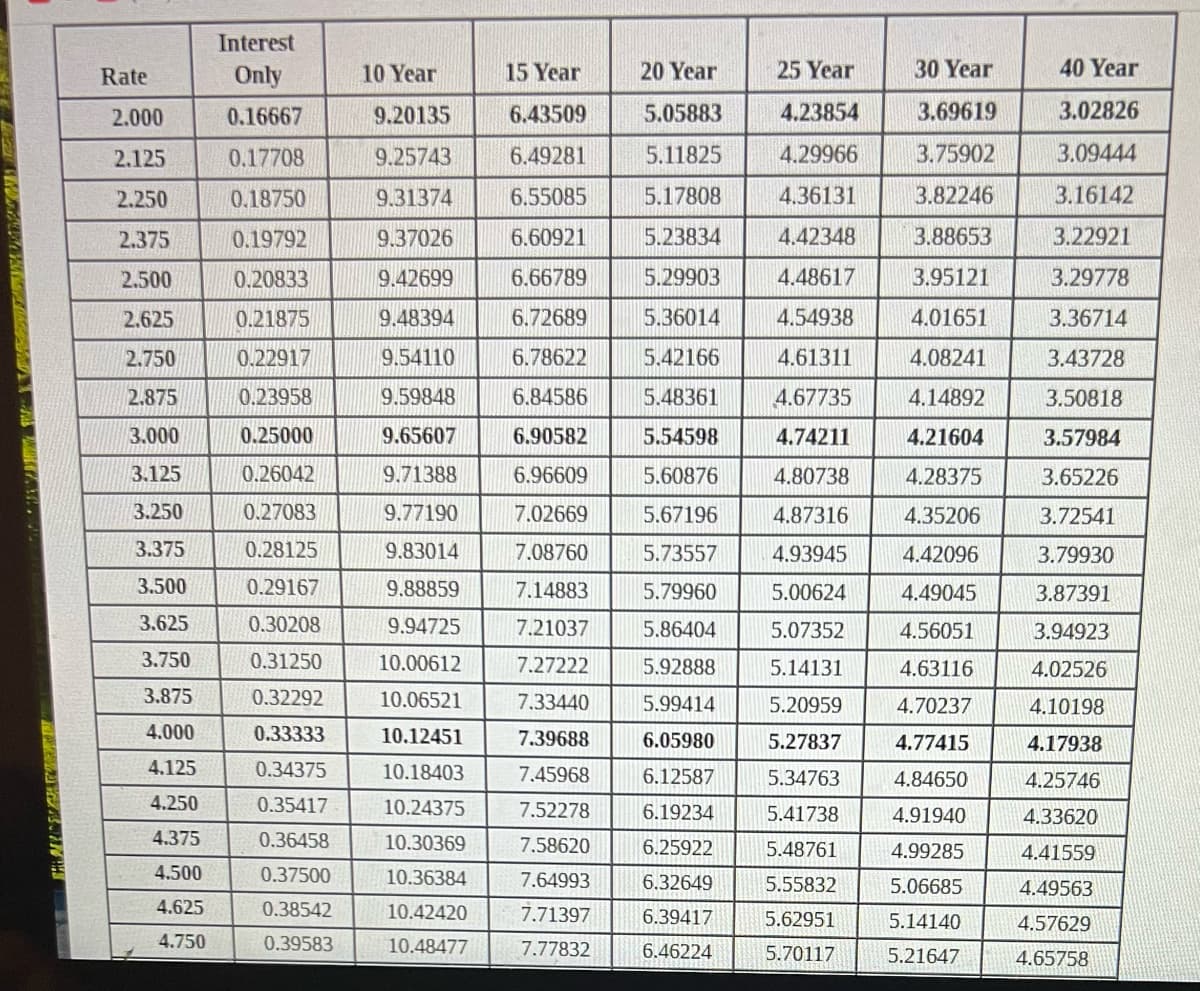

$390,000 at 3% for 25 years. Should they refinance both mortgages into one 30-year mortgage at 2.875% ? (Use the Table 15.1)

Note: Do not round intermediate calculations. Round your answers to the nearest cent.

Interest option 1

Interest option 2

Should you refinance your mortgage?

Transcribed Image Text:PERALD

Rate

2.000

2.125

2.250

2.375

2.500

2.625

2.750

2.875

3.000

3.125

3.250

3.375

3.500

3.625

3.750

3.875

4.000

4.125

4.250

4.375

4.500

4.625

4.750

Interest

Only

0.16667

0.17708

0.18750

0.19792

0.20833

0.21875

0.22917

0.23958

0.25000

0.26042

0.27083

0.28125

0.29167

0.30208

0.31250

0.32292

0.33333

0.34375

0.35417

0.36458

0.37500

0.38542

0.39583

10 Year

9.20135

9.25743

9.31374

9.37026

9.42699

9.48394

9.54110

9.59848

9.65607

9.71388

9.77190

9.83014

9.88859

9.94725

10.00612

10.06521

10.12451

10.18403

10.24375

10.30369

10.36384

10.42420

10.48477

15 Year

20 Year

25 Year

6.43509

5.05883

4.23854

6.49281

5.11825

4.29966

6.55085

5.17808

4.36131

6.60921

5.23834

4.42348

6.66789

5.29903

4.48617

6.72689

5.36014

4.54938

6.78622

5.42166

4.61311

6.84586

5.48361

4.67735

6.90582

5.54598

4.74211

6.96609

5.60876

4.80738

7.02669

5.67196

4.87316

7.08760

5.73557

4.93945

7.14883

5.79960

5.00624

7.21037 5.86404 5.07352

7.27222

5.92888

5.14131

7.33440

5.99414

5.20959

7.39688

6.05980

5.27837

7.45968

6.12587

5.34763

7.52278

6.19234

5.41738

7.58620

6.25922

5.48761

7.64993

6.32649

5.55832

7.71397

6.39417

5.62951

7.77832

6.46224

5.70117

30 Year

3.69619

3.75902

3.82246

3.88653

3.95121

4.01651

4.08241

4.14892

4.21604

4.28375

4.35206

4.42096

4.49045

4.56051

4.63116

4.70237

4.77415

4.84650

4.91940

4.99285

5.06685

5.14140

5.21647

40 Year

3.02826

3.09444

3.16142

3.22921

3.29778

3.36714

3.43728

3.50818

3.57984

3.65226

3.72541

3.79930

3.87391

3.94923

4.02526

4.10198

4.17938

4.25746

4.33620

4.41559

4.49563

4.57629

4.65758

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you