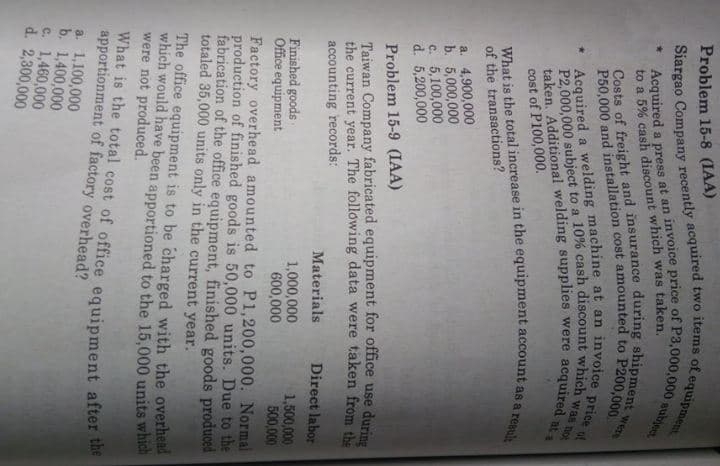

Siargao Company recently acquired two items of equipment Acquired a press at an invoice price of P3,000,000 subject to a 5% cash discount which was taken. Costs of freight and insurance during shipment v P50,000 and installation cost amounted to P200,000. were Acquired a welding machine at an invoice price of P2,000,000 subject to a 10% cash discount which was not taken. Additional welding supplies were acquired at a cost of P100,000. What is the total increase in the equipment account as a reault of the transactions? a. 4,900,000 b. 5,000,000 c. 5,100,000 d. 5,200,000

Siargao Company recently acquired two items of equipment Acquired a press at an invoice price of P3,000,000 subject to a 5% cash discount which was taken. Costs of freight and insurance during shipment v P50,000 and installation cost amounted to P200,000. were Acquired a welding machine at an invoice price of P2,000,000 subject to a 10% cash discount which was not taken. Additional welding supplies were acquired at a cost of P100,000. What is the total increase in the equipment account as a reault of the transactions? a. 4,900,000 b. 5,000,000 c. 5,100,000 d. 5,200,000

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section: Chapter Questions

Problem 6AP

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

100%

Transcribed Image Text:Problem 15-8 (IAA)

to a 5% cash discount which was taken.

were

price

of

at a

cost of P100,000.

of the transactions?

a. 4,900,000

b. 5,000,000

c. 5,100,000

d. 5,200,000

Problem 15-9 (IAA)

Taiwan Company fabricated equipment for office use durine

the current year. The following data were taken from the

accounting records:

Materials

Direct labor

Finished goods

Office equipment

1,000,000

600,000

1,500,000

500,000

Factory overhead amounted to P1,200,000. Normal

production of finished goods is 50,000 units. Due to the

fabrication of the office equipment, finished goods produced

totaled 35,000 units only in the current year.

The office equipment is to be charged with the overhead

which would have been apportioned to the 15,000 units which

were not produced.

apportionment of factory overhead?

a. 1,100,000

b. 1,400,000

c. 1,460,000

d. 2,300,000

Acquired a at an invoice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning