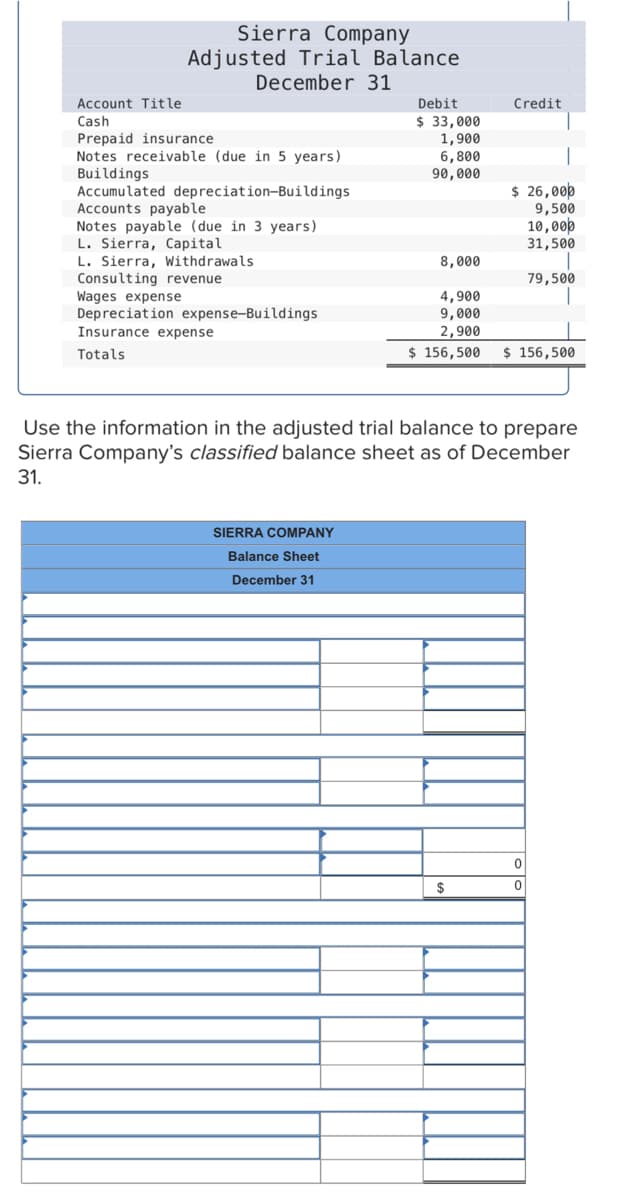

Sierra Company Adjusted Trial Balance December 31 Account Title Debit Credit Cash $ 33,000 Prepaid insurance 1,900 6,800 Notes receivable (due in 5 years) Buildings 90,000 Accumulated depreciation-Buildings Accounts payable $ 26,000 9,500 Notes payable (due in 3 years) 10,000 L. Sierra, Capital 31,500 L. Sierra, Withdrawals 8,000 Consulting revenue 79,500 Wages expense 4,900 9,000 Depreciation expense-Buildings Insurance expense 2,900 Totals $ 156,500 $ 156,500 Use the information in the adjusted trial balance to prepare Sierra Company's classified balance sheet as of December 31.

Q: Sassy Company uses the product cost concept of applying the cost-plus approach to product pricing…

A: Calculation of unit selling price for the company's product:- 12.78 is the right answer.…

Q: Determine the correct classification of the following liabilities: (1) Liability with a due…

A: The answer for the multiple choice question and relevant explanation are presented hereunder : The…

Q: Home Company manufactures tables with vinyl tops. The standard material cost for the vinyl used per…

A: Material usage variance= (Standard material quantity- Actual material quantity)* standard price…

Q: Direction: Encircle the letter of the best answer. 1.) jade invested P200,000 in a repair…

A: Transactions - Transaction are entered into by the organization in the normal course of business. To…

Q: On January 1, 2020, Dulcinea Company enters into a ten-year noncancelable lease for equipment having…

A: Finance lease refers to an agreement where a person transfer the right to use an asset to another…

Q: On December 31, 2019, Blackpink Incorporated purchase a trademark. Data pertinent to the trademark…

A: Impairment of assets means when there is reduction in value of asset over the period of time.

Q: Statement 1: All property, plant and equipment shall be initially measured at cost and presented in…

A: property plant and equipment are shown in the balance it as a set under the non current asset…

Q: A fixed asset with a cost of $24,737 and accumulated depreciation of $22,263 is traded for a similar…

A: The new equipment with commercial substance should be recorded at fair market value.

Q: 4) A plant that was built five years ago required a capital investment of t10 million. The plant…

A: Cost of fixed assets is determined not only on the basis of the acquisition cost and incidental…

Q: company has three jobs in process: Job No. 1, Job No. 2 and Job No. 3 Raw materials used 840,000…

A: Calculation of Direct material cost for Job no.1 , Job no. 2 , Job no. 3 Raw Material Used =…

Q: The payroll register of Castilla Heritage Co indicates $2,790 of social security withheld and…

A: Federal Unemployment Taxes = Taxable earnings x Federal Unemployment Taxes rate State Unemployment…

Q: Using the following accounts in Table (1) below, prepare a Balance Sheet for Bali Tour Sdn.Bhd. as…

A: The balance sheet's of the business organizations helps the stakeholders in analyzing the company's…

Q: Given the book values of the inventory items of Piggy Farm as of 31 December 2021: ITEM Accounts…

A: PIGGY FARM BALANCE SHEET as on 31/12/2021 ASSETS Current Assets Cash 1,500…

Q: Answer Problem #2 : items 5 & 6

A: In the give question we have to allocate overhead and labor cost to on jobs

Q: The cash balance of AA Company had the following information: Descriptions November December…

A: A bank Reconciliation statement is a report that is prepared to know the differences between…

Q: Question 1: What should an employer use to complete Form W-3? Answer: A. O Employee earnings records…

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: hich of the following statements are true and which are false?

A: I. Externalities is the one of the reason for market failure not an only reason. They are many…

Q: On 1 July 2021 Collaroy Ltd acquired the following assets and liabilities from Bilgola Ltd Carrying…

A: In case one company overtake the assets and liabilities of another company , then accounting for…

Q: Which of the following types of accounts allows investment gains to grow ta free and alows you to…

A: An employee may be able to get the benefits of the said scheme after a certain period of time.…

Q: A customer returns $870 worth of merchandise and receives a full refund. What accounts recognize…

A: Introduction: Sales returns: Returning of the goods to retailer called as sales returns. And the…

Q: Montana Incorporated began the year with a retained earnings balance of $50,000. The company paid a…

A: Introduction: Retained Earnings: Retained Earnings are share holders funds. Part of profit is kept…

Q: Statement 1: An entity shall disclose the period of construction in which borrowing costs are…

A: borrowing cost include financial charges like interest on loan and overdraft. the capitalisation of…

Q: Question 32: What statement about Form I-9 is accurate? Answer: A. The employee submits one or two…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Describe catastrophe recovery and explain why it's important for a company. To what extent do you…

A: The benefits of Catastrophe Recovery in this world has become immense after the situation like…

Q: For each of the following independent transactions, indicate whether there was an increase,…

A: Each financial transaction has respective effect on the asset equation. The asset equation is…

Q: Minor Company had checks outstanding totaling $5,145 on its April bank reconciliation. In May, Minor…

A: Bank reconciliation statement is used to determine the differences between the bank statement…

Q: Work in Process 160,000 3,760,000 Finished Goods Beg 320,000 720,000 1,200,000 pplied1,920,000 ? ?…

A: Cost of material requestion is the value of raw materials issued for production . It can be used…

Q: 27. How much is over or under-applied factory overhead? 28. How much is the ending work in process…

A: 27. Actual factory overhead= 18,40,000 factory overhead applied= 19,20,000 Factory overhead…

Q: The following information was taken from the records of GALATIANS Boutique Shop for the month of…

A: Retail inventory method is used by the retail operations like department stores to value the…

Q: Colin McFarland's weekly gross earnings for the week ending March 9 were $1,850, and her federal…

A: Formula: Social security tax = Gross earnings x Social security tax rate Medicare tax = Gross…

Q: Bill Casler bought a $9000, 9-month certificate of deposit (CD) that would earn 8% annual simple…

A: a. CD value at the time of maturity is the sum of principal and interest for 9 months = $ 9000+ $…

Q: Happy Tea Company’s regular selling price for a case of its product is $6. Variable costs are $4 per…

A: At the time of considering special order, if the special order is covered under the relevant range…

Q: The condensed income statement for Monroe Corp. for the past year is as follows: Product В C Sales…

A: If product B is discontinued then Total Fixed costs will be allocated to product "C" Because Fixed…

Q: Pal and Mall are partners with capital of P200, 000 and P100,000and sharing profits and losses 3:1…

A: A partnership is an agreement between two or more partners where partners are agreed to work…

Q: Determine the correct classification of the following liabilities: (1) Liability due in 6…

A: Current Liabilities are the liabilities which are due within 1 year. Non Current Liabilities are the…

Q: A $65 petty cash fund has cash of $20 and receipts of $60. The journal entry to replenish the…

A: Petty cash book is the cash books in which we include small expenses, It is sorted by date, we can…

Q: Securities exchanges create efficient markets that do all of the following EXCEPT

A: Because there are primary markets and Secondary Markets which investors have to take the opportunity…

Q: tigative services firm that is owned and operated by Shirley Vickers. On November 30, 20Y8, the end…

A: Hello student! Since you have posted multiple sub-questions, we will answer the first 3 sub-parts as…

Q: n the following ordinary annuity, the interest is compounded with each payment, and the payment is…

A: How long will it take to have enough for a 20% down payment on a $155,000 condo in the city:- 20%…

Q: Zhang Company, an IFRS company, sold $8,000,000 of 6%, 3-year bonds on Jan 1, 2016. The bonds pay…

A: A bond is a fixed-income security that represents an investor's obligation to a lender (typically…

Q: Statement 1: In impairment loss, the discount rate being used is the current pretax rate that…

A: Ans. While computing impairment loss it is necessary that the cash flows are adjusted and multiplied…

Q: A company is manufacturing three products X, Y and Z. The following information is supplied to you:…

A: A production cost statement is a statement consisting of direct, indirect, variable and fixed costs…

Q: Problem 16-1 (IAA) Roxas Company reported the following net income: 2020 2021 1,750,000 2,000,000 An…

A: A record is often recorded in the main ledger; however, it may also be entered in a subsidiary…

Q: On January 2, 2021, Tripod Company receives a government loan of P2,000,000 paying a coupon interest…

A: As per standard accounting practices a revenue is recognized when it is earned and…

Q: Question 2: How is self-employment income calculated?

A: As per guidelines, only one question is allowed to be solved so I am answering the first question.…

Q: Question Content Area Preferred and Common Stock Dividends Delafield Corporation has a single class…

A: Dividends refers to the payments that is made by the entity to its shareholders in return for the…

Q: Year 2 3 5 2500 7 8 Cost of 1500 1600 1800 2100 2900 3400 4000 operation Rescue 3500 2500 1700 800…

A: An asset's usage or maintenance cost increase with the period of time, then the assets need to be…

Q: partnership. The partnership pays P73,000 cash for Banner’s interest. How much is the capital…

A: A partnership is a legal process for two or more organizations to control and run a business and…

Q: te. The equipment had a remaining useful life of 8 years and estimated residual value of P50,000.…

A: Impairment of Assets

Q: Exercise 15-20 (Algorithmic) (LO. 3, 4) Jason and Paula are married. They file a joint return for…

A: A tax deduction called qualified business income deduction is the one which is given to the small…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Eastwood CompanyAdjusted Trial BalanceDecember 31, 2020 Debit Credit Cash $ 41,000 Accounts Receivable 163,500 Allowance for Doubtful Accounts $ 8,700 Prepaid Insurance 5,900 Inventory 208,500 Equity Investments (long-term) 339,000 Land 85,000 Construction in Process (building) 124,000 Patents 36,000 Equipment 400,000 Accumulated Depreciation—Equipment 240,000 Discount on Bonds Payable 20,000 Accounts Payable 148,000 Accrued Liabilities 49,200 Notes Payable 94,000 Bonds Payable 200,000 Common Stock 500,000 Paid-in Capital in Excess of Par—Common Stock 45,000 Retained Earnings 138,000 $1,422,900 $1,422,900 Additional information: 1. The LIFO method of inventory value is used. 2. The cost and fair value of the long-term investments that consist of stocks (with ownership less than 20% of total shares) are the same. 3. The amount of the Construction in Progress…7. Entity A publishes quarterly interim financial reports. Entity A’s annual depreciation for items of PPE is P120,000. At the end of the first quarter, Entity A’s inventories have a cost of P600,000 and a net realizable value of P510,000. Entity A expects that the total employee bonuses (13th month pay) that will be paid at year-end will amount to P60,000. How much is the total amount of expense to be recognized from the items described above in Entity A’s first quarter statement of profit or loss?Need in 10 mins 14. On January 1, 20x1, ABC sold a used vehicle with a historical cost of P2,000,0000 and accumulated depreciation of P700,000 in exchange for cash of P100,000 and a noninterest bearing note receivable of P1,000,000 due in 4 equal annual installments starting on December 31, 20x1 and every December 31, thereafter. The prevailing rate of interest for this type of note is 12%. On December 31, 20x2, the carrying amount of the note receivable is approximately (use 6-decimal present value factor)

- 25 Vanderbilt Company is a dealer in machinery. On January 1, 2010 machinery was leased to another enterprise with the following provisions: Annual rental payable at the end of each year, 3,000,000Lease term and useful life of machinery, 5 yearsCost of machinery, 8,000,000Residual value-unguaranteed, 1,000,000Implicit interest rate, 12%PV of an ordinary annuity of 1 for 5 periods at 12% 3.60PV of 1 for 5 periods at 12% 0.57 At the end of the lease term on December 31, 2010, the machinery will revert to Vanderbilt. The perpetual inventory system is used. Vanderbilt incurred initial direct cost of P300,000 in finalizing the lease agreement.What is the total financial revenue from the lease? a. 4,630,000 b. 4,200,000 c. 5,200,000 d. 3,630,000QUESTION 1The following trial balance relates to Golden Ltd at 30th September 2018 GHS'000 GHS'000Sales (a) 760,000Material purchases (b) 128,000Production labour (b) 248,000Factory overheads (b) 160,000Distribution costs 28,400Administrative expenses (c) 92,800Finance costs 700Investment income 1,600Leased property - at cost (b) 100,000Plant and equipment - at cost (b) 89,000Accumulated amortisation/depreciation at 1/10/2017- leased property 20,000- plant and equipment…Company B's December 31 Year-End Balance Sheet reveals the following: • December 31, 2020 net PPE of $865 • December 31, 2020 Accumulated Depreciation of $250 • December 31, 2021 net PPE of $770 • December 31, 2021 Accumulated Depreciation of $230 • Annual 2021 Depreciation Expense was $100 • During 2021, PPE was purchased for $560; all PPE purchases are made in cash. • During 2021, the gain of the sale of PPE was $20 What is the journal entry Company B recorded to recognize 2021 depreciation expense? Dr. Accumulated Depreciation $20 Cr. Depreciation Expense $20 Dr. Depreciation Expense $100 Cr. Accumulated Depreciation $100 Dr. Depreciation Expense $20 Cr. Accumulated Depreciation $20 Dr. Depreciation Expense $100 Cr. PPE $100

- Camaro GTO Torino Cash $ 2,550 $ 260 $ 1,300 Short-term investments 0 0 700 Current receivables 290 540 650 Inventory 2,250 2,080 3,200 Prepaid expenses 400 700 900 Total current assets $ 5,490 $ 3,580 $ 6,750 Current liabilities $ 2,280 $ 1,350 $ 3,700 Compute the acid-test ratio for each of the following separate cases. Camaro- GTO- Torino-i) Company X Financial Year ends March 31. A laptop purchased 02 August 2018 at a cost of P9,500 was disposed off in January 2020 for P6800. Assuming the organisation follows local GAAPS on depreciation, provide the Journal Entries for this transaction. Outline all assumptions used. (ii) The following in being considered: Purchase of an office building worth P1M from unrestricted funding. Currently, the office building is on a 2-year lease, with rentals of BWP22,000 per month. 11 Provide your recommendations to the Finance Manager. What would be the possible effect on the Financial Health of the organisation if these transactions are approved (iii) List any key financial controls for an NGO and why these are important. (iv) Company X’s year-end is March 31. It is now April 4. A staff member asks you to process an unpaid invoice with details as follows: The invoice is for bus transportation in the amount of P800 and is dated April 2. The invoice indicates the charges relate to…In 20x1, XYZ Company enters into a construction contract with a customer. The contract price is P10,000,000.Information on the contract follows:20X1 20X2 20X3Contract costs incurred during the year P2,645,132 P236,451 P2,657,000Estimated costs to complete 2,697,451 2,116,777 -Progress Billings 5,000,000 3,000,000 2,000,000Collections on progress billings 2,000,000 4,000,000 4,000,000 Using the cost-to-cost method, Note: Use up to two (2) decimal places in presenting the answer for percentage of completion. Use six (6)decimal places when applying the percentage.1. Percentage of completion for 20x1 _____________2. Revenue that should be recognized in 20x1 _____________3. Realized gross profit in 20x1 _____________4. Balance of "Contract Liability" at the end of 20x1 _____________

- In 20x1, XYZ Company enters into a construction contract with a customer. The contract price is P10,000,000.Information on the contract follows:20X1 20X2 20X3Contract costs incurred during the year P2,645,132 P236,451 P2,657,000Estimated costs to complete 2,697,451 2,116,777 -Progress Billings 5,000,000 3,000,000 2,000,000Collections on progress billings 2,000,000 4,000,000 4,000,000Using the cost-to-cost method, compute the following: Note: Use up to two (2) decimal places in presenting the answer for percentage of completion. Use six (6)decimal places when applying the percentage.7. Realized gross profit in 20x2 _____________8. The balance of "Contract Liability" at the end of 20x2 _____________9. Revenue that should be recognized in 20x3 _____________10. Realized gross profit in 20x3In 20x1, XYZ Company enters into a construction contract with a customer. The contract price is P10,000,000.Information on the contract follows:20X1 20X2 20X3Contract costs incurred during the year P2,645,132 P236,451 P2,657,000Estimated costs to complete 2,697,451 2,116,777 -Progress Billings 5,000,000 3,000,000 2,000,000Collections on progress billings 2,000,000 4,000,000 4,000,000 Using the cost-to-cost method, compute the following: Note: Use up to two (2) decimal places in presenting the answer for percentage of completion. Use six (6)decimal places when applying the percentage.4. Balance of "Contract Liability" at the end of 20x1 _____________5. Percentage of completion for 20x2 _____________6. Revenue that should be recognized in 20x2 _____________Intermediate Accounting ll ch 16 On January 1, 2021, Ameen Company purchased major pieces of manufacturing equipment for a total of $54 million. Ameen uses straight-line depreciation for financial statement reporting and deducted 100% of the equipment’s cost for income tax reporting in 2021. At December 31, 2023, the book value of the equipment was $45 million. At December 31, 2024, the book value of the equipment was $42 million. There were no other temporary differences and no permanent differences. Pretax accounting income for 2024 was $72 million. Required: Prepare the appropriate journal entry to record Ameen’s 2024 income taxes. Assume an income tax rate of 20%. What is Ameen’s 2024 net income?