Sierra Company Adjusted Trial Balance December 31 Account Title Debit $ 41,000 2,300 7,600 110,000 Credit Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) L. Sierra, Capital L. Sierra, Withdrawals Consulting revenue Wages expense Depreciation expense-Buildings $ 30,00p 11,500 12,00p 37,500 10,000 99,500 5,300 11,000 3,300 $ 190,500 $ 190,500 Insurance expense Totals

Sierra Company Adjusted Trial Balance December 31 Account Title Debit $ 41,000 2,300 7,600 110,000 Credit Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) L. Sierra, Capital L. Sierra, Withdrawals Consulting revenue Wages expense Depreciation expense-Buildings $ 30,00p 11,500 12,00p 37,500 10,000 99,500 5,300 11,000 3,300 $ 190,500 $ 190,500 Insurance expense Totals

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 46E: OBJECTIVE 6 Exercise 1-46 Income Statement ERS Inc. maintains and repairs office equipment. ERS had...

Related questions

Question

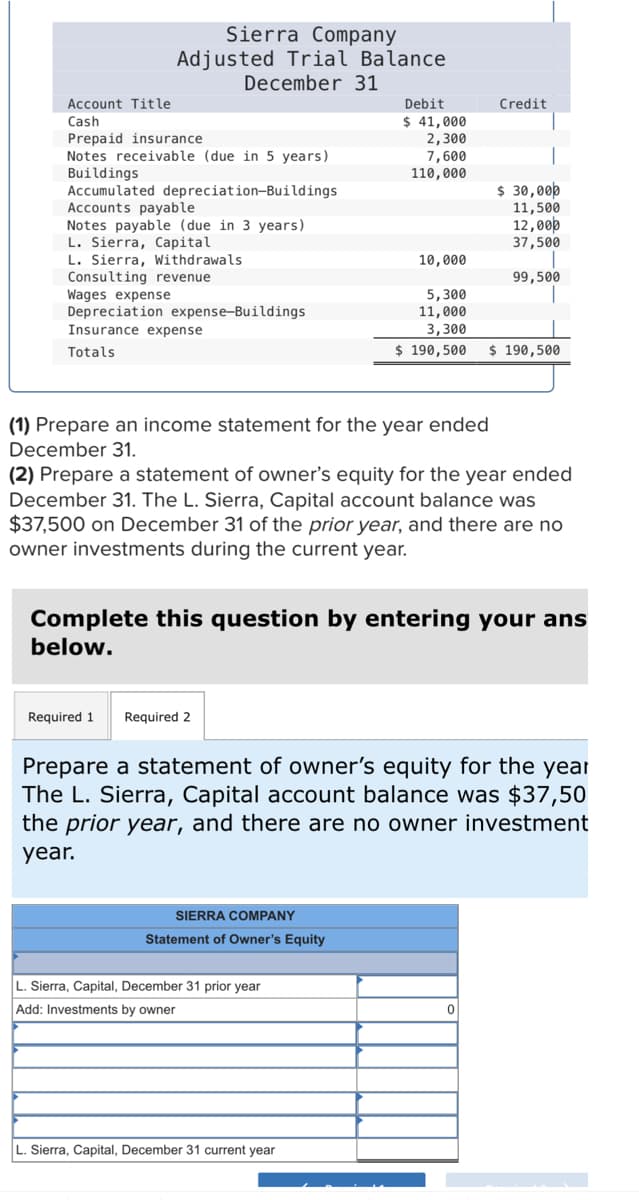

Transcribed Image Text:Sierra Company

Adjusted Trial Balance

December 31

Account Title

Cash

Prepaid insurance

Notes receivable (due in 5 years)

Buildings

Accumulated depreciation-Buildings

Accounts payable

Notes payable (due in 3 years)

L. Sierra, Capital

L. Sierra, Withdrawals

Consulting revenue

Wages expense

Depreciation expense-Buildings

Insurance expense

Debit

$ 41,000

2,300

7,600

110,000

Credit

$ 30,000

11,500

12,00p

37,500

10,000

99,500

5,300

11,000

3,300

$ 190,500

Totals

$ 190,500

(1) Prepare an income statement for the year ended

December 31.

(2) Prepare a statement of owner's equity for the year ended

December 31. The L. Sierra, Capital account balance was

$37,500 on December 31 of the prior year, and there are no

owner investments during the current year.

Complete this question by entering your ans

below.

Required 1

Required 2

Prepare a statement of owner's equity for the year

The L. Sierra, Capital account balance was $37,50

the prior year, and there are no owner investment

year.

SIERRA COMPANY

Statement of Owner's Equity

L. Sierra, Capital, December 31 prior year

Add: Investments by owner

L. Sierra, Capital, December 31 current year

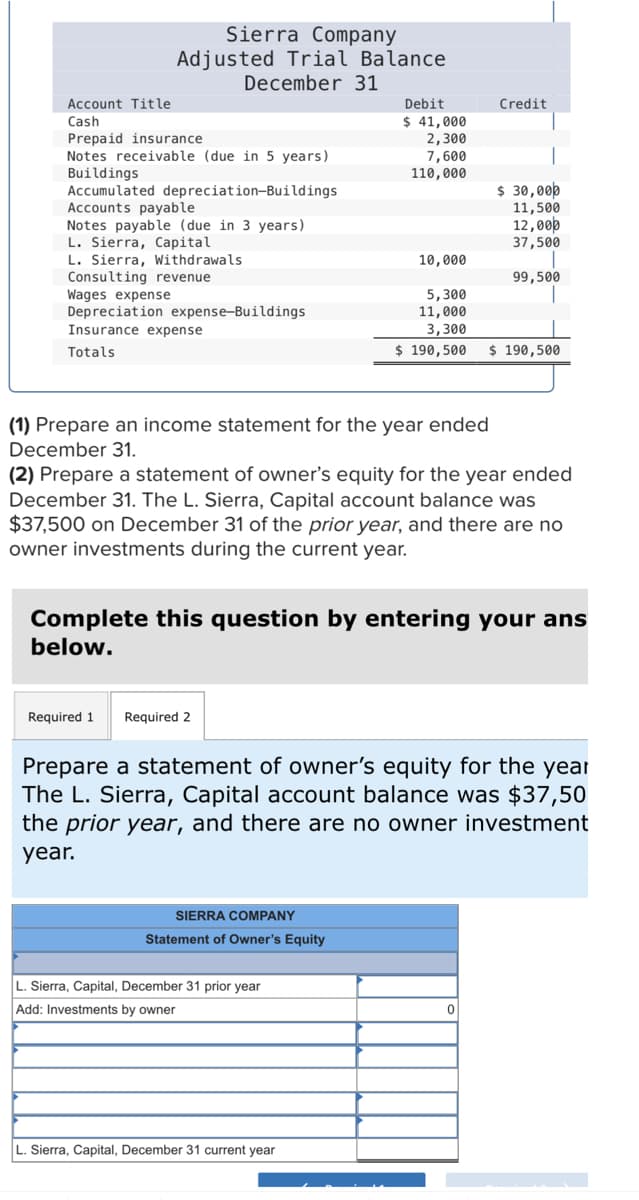

Transcribed Image Text:Sierra Company

Adjusted Trial Balance

December 31

Account Title

Cash

Prepaid insurance

Notes receivable (due in 5 years)

Buildings

Accumulated depreciation-Buildings

Accounts payable

Notes payable (due in 3 years)

L. Sierra, Capital

L. Sierra, Withdrawals

Consulting revenue

Wages expense

Depreciation expense-Buildings

Insurance expense

Debit

$ 41,000

2,300

7,600

110,000

Credit

$ 30,000

11,500

12,00p

37,500

10,000

99,500

5,300

11,000

3,300

$ 190,500

Totals

$ 190,500

(1) Prepare an income statement for the year ended

December 31.

(2) Prepare a statement of owner's equity for the year ended

December 31. The L. Sierra, Capital account balance was

$37,500 on December 31 of the prior year, and there are no

owner investments during the current year.

Complete this question by entering your ans

below.

Required 1

Required 2

Prepare a statement of owner's equity for the year

The L. Sierra, Capital account balance was $37,50

the prior year, and there are no owner investment

year.

SIERRA COMPANY

Statement of Owner's Equity

L. Sierra, Capital, December 31 prior year

Add: Investments by owner

L. Sierra, Capital, December 31 current year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning