Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 25,796 $ 30,153 $ 30,486 62,200 83,000 7,915 186,258 Cash Accounts receivable, net Merchandise inventory Prepaid expenses 89,300 112,500 8,307 50,700 57,000 3,387 160,327 Plant assets, net 192,747 Total assets $ 428,650 $ 369,526 $ 301,900 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 108,869 $ 63,699 $ 40,648 82,198 162,500 75,083 86,691 162,500 56,636 68,054 162,500 30,698 Total liabilities and equity $ 428,650 $ 369,526 $ 301,900 ecember 31, The company's income statements credit: the years ende 2016, follow. A all sales ar oi For Year Ended December 31 2017 2016 Sales $ 557,245 $ 439,736 Cost of goods sold Other operating expenses Interest expense $ 339,919 172,746 9,473 7,244 $ 285,828 111,253 10,114 6,596 Income taxes Total costs and expenses 529,382 413,791 Net income $ 27,863 $ 25,945 Earnings per share $ 1.71 1.60

Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 25,796 $ 30,153 $ 30,486 62,200 83,000 7,915 186,258 Cash Accounts receivable, net Merchandise inventory Prepaid expenses 89,300 112,500 8,307 50,700 57,000 3,387 160,327 Plant assets, net 192,747 Total assets $ 428,650 $ 369,526 $ 301,900 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 108,869 $ 63,699 $ 40,648 82,198 162,500 75,083 86,691 162,500 56,636 68,054 162,500 30,698 Total liabilities and equity $ 428,650 $ 369,526 $ 301,900 ecember 31, The company's income statements credit: the years ende 2016, follow. A all sales ar oi For Year Ended December 31 2017 2016 Sales $ 557,245 $ 439,736 Cost of goods sold Other operating expenses Interest expense $ 339,919 172,746 9,473 7,244 $ 285,828 111,253 10,114 6,596 Income taxes Total costs and expenses 529,382 413,791 Net income $ 27,863 $ 25,945 Earnings per share $ 1.71 1.60

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 16MCQ: ( Appendix 6B) Refer to the information for Morgan Inc. above. If Morgan uses a periodic inventory...

Related questions

Topic Video

Question

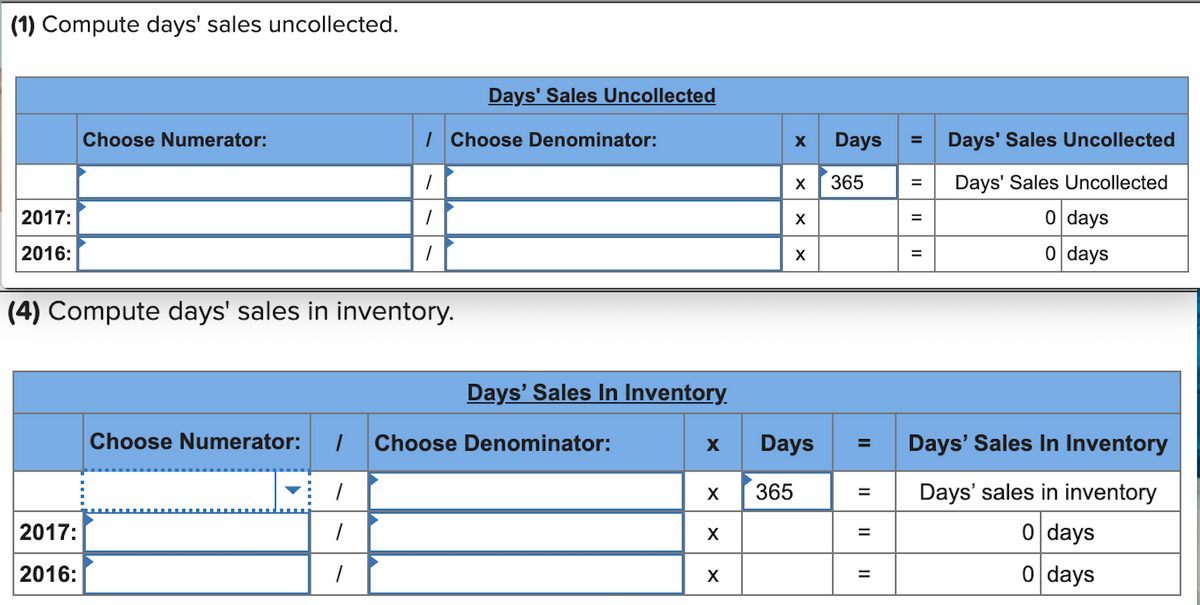

Transcribed Image Text:(1) Compute days' sales uncollected.

Days' Sales Uncollected

Choose Numerator:

| Choose Denominator:

Days

Days' Sales Uncollected

365

Days' Sales Uncollected

X

2017:

0 days

2016:

0 days

(4) Compute days' sales in inventory.

Days' Sales In Inventory.

Choose Numerator:

Choose Denominator:

Days

Days' Sales In Inventory

%3D

365

Days' sales in inventory

2017:

0 days

2016:

0 days

%D

II

II

II

II

II

![Exercise 13-8 Liquidity analysis and interpretation LO P3

[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

2017

2016

2015

Assets

$ 25,796 $

89,300

112,500

8,307

30,153 $

62,200

83,000

7,915

30,486

50,700

57,000

3,387

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

192,747

186,258

160,327

Total assets

$ 428,650 $ 369,526 $ 301,900

Liabilities and Equity

Accounts payable

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par value

Retained earnings

$ 108,869 $

63,699 $ 40,648

82,198

162,500

86,691

162,500

56,636

68,054

162,500

30,698

75,083

Total liabilities and equity

$ 428,650 $ 369,526 $ 301,900

The company's income statements for the years ended December 31, 2017 and 2016, follow. Assume that all sales are on

credit:

For Year Ended December 31

2017

2016

Sales

$ 557,245

$ 439,736

$ 339,919

172,746

9,473

7,244

$ 285,828

111,253

10,114

6,596

Cost of goods sold

Other operating expenses

Interest expense

Income taxes

Total costs and expenses

529,382

413,791

Net income

$ 27,863

$

25,945

Earnings per share

$

1.71

$

1.60](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F75227c3d-0045-449f-908c-0dff54e4e54b%2F7aaf674f-8751-468a-af81-c8d0f6b2d954%2F0k09kkh_processed.png&w=3840&q=75)

Transcribed Image Text:Exercise 13-8 Liquidity analysis and interpretation LO P3

[The following information applies to the questions displayed below.]

Simon Company's year-end balance sheets follow.

At December 31

2017

2016

2015

Assets

$ 25,796 $

89,300

112,500

8,307

30,153 $

62,200

83,000

7,915

30,486

50,700

57,000

3,387

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

192,747

186,258

160,327

Total assets

$ 428,650 $ 369,526 $ 301,900

Liabilities and Equity

Accounts payable

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par value

Retained earnings

$ 108,869 $

63,699 $ 40,648

82,198

162,500

86,691

162,500

56,636

68,054

162,500

30,698

75,083

Total liabilities and equity

$ 428,650 $ 369,526 $ 301,900

The company's income statements for the years ended December 31, 2017 and 2016, follow. Assume that all sales are on

credit:

For Year Ended December 31

2017

2016

Sales

$ 557,245

$ 439,736

$ 339,919

172,746

9,473

7,244

$ 285,828

111,253

10,114

6,596

Cost of goods sold

Other operating expenses

Interest expense

Income taxes

Total costs and expenses

529,382

413,791

Net income

$ 27,863

$

25,945

Earnings per share

$

1.71

$

1.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning