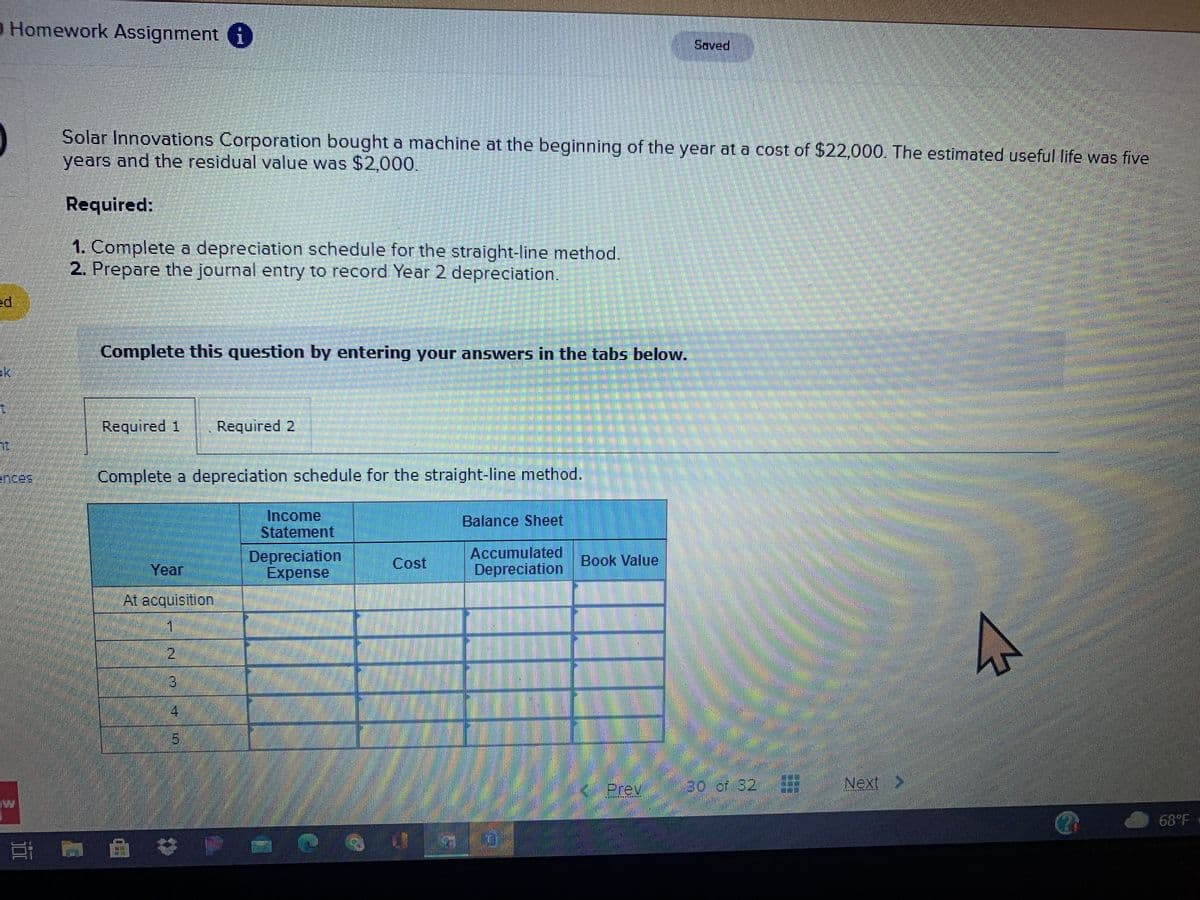

Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $22,000. The estimated useful life was five years and the residual value was $2,00. Required: 1. Complete a depreciation schedule for the straight-line method. 2. Prepare the journal entry to record Year 2 depreciation. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete a depreciation schedule for the straight-line method. Income Balance Sheet Statement Accumulated Depreciation Expense Cost Book Value Year Depreciation At acquisition 4. Prev 30 of 32 Next >

Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $22,000. The estimated useful life was five years and the residual value was $2,00. Required: 1. Complete a depreciation schedule for the straight-line method. 2. Prepare the journal entry to record Year 2 depreciation. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete a depreciation schedule for the straight-line method. Income Balance Sheet Statement Accumulated Depreciation Expense Cost Book Value Year Depreciation At acquisition 4. Prev 30 of 32 Next >

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE

Related questions

Question

What is this?

Transcribed Image Text:9 Homework Assignment i

Saved

Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $22,000. The estimated useful life was five

years and the residual value was $2,000.

Required:

1. Complete a depreciation schedule for the straight-line method.

2. Prepare the journal entry to record Year 2 depreciation.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

ances

Complete a depreciation schedule for the straight-line method.

Income

Statement

Balance Sheet

Depreciation

Expense

Accumulated

Depreciation

Cost

Book Value

Year

At acquisition

1

2.

4

Prev*

100.of 82

Next>

68 F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub