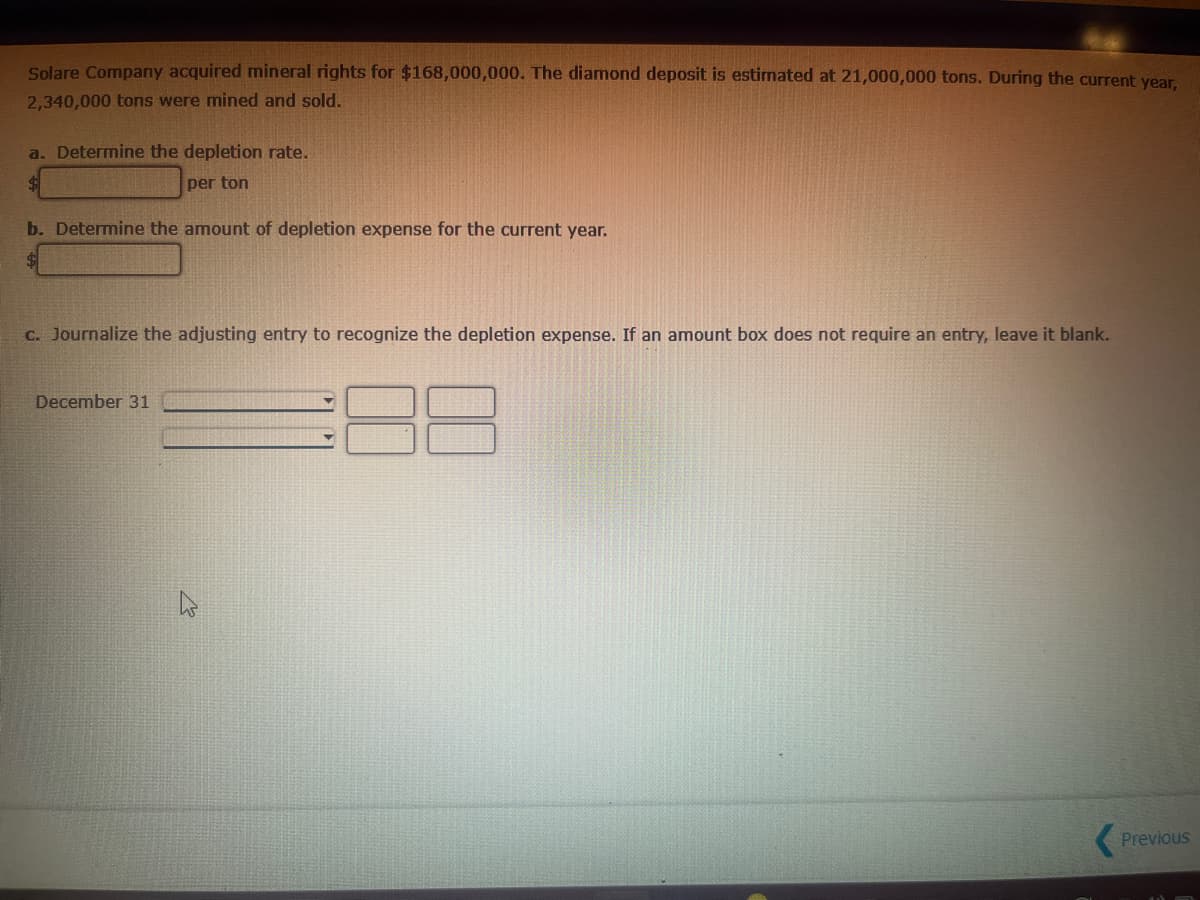

Solare Company acquired mineral rights for $168,000,000. The diamond deposit is estimated at 21,000,000 tons. During the current year, 2,340,000 tons were mined and sold. a. Determine the depletion rate. per ton b. Determine the amount of depletion expense for the current year. c. Journalize the adjusting entry to recognize the depletion expense. If an amount box does not require an entry, leave it blank. December 31 Previous

Solare Company acquired mineral rights for $168,000,000. The diamond deposit is estimated at 21,000,000 tons. During the current year, 2,340,000 tons were mined and sold. a. Determine the depletion rate. per ton b. Determine the amount of depletion expense for the current year. c. Journalize the adjusting entry to recognize the depletion expense. If an amount box does not require an entry, leave it blank. December 31 Previous

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 6CE

Related questions

Question

Transcribed Image Text:Solare Company acquired mineral rights for $168,000,000. The diamond deposit is estimated at 21,000,000 tons. During the current year,

2,340,000 tons were mined and sold.

a. Determine the depletion rate.

per ton

b. Determine the amount of depletion expense for the current year.

c. Journalize the adjusting entry to recognize the depletion expense. If an amount box does not require an entry, leave it blank.

December 31

Previous

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning