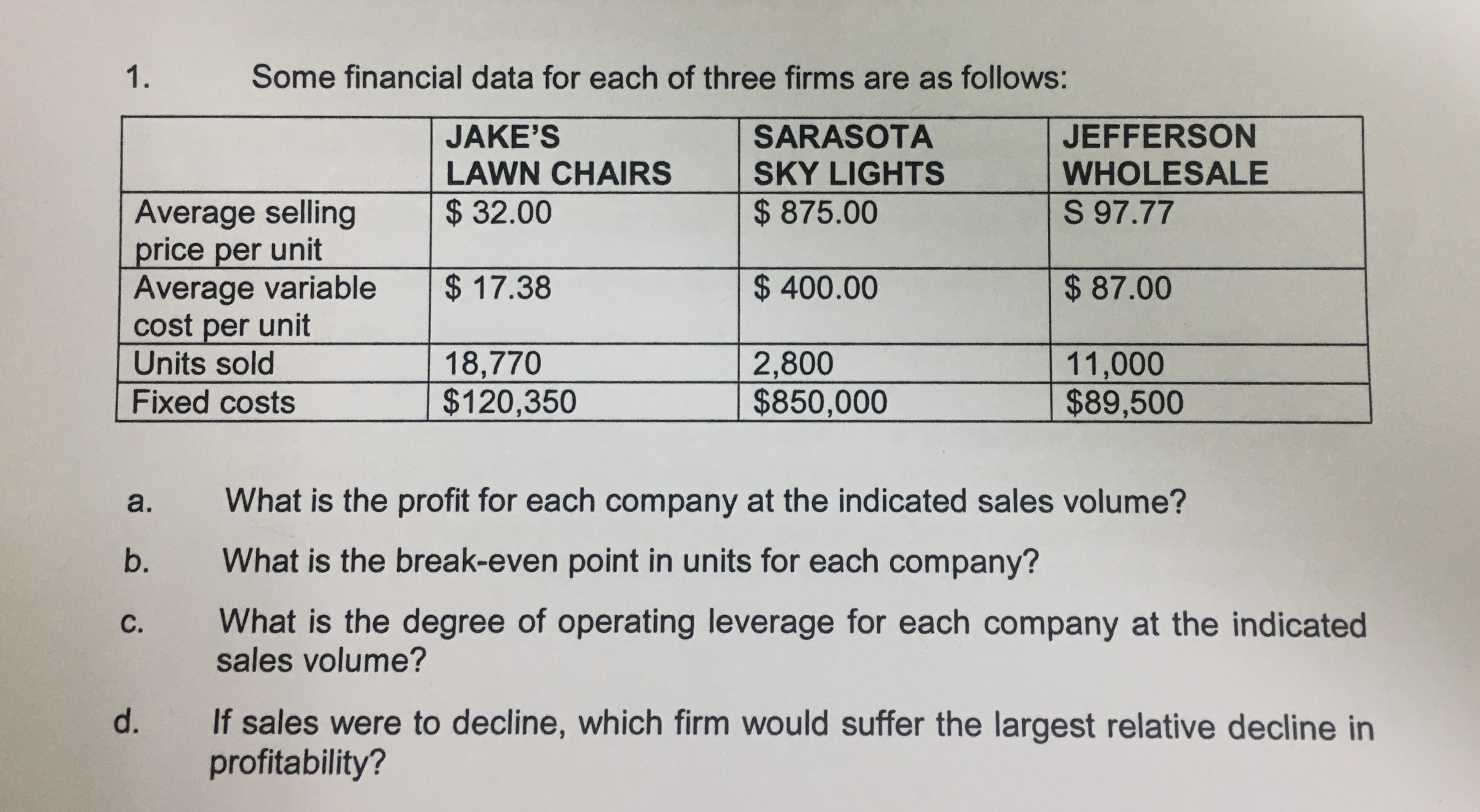

Some financial data for each of three firms are as follows: 1. JEFFERSON JAKE'S LAWN CHAIRS SARASOTA SKY LIGHTS WHOLESALE Average selling price per unit Average variable cost per unit Units sold S 97.77 $ 32.00 $ 875.00 $ 87.00 $ 17.38 $400.00 18,770 $120,350 2,800 $850,000 11,000 $89,500 Fixed costs What is the profit for each company at the indicated sales volume? a. What is the break-even point in units for each company? b. What is the degree of operating leverage for each company at the indicated sales volume? с. If sales were to decline, which firm would suffer the largest relative decline in profitability? d.

Some financial data for each of three firms are as follows: 1. JEFFERSON JAKE'S LAWN CHAIRS SARASOTA SKY LIGHTS WHOLESALE Average selling price per unit Average variable cost per unit Units sold S 97.77 $ 32.00 $ 875.00 $ 87.00 $ 17.38 $400.00 18,770 $120,350 2,800 $850,000 11,000 $89,500 Fixed costs What is the profit for each company at the indicated sales volume? a. What is the break-even point in units for each company? b. What is the degree of operating leverage for each company at the indicated sales volume? с. If sales were to decline, which firm would suffer the largest relative decline in profitability? d.

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 19Q: The following is select account information for Sunrise Motors. Sales: $256,400; Sales Returns and...

Related questions

Question

Transcribed Image Text:Some financial data for each of three firms are as follows:

1.

JEFFERSON

JAKE'S

LAWN CHAIRS

SARASOTA

SKY LIGHTS

WHOLESALE

Average selling

price per unit

Average variable

cost per unit

Units sold

S 97.77

$ 32.00

$ 875.00

$ 87.00

$ 17.38

$400.00

18,770

$120,350

2,800

$850,000

11,000

$89,500

Fixed costs

What is the profit for each company at the indicated sales volume?

a.

What is the break-even point in units for each company?

b.

What is the degree of operating leverage for each company at the indicated

sales volume?

с.

If sales were to decline, which firm would suffer the largest relative decline in

profitability?

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning