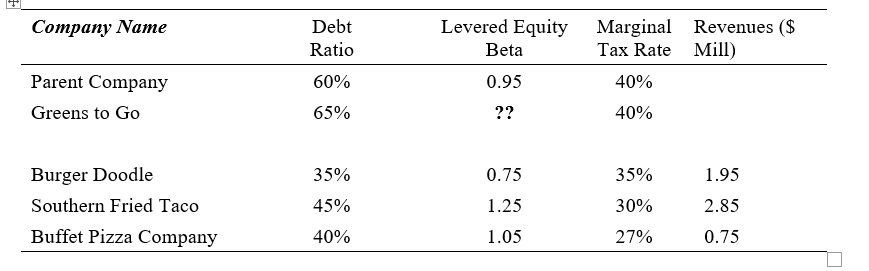

Соmрапy Naте Debt Levered Equity Margınal Revenues ($ Ratio Beta Tax Rate Mill) Parent Company 60% 0.95 40% Greens to Go 65% ?? 40% Burger Doodle 35% 0.75 35% 1.95 Southern Fried Taco 45% 1.25 30% 2.85 Buffet Pizza Company 40% 1.05 27% 0.75

Соmрапy Naте Debt Levered Equity Margınal Revenues ($ Ratio Beta Tax Rate Mill) Parent Company 60% 0.95 40% Greens to Go 65% ?? 40% Burger Doodle 35% 0.75 35% 1.95 Southern Fried Taco 45% 1.25 30% 2.85 Buffet Pizza Company 40% 1.05 27% 0.75

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 87E: Cost of Debt Financing Stinson Corporations cost of debt financing is 6%. Its tax rate is 30%....

Related questions

Question

- Calculate the unlevered asset betas for each of the three comparable firms being sure to adjust appropriately for their respective marginal tax rates

- Calculate the arithmetic industry average of the three asset betas

- Calculate the weighted average asset beta using the revenues to determine the weights

Transcribed Image Text:Debt

Levered Equity

Marginal Revenues ($

Tax Rate Mill)

Соmpany Naте

Ratio

Beta

Parent Company

60%

0.95

40%

Greens to Go

65%

??

40%

Burger Doodle

35%

0.75

35%

1.95

Southern Fried Taco

45%

1.25

30%

2.85

Buffet Pizza Company

40%

1.05

27%

0.75

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning