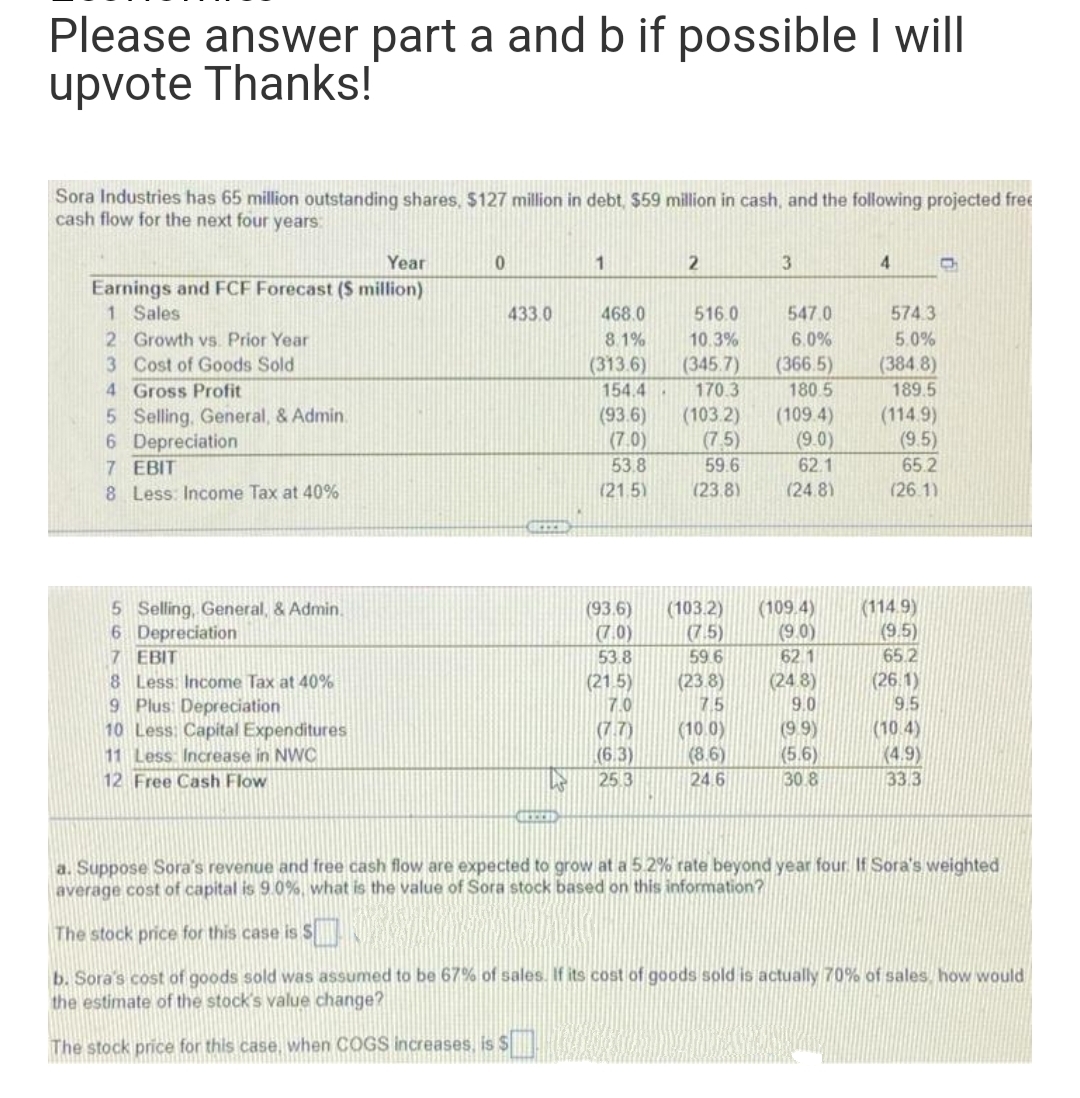

Sora Industries has 65 million outstanding shares, $127 million in debt, $59 million in cash, and the following projected free cash flow for the next four years: Year 0 1 2 3 4 C Earnings and FCF Forecast ($ million) 1 Sales 2 Growth vs. Prior Year 3 Cost of Goods Sold 4 Gross Profit 5 Selling, General, & Admin 6 Depreciation 7 EBIT 8 Less: Income Tax at 40% 5 Selling, General, & Admin. (103.2) (109.4) (114.9) (93.6) (7.0) 6 Depreciation (7.5) (9.0) (9.5) 7 EBIT 53.8 59.6 62.1 65.2 8 Less: Income Tax at 40% (21.5) (23.8) (24.8) (26.1) 9 Plus: Depreciation 7.0 7.5 9.0 9.5 10 Less: Capital Expenditures (7.7) (10.0) (9.9) (10.4) 11 Less Increase in NWC (6.3) (8.6) (5.6) (4.9) 12 Free Cash Flow 25.3 24.6 30.8 33.3 FEED a. Suppose Sora's revenue and free cash flow are expected to grow at a 5.2% rate beyond year four. If Sora's weighted average cost of capital is 9.0%, what is the value of Sora stock based on this information? The stock price for this case is S b. Sora's cost of goods sold was assumed to be 67% of sales. If its cost of goods sold is actually 70% of sales, how would the estimate of the stock's value change? The stock price for this case when COGS increases, is $ 433.0 COLLE W 468.0 8.1% (313.6) 154.4 (93.6) (7.0) 53.8 (21.5) 516.0 547.0 10.3% 6.0% (345.7) (366.5) 170.3 180.5 (103.2) (109.4) (7.5) (9.0) 59.6 62.1 (23.8) (24.8) 574.3 5.0% (384.8) 189.5 (114.9) (9.5) 65.2 (26.1)

Sora Industries has 65 million outstanding shares, $127 million in debt, $59 million in cash, and the following projected free cash flow for the next four years: Year 0 1 2 3 4 C Earnings and FCF Forecast ($ million) 1 Sales 2 Growth vs. Prior Year 3 Cost of Goods Sold 4 Gross Profit 5 Selling, General, & Admin 6 Depreciation 7 EBIT 8 Less: Income Tax at 40% 5 Selling, General, & Admin. (103.2) (109.4) (114.9) (93.6) (7.0) 6 Depreciation (7.5) (9.0) (9.5) 7 EBIT 53.8 59.6 62.1 65.2 8 Less: Income Tax at 40% (21.5) (23.8) (24.8) (26.1) 9 Plus: Depreciation 7.0 7.5 9.0 9.5 10 Less: Capital Expenditures (7.7) (10.0) (9.9) (10.4) 11 Less Increase in NWC (6.3) (8.6) (5.6) (4.9) 12 Free Cash Flow 25.3 24.6 30.8 33.3 FEED a. Suppose Sora's revenue and free cash flow are expected to grow at a 5.2% rate beyond year four. If Sora's weighted average cost of capital is 9.0%, what is the value of Sora stock based on this information? The stock price for this case is S b. Sora's cost of goods sold was assumed to be 67% of sales. If its cost of goods sold is actually 70% of sales, how would the estimate of the stock's value change? The stock price for this case when COGS increases, is $ 433.0 COLLE W 468.0 8.1% (313.6) 154.4 (93.6) (7.0) 53.8 (21.5) 516.0 547.0 10.3% 6.0% (345.7) (366.5) 170.3 180.5 (103.2) (109.4) (7.5) (9.0) 59.6 62.1 (23.8) (24.8) 574.3 5.0% (384.8) 189.5 (114.9) (9.5) 65.2 (26.1)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 9MC

Related questions

Question

Don't copy the answer

Transcribed Image Text:Please answer part a and b if possible I will

upvote Thanks!

Sora Industries has 65 million outstanding shares, $127 million in debt, $59 million in cash, and the following projected free

cash flow for the next four years:

Year

0

1

2

3

4

C

Earnings and FCF Forecast ($ million)

1 Sales

468.0

2 Growth vs. Prior Year

8.1%

3

Cost of Goods Sold

(313.6)

4 Gross Profit

154.4

5 Selling, General, & Admin

(93.6)

6

Depreciation

(7.0)

7 EBIT

53.8

8 Less: Income Tax at 40%

(21.5)

5 Selling, General, & Admin.

(93.6) (103.2)

(109.4)

(114.9)

6 Depreciation

(7.0)

(7.5)

(9.0)

(9.5)

7 EBIT

53.8

59.6

62 1

65.2

8 Less: Income Tax at 40%

(21.5)

(23.8)

(248)

(26.1)

9 Plus: Depreciation

7.0

7.5

9.0

9.5

10 Less: Capital Expenditures

(7.7)

(10,0)

(9.9)

(10.4)

11 Less Increase in NWC

(6.3)

(8.6)

(5.6)

(4.9)

12 Free Cash Flow

L

25.3

24.6

30.8

33.3

a. Suppose Sora's revenue and free cash flow are expected to grow at a 5.2% rate beyond year four. If Sora's weighted

average cost of capital is 9.0%, what is the value of Sora stock based on this information?

The stock price for this case is S

b. Sora's cost of goods sold was assumed to be 67% of sales. If its cost of goods sold is actually 70% of sales, how would

the estimate of the stock's value change?

The stock price for this case, when COGS increases, is $

433.0

COCTICED

516.0

10.3%

(345.7)

170.3

(103.2)

(7.5)

59.6

(23.8)

547.0

6.0%

(366.5)

180.5

(109.4)

(9.0)

62.1

(24.8)

574.3

5.0%

(384.8)

189.5

(114.9)

(9.5)

65.2

(26.1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning