Spice asks Meyers to quantify price changes from changes in interest rates. To illustrate, Meyers computes the value change for the fixed-rate note in the table. Specifically, he assumes an increase in the level of interest rate of 100 basis points. Using the information in the table, what is the predicted change in the price of the fixed-rate note? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Predicted price change

Spice asks Meyers to quantify price changes from changes in interest rates. To illustrate, Meyers computes the value change for the fixed-rate note in the table. Specifically, he assumes an increase in the level of interest rate of 100 basis points. Using the information in the table, what is the predicted change in the price of the fixed-rate note? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Predicted price change

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Long-Term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 12.1CP

Related questions

Question

Ee 364.

Transcribed Image Text:Problem 16-18

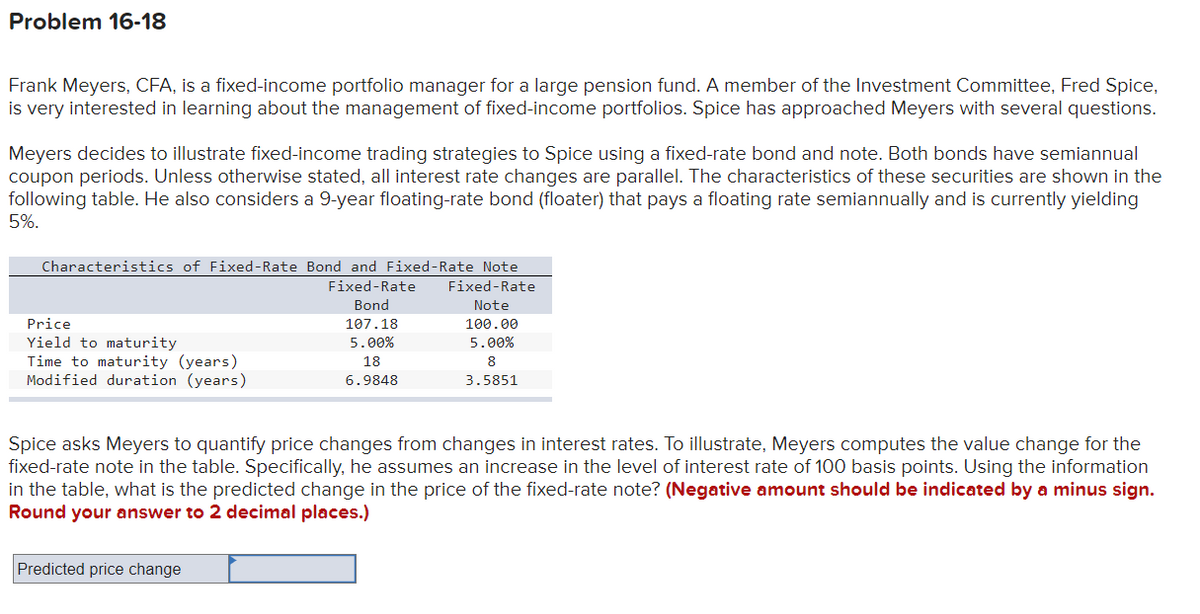

Frank Meyers, CFA, is a fixed-income portfolio manager for a large pension fund. A member of the Investment Committee, Fred Spice,

is very interested in learning about the management of fixed-income portfolios. Spice has approached Meyers with several questions.

Meyers decides to illustrate fixed-income trading strategies to Spice using a fixed-rate bond and note. Both bonds have semiannual

coupon periods. Unless otherwise stated, all interest rate changes are parallel. The characteristics of these securities are shown in the

following table. He also considers a 9-year floating-rate bond (floater) that pays a floating rate semiannually and is currently yielding

5%.

Characteristics of Fixed-Rate Bond and Fixed-Rate Note

Fixed-Rate

Note

Fixed-Rate

Bond

107.18

5.00%

18

6.9848

100.00

5.00%

Price

Yield to maturity

Time to maturity (years)

Modified duration (years)

8

3.5851

Spice asks Meyers to quantify price changes from changes in interest rates. To illustrate, Meyers computes the value change for the

fixed-rate note in the table. Specifically, he assumes an increase in the level of interest rate of 100 basis points. Using the information

in the table, what is the predicted change in the price of the fixed-rate note? (Negative amount should be indicated by a minus sign.

Round your answer to 2 decimal places.)

Predicted price change

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning