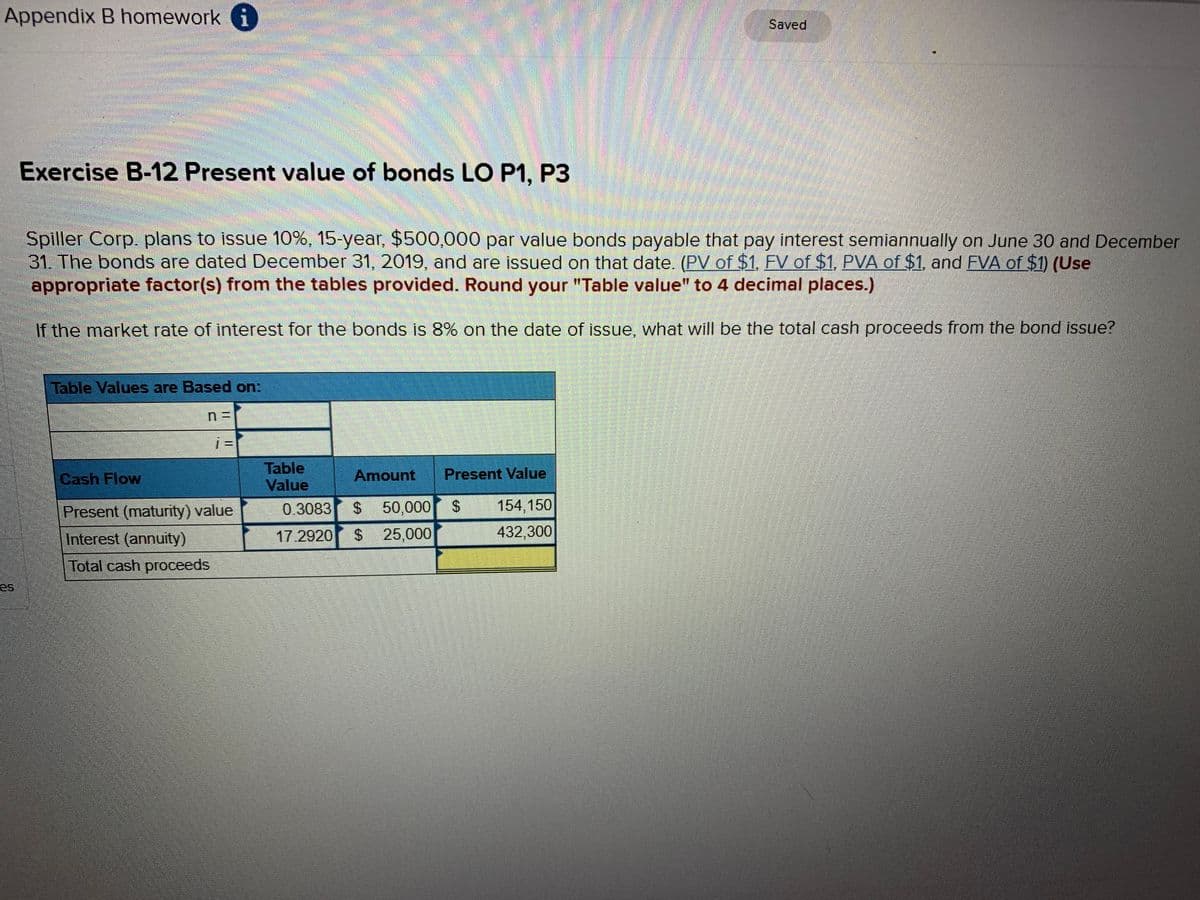

Spiller Corp. plans to issue 10%, 15-year, $500,000 par value bonds payable that pay interest semiannually on June 30 and December 31. The bonds are dated December 31, 2019, and are issued on that date. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.) If the market rate of interest for the bonds is 8% on the date of issue, what will be the total cash proceeds from the bond issue? Table Values are Based on: n = Table Value Cash Flow Amount Present Value 0.3083 24 50,000 S 154,150 Present (maturity) value Interest (annuity) 17.2920 %2$ 25,000 432,300 Total cash proceeds

Spiller Corp. plans to issue 10%, 15-year, $500,000 par value bonds payable that pay interest semiannually on June 30 and December 31. The bonds are dated December 31, 2019, and are issued on that date. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.) If the market rate of interest for the bonds is 8% on the date of issue, what will be the total cash proceeds from the bond issue? Table Values are Based on: n = Table Value Cash Flow Amount Present Value 0.3083 24 50,000 S 154,150 Present (maturity) value Interest (annuity) 17.2920 %2$ 25,000 432,300 Total cash proceeds

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 64BE: Brief Exercise (Appendix 9A) Bond Issue Price On January 1, 2020, Ruby Inc. issued 3,000 $1,000 par...

Related questions

Question

100%

Transcribed Image Text:Appendix B homework i

Saved

Exercise B-12 Present value of bonds LO P1, P3

Spiller Corp. plans to issue 10%, 15-year, $500,000 par value bonds payable that pay interest semiannually on June 30 and December

31. The bonds are dated December 31, 2019, and are issued on that date. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use

appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.)

If the market rate of interest for the bonds is 8% on the date of issue, what will be the total cash proceeds from the bond issue?

Table Values are Based on:

%3D

Table

Value

Cash Flow

Amount

Present Value

Present (maturity) value

0.3083

%24

$ 50,000

154,150

Interest (annuity)

%24

25,000

432,300

17.2920

Total cash proceeds

es

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Expert Answers to Latest Homework Questions

Q: please answer in text form and in proper format answer with must explanation , calculation for each…

Q: Here are simplified financial statements for Phone Corporation in 2020:

INCOME STATEMENT

(Figures in…

Q: 55

15

The Foundational 15 (Algo) [LO14-2, LO14-3, LO14-4, LO14-5, LO14-6]

[The following information…

Q: !

Required information

[The following information applies to the questions displayed below.]

Jackson…

Q: The IRR of normal Project X is greater than the IRR of normal Project Y, and both IRRS are greater…

Q: A 2.30 g sample of gas exerts a pressure of 1.16 atm in a 335. mL container at 299. K. Determine the…

Q: Carry out the following transformations.

OH

&&

Ph

Hint: Suzuki Coupling

Hint: Heck Coupling

Q: A movie studio is scheduling the release of six films-Fiesta,

Glaciers, Hurricanes, Jets, Kangaroos,…

Q: Tempo Company's fixed budget (based on sales of 10,000 units) folllows.

Fixed Budget

Direct labor…

Q: Tesar Chemicals is considering Projects S and L, whose cash flows are shown below. These projects…

Q: The graph below shows the demand curve for a perfectly competitive firm.

Suppose that firms in this…

Q: Describe how you would prepare exactly 100 mL of picolinate buffer, pH 5.53. Possible stating…

Q: Modify the structure of cysteine

Q: The amino acid proline has ionization constants Ka1 = 1.12 x 10 ^-2 AND kA2 = 2.29 X 10 ^-11, which…

Q: A company declares and distributes a 30% common stock dividend to common stockholders. By how much…

Q: Tokyu Co. has a WACC of 12 percent. Its debt sells

at a yield to maturity of 8 percent and its tax…

Q: 3

Sunland Corporation enters into an agreement with Yates Rentals Co. on January 1, 2021 for the…

Q: Lois Clark bought a ring for $6,700. She must still pay a 5% sales tax and a 10% excise tax. The…

Q: On January 1, 2019, Desert Company purchased equipment at a cost of

$388,388. The equipment was…

Q: Your friend Harold is trying to decide whether to buy or lease his next vehicle. He has gathered…

Q: The Foundational 15 (Algo) [LO14-2, LO14-3, LO14-4, LO14-5, LO14-6]

[The following information…