Splish Landscaping began construction of a new plant on December 1, 2025. On this date, the company purchased a parcel of land for $391,600 in cash. In addition, it paid $5,600 in surveying costs and $11,200 for a title insurance policy. An old dwelling on the premises was demolished at a cost of $8,400, with $2,800 being received from the sale of materials. Architectural plans were also formalized on December 1, 2025, when the architect was paid $84,000. The necessary building permits costing $8,400 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2026 as follows. Date of Payment March 1 May 1 July 1 Amount of Payment $672,000 924,000 168,000

Splish Landscaping began construction of a new plant on December 1, 2025. On this date, the company purchased a parcel of land for $391,600 in cash. In addition, it paid $5,600 in surveying costs and $11,200 for a title insurance policy. An old dwelling on the premises was demolished at a cost of $8,400, with $2,800 being received from the sale of materials. Architectural plans were also formalized on December 1, 2025, when the architect was paid $84,000. The necessary building permits costing $8,400 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in December with payments made to the contractor in 2026 as follows. Date of Payment March 1 May 1 July 1 Amount of Payment $672,000 924,000 168,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 13P

Related questions

Question

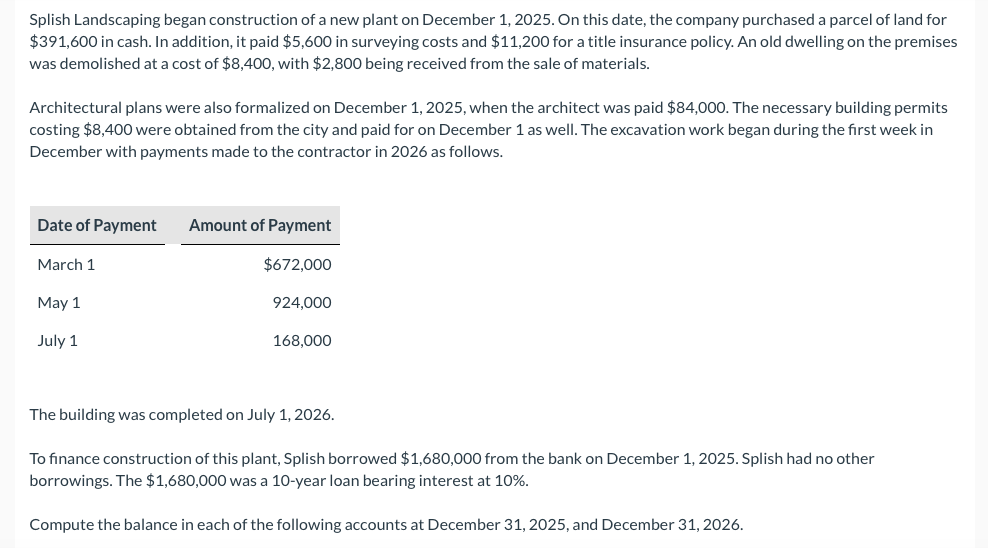

Transcribed Image Text:Splish Landscaping began construction of a new plant on December 1, 2025. On this date, the company purchased a parcel of land for

$391,600 in cash. In addition, it paid $5,600 in surveying costs and $11,200 for a title insurance policy. An old dwelling on the premises

was demolished at a cost of $8,400, with $2,800 being received from the sale of materials.

Architectural plans were also formalized on December 1, 2025, when the architect was paid $84,000. The necessary building permits

costing $8,400 were obtained from the city and paid for on December 1 as well. The excavation work began during the first week in

December with payments made to the contractor in 2026 as follows.

Date of Payment

March 1

May 1

July 1

Amount of Payment

$672,000

924,000

168,000

The building was completed on July 1, 2026.

To finance construction of this plant, Splish borrowed $1,680,000 from the bank on December 1, 2025. Splish had no other

borrowings. The $1,680,000 was a 10-year loan bearing interest at 10%.

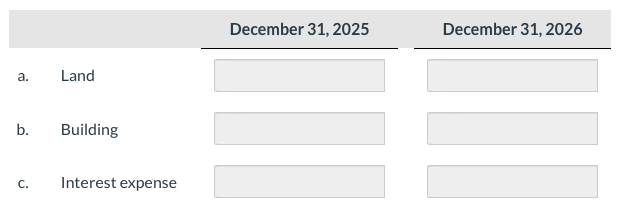

Compute the balance in each of the following accounts at December 31, 2025, and December 31, 2026.

Transcribed Image Text:a.

Land

b. Building

C. Interest expense

December 31, 2025

III

December 31, 2026

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College