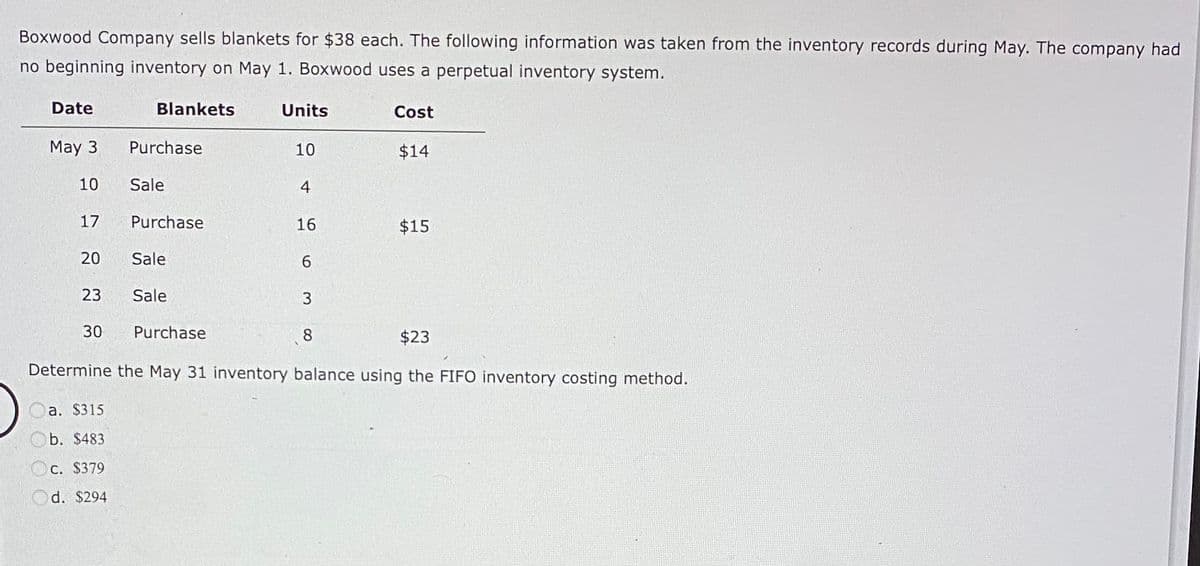

Boxwood Company sells blankets for $38 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date May 3 10 17 20 23 Blankets 30 Purchase Sale Purchase Sale Sale Units 10 4 16 6 3 Cost 8 $14 Purchase $23 Determine the May 31 inventory balance using the FIFO inventory costing method. Oa. $315 Ob. $483 Oc. $379 Od. $294 $15

Boxwood Company sells blankets for $38 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date May 3 10 17 20 23 Blankets 30 Purchase Sale Purchase Sale Sale Units 10 4 16 6 3 Cost 8 $14 Purchase $23 Determine the May 31 inventory balance using the FIFO inventory costing method. Oa. $315 Ob. $483 Oc. $379 Od. $294 $15

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 3E: Basga Company uses the periodic inventory system. Beginning inventory amounted to 241,072. A...

Related questions

Topic Video

Question

Transcribed Image Text:Boxwood Company sells blankets for $38 each. The following information was taken from the inventory records during May. The company had

no beginning inventory on May 1. Boxwood uses a perpetual inventory system.

Date

May 3

10

17

20

23

30

a. $315

b. $483

Blankets

C. $379

d. $294

Purchase

Sale

Purchase

Sale

Sale

Purchase

Units

10

4

16

6

3

Cost

8

$23

Determine the May 31 inventory balance using the FIFO inventory costing method.

$14

$15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Assets

| Line Item Description | Amount |

|---|---|

| Cash and short-term investments | $39,965 |

| 29,855 | |

| Inventory | 25,669 |

| Property, plant, and equipment | 257,215 |

| Total assets | $352,704 |

Liabilities and

| Line Item Description | Amount |

|---|---|

| Current liabilities | $68,970 |

| Long-term liabilities | 99,521 |

| Common stock, $20 par | 120,220 |

| 63,993 | |

| Total liabilities and stockholders' equity | $352,704 |

Income Statement

| Line Item Description | Amount |

|---|---|

| Sales | $80,599 |

| Cost of goods sold | (36,270) |

| Gross profit | $44,329 |

| Operating expenses | (28,493) |

| Net income | $15,836 |

| Line Item Description | Amount |

|---|---|

| Shares of common stock | 6,011 |

| Market price per share of common stock | $20 |

| Dividends per share | $1.00 |

| Cash provided by operations | $40,000 |

What is the return on stockholders' equity?

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning