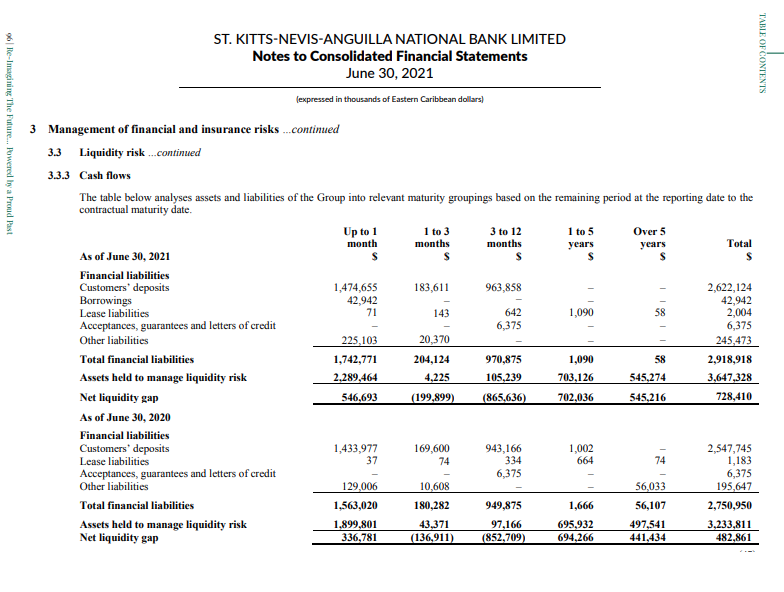

ST. KITTS-NEVIS-ANGUILLA NATIONAL BANK LIMITED Notes to Consolidated Financial Statements June 30, 2021 (expressed in thousands of Eastern Caribbean dollars) 3 Management of financial and insurance risks ... continued 3.3 Liquidity risk...continued 3.3.3 Cash flows The table below analyses assets and liabilities of the Group into relevant maturity groupings based on the remaining period at the reporting date to the contractual maturity date. As of June 30, 2021 Financial liabilities Customers' deposits Borrowings Lease liabilities Acceptances, guarantees and letters of credit Other liabilities Total financial liabilities Assets held to manage liquidity risk Net liquidity gap As of June 30, 2020 Financial liabilities Customers' deposits Lease liabilities Acceptances, guarantees and letters of credit Other liabilities Total financial liabilities Assets held to manage liquidity risk Net liquidity gap Up to 1 month 1,474,655 42,942 71 225,103 1,742,771 2,289,464 546,693 1,433,977 37 129,006 1,563,020 1,899,801 336,781 1 to 3 months 183,611 143 20,370 204,124 4,225 (199,899) 169,600 74 10,608 180,282 3 to 12 months 963,858 642 6,375 970,875 105,239 (865,636) 943,166 334 6,375 949,875 43,371 97,166 (136,911) (852,709) 1 to 5 years S 1,090 1,090 703,126 702,036 1,002 664 1,666 695,932 694,266 Over 5 years S 58 545,274 545,216 56,033 56,107 497,541 441,434 Total S 2,622,124 42,942 2,004 6,375 245,473 2,918,918 3,647,328 728,410 2,547,745 1,183 6,375 195,647 2,750,950 3,233,811 482,861 TABLE OF CONTENTS

ST. KITTS-NEVIS-ANGUILLA NATIONAL BANK LIMITED Notes to Consolidated Financial Statements June 30, 2021 (expressed in thousands of Eastern Caribbean dollars) 3 Management of financial and insurance risks ... continued 3.3 Liquidity risk...continued 3.3.3 Cash flows The table below analyses assets and liabilities of the Group into relevant maturity groupings based on the remaining period at the reporting date to the contractual maturity date. As of June 30, 2021 Financial liabilities Customers' deposits Borrowings Lease liabilities Acceptances, guarantees and letters of credit Other liabilities Total financial liabilities Assets held to manage liquidity risk Net liquidity gap As of June 30, 2020 Financial liabilities Customers' deposits Lease liabilities Acceptances, guarantees and letters of credit Other liabilities Total financial liabilities Assets held to manage liquidity risk Net liquidity gap Up to 1 month 1,474,655 42,942 71 225,103 1,742,771 2,289,464 546,693 1,433,977 37 129,006 1,563,020 1,899,801 336,781 1 to 3 months 183,611 143 20,370 204,124 4,225 (199,899) 169,600 74 10,608 180,282 3 to 12 months 963,858 642 6,375 970,875 105,239 (865,636) 943,166 334 6,375 949,875 43,371 97,166 (136,911) (852,709) 1 to 5 years S 1,090 1,090 703,126 702,036 1,002 664 1,666 695,932 694,266 Over 5 years S 58 545,274 545,216 56,033 56,107 497,541 441,434 Total S 2,622,124 42,942 2,004 6,375 245,473 2,918,918 3,647,328 728,410 2,547,745 1,183 6,375 195,647 2,750,950 3,233,811 482,861 TABLE OF CONTENTS

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Using the attached picture explain if the bank is in a good position in terms of the liquidity gap ratio.

Transcribed Image Text:96 Re-Imagining The Future... Powered by a Proud Past

ST. KITTS-NEVIS-ANGUILLA

NATIONAL BANK LIMITED

Notes to Consolidated Financial Statements

June 30, 2021

Financial liabilities

Customers' deposits

Lease liabilities

3 Management of financial and insurance risks ... continued

3.3 Liquidity risk...continued

3.3.3

Cash flows

The table below analyses assets and liabilities of the Group into relevant maturity groupings based on the remaining period at the reporting date to the

contractual maturity date.

As of June 30, 2021

Financial liabilities

Customers' deposits

Borrowings

Lease liabilities

Acceptances, guarantees and letters of credit

Other liabilities

Total financial liabilities

Assets held to manage liquidity risk

Net liquidity gap

As of June 30, 2020

Acceptances, guarantees and letters of credit

Other liabilities

Total financial liabilities

Assets held to manage liquidity risk

Net liquidity gap

(expressed in thousands of Eastern Caribbean dollars)

Up to 1

month

$

1,474,655

42,942

71

225,103

1,742,771

2,289,464

546,693

1,433,977

37

129,006

1,563,020

1,899,801

336,781

1 to 3

months

$

183,611

143

169,600

74

3 to 12

months

$

10,608

180,282

43,371

(136,911)

963,858

20,370

204,124

970,875

4,225

105,239

(199,899) (865,636)

642

6,375

943,166

334

6,375

949,875

97,166

(852,709)

1 to 5

years

S

1,090

1,090

703,126

702,036

1,002

664

1,666

695,932

694,266

Over 5

years

S

58

58

545,274

545,216

74

56,033

56,107

497,541

441,434

Total

$

2,622,124

42,942

2,004

6,375

245,473

2,918,918

3,647,328

728,410

2,547,745

1,183

6,375

195,647

2,750,950

3,233,811

482,861

TABLE OF CONTENTS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education