stainht 14. A Japanese investor can earn a I percent annual interest rate in Japan or about 3.5 percent per year in the United States. If the spot exchange rate is 101 yen to the dollar, at what one-year forward rate would an investor be indifferent between the U.S. and Japanese investments? A. VI00.58 B. 98.56 C. V101.68 D. 197.42 E. VI03.50 An investor starts with $1 million and converts it to 0.75 million pounds, which is then invested for one year. In a year the investor has 0.7795 millice pounds, which she then converts to dollars at an exchange rate of 0.72 pounds per dollar. The U.S. dollar anual rate of return eamed was 15.

stainht 14. A Japanese investor can earn a I percent annual interest rate in Japan or about 3.5 percent per year in the United States. If the spot exchange rate is 101 yen to the dollar, at what one-year forward rate would an investor be indifferent between the U.S. and Japanese investments? A. VI00.58 B. 98.56 C. V101.68 D. 197.42 E. VI03.50 An investor starts with $1 million and converts it to 0.75 million pounds, which is then invested for one year. In a year the investor has 0.7795 millice pounds, which she then converts to dollars at an exchange rate of 0.72 pounds per dollar. The U.S. dollar anual rate of return eamed was 15.

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 46QA

Related questions

Question

Transcribed Image Text:stainht

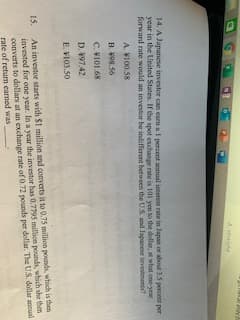

14. A Japanese investor can earn a I percent annual interest rate in Japan or about 3.5 percent per

year in the United States. If the spot exchange rate is 101 yen to the dollar, at what one-year

forward rate would an investor be indifferent between the U.S. and Japanese investments?

A. VI00.58

B. 98.56

C. V101.68

D. 197.42

E. VI03.50

An investor starts with $1 million and converts it to 0.75 million pounds, which is then

invested for one year. In a year the investor has 0.7795 millice pounds, which she then

converts to dollars at an exchange rate of 0.72 pounds per dollar. The U.S. dollar anual

rate of return eamed was

15.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT