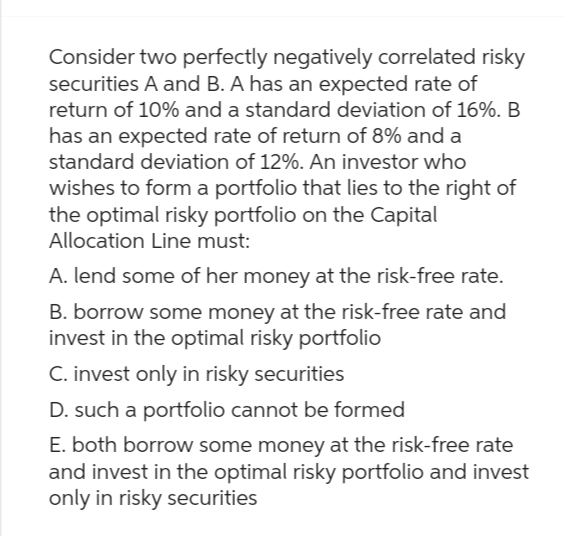

standard deviation of 12%. An investor who wishes to form a portfolio that lies to the right of the optimal risky portfolio on the Capital Allocation Line must:

Q: You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that…

A: The cash flows of the project include the initial investment amount, the operating cash flows, and…

Q: On January 1, 2023, Shamrock Corporation purchased a newly issued $1,400,000 bond. The bond matured…

A: Bond price - The price of a bond is that amount which is equal to the sum of the present value of…

Q: Calculate the perpetual equivalent annual cost (years 1 to ∞) of $950,000 now and $775,000, 8 years…

A: In year 0,Cash flow= 950000 + 775000/(1 + 0.11)^8= 1286293.0346

Q: Asif received a bonus of $10 000, which he immediately invested in a fund earning 9.25% compounded…

A: Future value of the amount is the amount of deposit done and amount of interest accumulated over the…

Q: Brief introduction/background of CIBC. (Comprehensive summary of the bank’s origin identifying its…

A: The Canadian Imperial Bank of Commerce, commonly referred to as CIBC, is one of the 'Big Five' banks…

Q: The U.S. government borrows money by selling Treasury bills. Treasury bills are discounted notes…

A: Date of issue of the T-Bills = June 4, 2003Period of the t-bills = 155 days

Q: Find the time it takes for $7,300 to double when invested at an annual interest rate of 11%,…

A: Compounding interest refers to the accumulating interest and interest on interest. Here we are given…

Q: Problem 6-31 Bond Yields [LO 2] You find the following corporate bond quotes. To calculate the…

A: A bond is a fixed-income security that offers the investor constant cash flow throughout its life in…

Q: An asset used in a 4-year project falls in the 5-year MACRS class (MACRS Table) for tax purposes.…

A: Free cash flow is that amount which is earned by the investor from the project. It is the net amount…

Q: A project has a forecasted cash flow of $121 in year 1 and $132 in year 2. The interest rate is 8%,…

A: To calculate the required rate of return the CAPM formula is used and then discounts the cash flows…

Q: The duration of a preferred stock is its maturity. O A. Greater than or less than, depending on its…

A: The preferred stock is usually issued for the longer term with no definite maturity date. The issuer…

Q: You have been asked by the president of your company to evaluate the proposed acquisition of a new…

A: Free cash flows (FCF) the amount of cash flow available to investors after the firm has met all…

Q: You need $24,856 at the end of nine years, and your only investment outlet is a 10 percent long-term…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: At year-end 2021, Wallace Landscaping's total assets, all of which are used in operations, were…

A: Capital structure of company includes the debt and equity and current liabilities and these keep…

Q: The following table provides summary data for Applied Materials Inc. and its competitors, KLA Tencor…

A: Here, in millionsAMKLALamCompany Assumed Values $ 20,513.00 $ 26,202.00Equity Assumed Values $…

Q: A fixed interest stock is redeemable at 108% if it has an optional redemption date that falls within…

A: As per the question yearly coupon rate is = 6.50 % so the semi-annual rate is 3.25%( 6.50%/2)So,…

Q: An investment of $158397 is expected to generate an after-tax cash flow of $94000 in one year and…

A: CF0 = -$158397CF1 = $94000CF2 = $129000

Q: Chill Pill Pharmaceuticals is expecting a growth rate of 20% for the next two years due to its new…

A: The dividend discount model suggests that the price of the stock is the present value of all the…

Q: Brief introduction/background of the bank. (Comprehensive summary of the bank’s origin identifying…

A: The objective of this question is to provide a comprehensive summary of a bank's origin, its growth,…

Q: Calculate the effective rate under the following terms, All fees and conditions that are listed…

A: Effective Interest Rate (EIR) or Annual Percentage Rate (Apr) :In finance, the effective interest…

Q: dering Projects ver company has lost investment information for Project period for both projects are…

A: Payback period is the period required to recover initial cash flow of the project and is one simple…

Q: MIRR unequal lives. Grady Enterprises is looking at two project opportunities for a parcel of land…

A: MIRR stands for "Modified Internal Rate of Return." It is a financial metric used to evaluate the…

Q: A 25-year bond issue of 5300000 and bearing interest at 3.5% payable annually is sold to yield 4%…

A: Price of bond is the present value of coupon payments plus present value of the par value of the…

Q: What is the implied interest rate on a Treasury bond ($100,000, 6% coupon, semiannual payment with…

A: The implied rates will be computed using the RATE function in the Excel sheet where several years to…

Q: You are considering investing in the company Husky Inc. The company just paid $2 dividends over the…

A: Present value factor is computed as follows:-Present value factor = wherer= discount raten= time…

Q: The YTM on a bond is the interest rate you earn on your investment if interest rates don’t change.…

A: As part b is incomplete i am going to solve the part A for please re-upload for the rest.A bond is…

Q: Waller Company paid a $0.150 dividend per share in 2000, which grew to $0.324 in 2012. This growth…

A: First we have to calculate the growth rate

Q: A company just paid a dividend of $0.40. The dividends are expected to grow at a rate of 7% for the…

A: Dividends refer to share of profits by a company with its shareholders. The management of a company…

Q: Note: Do not round intermediate calculations. Round your answer to the nearest ce $ CA Amount of…

A: In annuity due payments are made at the beginning of periods and value of annuity is the present…

Q: The financial statements of Friendly Fashions include the following selected data (in millions) is…

A: Ratio analysis aids in decision-making by assisting stakeholders in comprehending a company's…

Q: You have just been offered a contract worth $1.15 million per year for 6 years. However, to take the…

A: The most you pay for the equipment will be the present value of all future cash flows. We need to…

Q: Over the year, the time-weighted return is 0%, and the dollar-weighted return is Y. Calculate Y. Y =…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: • Westover Ridge offers a 6 percent coupon bond with semiannual payments and a yield to maturity of…

A: A bond is a kind of debt security issued by the government and private companies to the public for…

Q: The NPV (rent the machine) is $. (Round to the nearest dollar.) The NPV (purchase the current…

A: Net Present Value (NPV) is a financial concept widely used in investment analysis and capital…

Q: Working as an investment analyst for a fund that invests in fixed-income assets, you are tasked with…

A: Solution:-Bond price means the price at which a bond is trading in the market. It is the summation…

Q: 1. A fund manager expects a surge in the Turkish stock market in a month and wishes to invest $10…

A: Swap points can be used to determine the forward exchange rate. We need to add the given swap points…

Q: bond of £6,000 nominal is redeemable at 109% on any coupon payment date between 11 and 23 years from…

A: Price of bond is the present value of coupon payments plus present value of the par value of the…

Q: The plan developed by the entrepreneurial business to specify who the customers are and how they…

A: A financial plan is the process of identifying the current financial situation of a business for…

Q: a. What is the expected return on an equally weighted portfolio of these three stocks? (Do not round…

A: Expected Return is 0.114675 or 11.47%Variance for this portfolio is 0.001823This is the formula…

Q: Calculate the value of a $1,000 bond which has 10 years until maturity and pays annual interest at…

A: 1.Present value of Interest payments of bond is computed as follows:-PV= A*wherePV= Present value of…

Q: what are the terminal cash flows in Year 3? $135,844 $ 224,549 $ 208,813 $ 225,000 $ 158,813

A: Terminal value is the estimated value of a business or an investment at the end of a business or an…

Q: Bonds issued by the Coleman Manufacturing Company have a par value of $1,000, which of course is…

A: YTM is also known as Yield to maturity. It is a capital budgeting technique which helps in decision…

Q: Problem 16-10 Spreadsheet Problem: Standard Deviation in EPS after Leveraging with Taxes (LG16-4)…

A: Expected EPS is computed as the summation of the multiplication of probability percentage and EPS in…

Q: hat is the annuity of stream equivalent of this net present value at 7% and at 4% CVC supplies…

A: NPV is the difference between present value of cash flow and initial investment of the project that…

Q: project will produce an operating cash flow of $18,000 a year for 8 years. The initial fixed asset…

A: The IRR is the discount rate that makes the Net Present Value (NPV) of the project equal to zero.…

Q: A Honda Civic Type R retails for $27,191 (all taxes included). What are the monthly loan payments…

A: A loan refers to a contract between two parties where an amount is forwarded by one party to the…

Q: a. What was your net profit per unit if you had purchased the call option? Use a minus sign to enter…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: A U.S. firm holds an asset in France and faces the following scenario: State 2 25% Probability Spot…

A: Exchange exposure is to be calculated by taking the total amount involved in all the transactions as…

Q: Krell Industries has a share price of $22.58 today. If Krell is expected to pay a dividend of $0.93…

A: Dividend yield = Dividend expected to pay / current share priceEquity cost of capital = Expected…

Q: a. Calculate each project's NPV. Round your answers to two decimal places. Do not round your…

A: "As you have asked multiple questions, according to honoring guidelines we will answer the first…

Step by step

Solved in 3 steps

- Security A has an expected rate of return of 6%, a standard deviation of returns of 30%, a correlation coefficient with the market of −0.25, and a beta coefficient of −0.5. Security B has an expected return of 11%, a standard deviation of returns of 10%, a correlation with the market of 0.75, and a beta coefficient of 0.5. Which security is more risky? Why?You have been hired at the investment firm of Bowers Noon. One of its clients doesnt understand the value of diversification or why stocks with the biggest standard deviations dont always have the highest expected returns. Your assignment is to address the clients concerns by showing the client how to answer the following questions: d. Construct a plausible graph that shows risk (as measured by portfolio standard deviation) on the x-axis and expected rate of return on the y-axis. Now add an illustrative feasible (or attainable) set of portfolios and show what portion of the feasible set is efficient. What makes a particular portfolio efficient? Dont worry about specific values when constructing the graphmerely illustrate how things look with reasonable data.A portfolio that combines the risk-free asset and the market portfolio has an expected return of 6.4 percent and a standard deviation of 9.4 percent. The risk-free rate is 3.4 percent, and the expected return on the market portfolio is 11.4 percent. Assume the capital asset pricing model holds. What expected rate of return would a security earn if it had a .39 correlation with the market portfolio and a standard deviation of 54.4 percent? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

- An investor has an opportunity to invest in two risky assets and a risk-free asset. Theexpected return of the two risky assets are μ1 = 0.12, μ2 = 0.15. Their standarddeviations are σ1 = 0.05 and σ2 = 0.1, and the correlation coefficient between theirreturn is 0.2. The risk-free rate is 0.05. Suppose the investor has $1000 and he wantsto hold a portfolio with expected return of 0.1. If the investor is risk averse, how muchshould he invest in the two risky assets and the risk-free asset?Suppose that there are two assets: A and B. Asset A has expected return of 20%. B has expected return of 12% and standard deviation of σ* σ* = standard Deviation (σ) (a) “As B is strictly dominated by A in terms of total risk (standard deviation), there is no value in having B in portfolio formation.” (Without doing any calculation) (b) “If the correlation coefficient ρ between A and B = 1, it is always optimal to invest in A only.” (Show your proof) (c) “If the correlation coefficient ρ between A and B = -1, it is always optimal to invest in 50% in A and 50% in B when forming a minimum variance portfolio of the two.” (Show your proof) [ (d) “Given that σA= σB=σ*, it is always optimal to combine half of A and half of B when forming a minimum variance portfolio of the two when ρ ε (-1,1).” (Show your proof)Drew can design a risky portfolio based on two risky assets, Origami and Gamiori. Origami has an expected return of 13% and a standard deviation of 20%. Gamiori has an expected return of 6% and a standard deviation of 10%. The correlation coefficient between the returns of Origami and Gamiori is 0.30. The risk-free rate of return is 2%. What is the Sharpe ratio of the optimal risky portfolio? A. 60.26% B. 12.19% C. 9.34% D. 47.78%

- 1. Consider a Treasury bill with a rate of return of 1% and the following risky securities: Security A: E(r) =0.1; variance = 0.03; Security B: E(r) = 0.015; variance = 0.0225; Security C: E(r) = 0.07; variance = 0.04; Security D: E(r) = 0.25; variance = 0.25.The investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. The security the investor should choose as part of her complete portfolio to achieve the best CAL would be _________." A B C D 2. Security with normally distributed returns has an annual expected return of 10% and a standard deviation of 6%. The probability of getting a return between -1.76% and 21.76% in any one year is NOTE: All answers should be express in strictly numerical terms. For example, if the answer is 5%, write 0.05Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 10% and a standard deviation of 16%. B has an expected rate of return of 8% and a standard deviation of 12%. The risk-free portfolio that can be formed with the two securities will earn a(n) _____ rate of return. A) 8.5% B) 9.0% C) 8.9% D) 9.9%Consider a T-bill with a rate of return of 6% and the following risky securities: Security A: E(r) = 9%; Standard Deviation = 9% Security B: E(r) = 10%; Standard Deviation = 11% security C: E(r)= 16%; Standard Deviation = 20% Security D: E(r) = 18%; Standard Deviation = 26% From which set of portfolios, formed with the T-bill and any one of the four risky securities, woulda risk-averse investor always choose his portfolio? Select one: A. The set of portfolios formed with the T-bill and security D. B.The set of portfolios formed with the T-bill and security A. oC. The set of portfolios formed with the T-bill and security B. D. The set of portfolios formed with the T-bill and security c. E. Cannot be determined.

- Consider a treasury bill with a rate of return of 5% and the following risky securities:Security A: E(r) = .15; variance = .0400Security B: E(r) = .10; variance = .0225Security C: E(r) = .12; variance = .1000Security D: E(r) = .13; variance = .0625The investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. The security the investor should choose as part of his complete portfolio to achieve the best Sharpe ratio would be?Assume an economy in which there are three securities: Stock A with rA = 10% and σA = 10%; Stock B with rB = 15% and σB = 20%; and a riskless asset with rRF = 7%. Stocks A and B are uncorrelated (rAB = 0). Which of the following statements is most CORRECT? 1. b. The expected return on the investor’s portfolio will probably have an expected return that is somewhat below 10% and a standard deviation (SD) of approximately 10%. 2. d. The investor’s risk/return indifference curve will be tangent to the CML at a point where the expected return is in the range of 7% to 10%. 3. e. Since the two stocks have a zero correlation coefficient, the investor can form a riskless portfolio whose expected return is in the range of 10% to 15%. 4. a. The expected return on the investor’s portfolio will probably have an expected return that is somewhat above 15% and a standard deviation (SD) of approximately 20%. 5.…Consider a T-bill with a rate of return of 5% and the following risky securities:Security A: E(r) = 0.15; Variance = 0.04Security B: E(r) = 0.10; Variance = 0.0225Security C: E(r) = 0.12; Variance = 0.01Security D: E(r) = 0.13; Variance = 0.0625From which set of portfolios, formed with the T-bill and any one of the four risky securities, would a risk-averse investor always choose his portfolio? A. Cannot be determined. B. The set of portfolios formed with the T-bill and security B. C. The set of portfolios formed with the T-bill and security C. D. The set of portfolios formed with the T-bill and security D. E. The set of portfolios formed with the T-bill and security A.