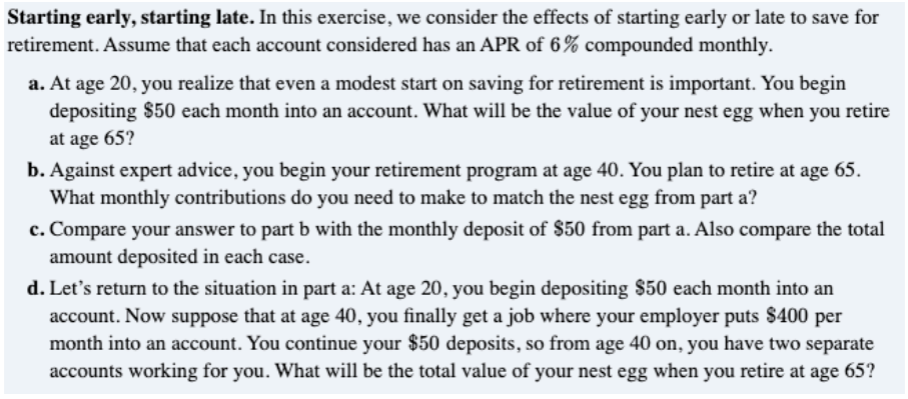

Starting early, starting late. In this exercise, we consider the effects of starting early or late to save for retirement. Assume that each account considered has an APR of 6% compounded monthly. a. At age 20, you realize that even a modest start on saving for retirement is important. You begin depositing $50 each month into an account. What will be the value of your nest egg when you retire at age 65? b. Against expert advice, you begin your retirement program at age 40. You plan to retire at age 65. What monthly contributions do you need to make to match the nest egg from part a? c. Compare your answer to part b with the monthly deposit of $50 from part a. Also compare the total amount deposited in each case.

Starting early, starting late. In this exercise, we consider the effects of starting early or late to save for retirement. Assume that each account considered has an APR of 6% compounded monthly. a. At age 20, you realize that even a modest start on saving for retirement is important. You begin depositing $50 each month into an account. What will be the value of your nest egg when you retire at age 65? b. Against expert advice, you begin your retirement program at age 40. You plan to retire at age 65. What monthly contributions do you need to make to match the nest egg from part a? c. Compare your answer to part b with the monthly deposit of $50 from part a. Also compare the total amount deposited in each case.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Starting early, starting late. In this exercise, we consider the effects of starting early or late to save for

retirement. Assume that each account considered has an APR of 6% compounded monthly.

a. At age 20, you realize that even a modest start on saving for retirement is important. You begin

depositing $50 each month into an account. What will be the value of your nest egg when you retire

at age 65?

b. Against expert advice, you begin your retirement program at age 40. You plan to retire at age 65.

What monthly contributions do you need to make to match the nest egg from part a?

c. Compare your answer to part b with the monthly deposit of $50 from part a. Also compare the total

amount deposited in each case.

d. Let's return to the situation in part a: At age 20, you begin depositing $50 each month into an

account. Now suppose that at age 40, you finally get a job where your employer puts $400 per

month into an account. You continue your $50 deposits, so from age 40 on, you have two separate

accounts working for you. What will be the total value of your nest egg when you retire at age 65?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College