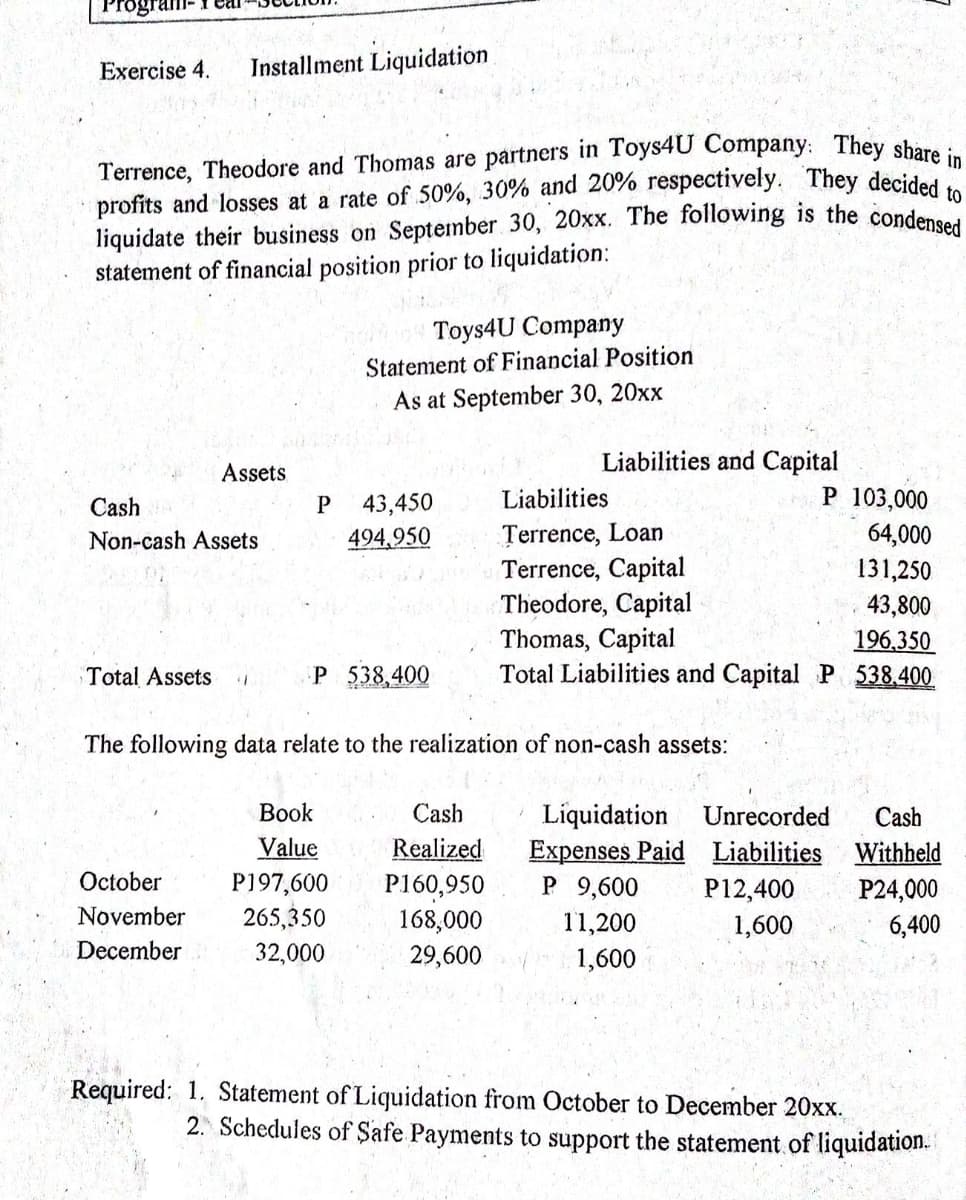

Statement of Liquidation from October to December 20xx. Schedules of Şafe Payments to support the statement of liquidation.

Q: RM Inc. had the following bank reconciliation on August 31, 2021: Balance per bank statement, 8/31 A...

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with...

Q: Presented below is a list of items that may or may not be reported as inventory in a company’s Decem...

A: Inventory means the goods in which the business deals. Inventory should be valued correctly as it i...

Q: A herd of 100, 2-year old animals was held at January 2, 2021. Ten animals aged 2.5 years were purc...

A: Fair value of the biological assets at December 31, 2021: Age on December 31, 2021 Fair value a...

Q: SecuriCorp operates a fieet of armored cars that make scheduled pickups and dellverles In the Los An...

A: "Since you have asked multiple questions, we will solve first question for you. If you want any spec...

Q: Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base...

A: Standards are set in advance, from the standard set the actual performance are required to be measur...

Q: RM Inc. had the following bank reconciliation on August 31, 2021: Balance per bank statement, 8/31 A...

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with ...

Q: Sottso has an investment opportunity costing $300,000 that is expected to yield the following flows ...

A: Net Present Value (NPV): It is one of the methods of Capital Budgetting techniques to evaluate vario...

Q: Sheffield Corp. includes one coupon in each bag of dog food it sells. In return for eight coupons, c...

A: Given 2020 Bags of dog sold 520000 Leashes purchased 19000 Coupons redeemed ...

Q: At January 1, the total of the purchases ledger accounts was $38,000, while at December 31 it was $4...

A: The credit purchase can be calculated by adding up cash payment to a supplier, closing the balance o...

Q: In 2020, Ted Baker had total assets of $510.31 million, of which $219.92 million were total noncurre...

A: Current Assets are those assets which provides economic benefits to the owner Upto a period of 12 mo...

Q: Escalera Company reported an impairment loss of P5,200,000 in its income statement for the year 2016...

A: The question is related to Impairment of Assets. The Impairment Loss is Excess of Carrying Amount ov...

Q: Fifo Company purchased a machine with a cash price of P350,000. Fifo gave the following as pay...

A: Discount on notes payable to be recorded on the date of purchase = Fair value of shares issued + cas...

Q: [ine ToIioWing inrormation appiies to the questions dispiayea below.j Del Gato Clinic's cash account...

A: It's the summary of banking and business activity which is used to reconcile bank statement with Cas...

Q: to buy a $155000 harvester from John Deere. The contract required Sheridan Farm to pay $155000 in ad...

A: The Unearned revenue is the revenue received in cash but not earned yet i.e services are not provide...

Q: Entity G acquired a 40% interest in Pokus Corp. for P1,700,000 on January 1,2021. The shareholders' ...

A: Equity Method: The equity method of bookkeeping is the most common way of treating interests in part...

Q: List Ken Lewin's assets in one column . His liabilities in another, and calculate his equity.

A: Equity = Assets - Liabilities We have to prepare Balance Sheet through in which we will post Assets ...

Q: On July 1, 2017, Entity H acquired 25% of the shares of Oki, Inc. for P1,000,000. At the date, the e...

A: Entity H acquired 25% share, therefore its share in profit = 25% x 160000 = 40000

Q: purchased goods with invoice price of P3,000 on account on December 27, 2021. The related shipping c...

A: Under FOB shipping terms of the shipment, Freight is to be borne by the buyer of goods. Therefore it...

Q: At the end of the year WIP totaled $ 6,000. Calculate the total costs of goods manufactured and tran...

A: Cost of goods manufactured is the total costs incurred in manufacturing the product in current perio...

Q: Discuss the following: a. Are these budget standards challenging for the department that produces li...

A: A Departmental Manager is the person who is responsible for keeping note of stocks available with th...

Q: Klumper Corporation is a divers the following stx activity cost pools and activity rates: manufactur...

A: Overheads are the indirect expenses which are not traceable directly on the cost object.

Q: Ex 5. Calculate the retained earnings of a retail company considering the following financial inform...

A: Formula: Ending Retained earnings balance = Beginning Retained Earnings balance + Net Income - Divid...

Q: entries

A:

Q: · Check payable to Taemin Inc., dated January 4, 2020, included in the December 31 checkbook b...

A: The answer has been mentioned below.

Q: The Bottling Department of Lake Michigan Water Company had 3,000 liters in beginning work in process...

A: Process costing is used in that organization where a similar kind of product is produced and goods p...

Q: Hermosa, Ic., produces one model of mountain bike. Partial information for the company follows: Numb...

A: Formulas: Contribution margin ratio = Contribution margin / sales Contribution margin = Sales - Vari...

Q: QS 7-7 Percent of accounts receivable method LO P3 Warner Company's year-end unadjusted trial balanc...

A: An allowance for doubtful accounts is a balance-sheet counter item that nets against total receivabl...

Q: Goodwill of Php 300,000 to be recorded and allocated to the prior partners. The prior partners, Bal...

A: Admission of a partner into the partnership means adding one more person in the business into the pa...

Q: 7. The entry to record the purchase of materials using a job costing system would include Ocredit to...

A: The question is based on the concept of Cost Accounting. Job costing is used in manufacturing entity...

Q: You are the cost accountant for Fashions, Inc. On July 31, 2002, a fire destroyed part of your compa...

A: The balances of WIP inventory, finished goods inventory and raw material inventory as on 30th June (...

Q: On January 2, 2020, Popsters Corporation purchased 80% of SG Corporation's ordinary shares for P648,...

A: Business acquisition refers to when a corporation acquires majority or controlling stake in another ...

Q: n October 17, Nikle Company purchased a building and a plot of land for $836,900. The building was v...

A: Assets which comes in will be debited with their value. Assets which goes out or liability which is ...

Q: Using the data given below, compute for the total amount of items that meet the definition of financ...

A: Answer: Total amount of items that meet the definition of financial liability = 100,000 + 1,200,000...

Q: 1. Purchased raw materials on account, $95,200. 2. Raw Materials of $40,000 were requisitioned to th...

A: 1.Raw Materials inventory a/c Dr. $95,200 Accounts Payable A/c. Cr. $95,200 2....

Q: 6. Engineers who design cars for a car manufacturing company submit their timesheets. The entry to r...

A: Following entry will be passed to record direct labour cost incurred on job : Work in process inven...

Q: Javon Company set standards of 2 hours of direct labor per unit at a rate of $15.50 per hour. During...

A: 1. October: Actual Cost Standard Cost AH x AR AH x SR SH x SR 11500 x 15.7 11...

Q: warranty

A: 2 year warranty coverage included in sale price. Warranty expenses should be recorded in 2021 as fol...

Q: Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Perform...

A: planned budget = planned labor hours* budgeted variable cost per hour+...

Q: Exercise 7-6 Percent of sales method; writé-öft At year-end (December 31), Chan Company estimates it...

A: The journal Entry for above transaction are as follows

Q: E1 1 To ald in planning, Jay Corporation is preparing a contributon format income statement. 3 Budge...

A: Contribution margin=Sales-Total variable expensesNet operating income=Contribution margin-Total fixe...

Q: Magic Realm, Incorporated, has developed a new fantasy board game. The company sold 26,400 games las...

A: Magic Realm Incorporated Question - 1) (a) Contri...

Q: What are the components of audit risk and how do these relate to each other?

A: The possibility that financial statements are significantly incorrect, even if the audit opinion cer...

Q: Pampanga's best provided the following information: ...

A: Solution: Inventory to be reported on statement of financial position = Raw materials inventory + Fi...

Q: surance policy of Zandy, for whicl e was paying an annual premium o 10,000 since April 2000 matured....

A: Solution Note : Dear student as per the Q&A guideline we are required to answer the first questi...

Q: Determine the benefit-cost ratios for each option Determine whether the additional initial cost of s...

A: Solution Formula for benefit cost ratio =present value or the benefit / present value of cost Discou...

Q: Rainbow Company has the following information pertaining to its biological assets for the year 2021....

A: A biological asset, according to International Accounting Standard 41 (IAS 41), is any living plant ...

Q: Use the following information for the Exercises below. (Algo) [The following information applies to ...

A: A variance is said to be Favorable when the budgeted revenues are less than actual revenues and budg...

Q: In 2020, Ted Baker had total assets of S510.31 million, of which $219.92 million were total noncurre...

A: Lets understand the basics. Current asset to total assets is a ratio in which current asset is compa...

Q: On January 1, 2018, Apple Company sold delivery equipment costing P1,000,000 with accumulated deprec...

A: Gain (loss) on sale of delivery equipment in 2018 = Present value of the Note - Net carrying value o...

Q: The dollar sales required for the company to break even is closest to:

A:

Step by step

Solved in 3 steps

- Cheese Partners has decided to close the store. At the date of closing, Cheese Partners had the following account balances: A competitor agrees to buy the inventory and store fixtures for $20,000. Prepare the journal entries detailing the liquidation, assuming that partners Colette and Swarma are sharing profits on a 50:50 basis:STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership of Delco, Smith, and Walker is to be liquidated. After making closing entries on March 31, 20--, the following accounts remain Open. The noncash assets are sold for 165,000. Profits and losses are shared equally. REQUIRED 1. Prepare a statement of partnership liquidation for the period April 115, 20--, showing the following: (a) The sale of noncash assets on April 1 (b) The allocation of any gain or loss to the partners on April 1 (c) The payment of the liabilities on April 12 (d) The distribution of cash to the partners on April 15 2. Journalize these four transactions in a general journal.The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash $ 61,000 Liabilities $ 55,000 Noncash assets 329,000 Drysdale, loan 42,500 Drysdale, capital (50%) 107,500 Koufax, capital (30%) 97,500 Marichal, capital (20%) 87,500 a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be $21,000. Prepare a predistribution schedule to guide the distribution of cash. Further, modify the tags in explanation as well. b. Assume that assets costing $99,000 are sold for $72,500. How is the available cash to be divided?

- Partners Ong, Rodriguez, Pamittan and Reyes who share profits andlosses at 30%, 30%, 20% and 20%, respectively, decided to liquidate. Allpartnership assets are to be converted into cash. Before liquidation, thecondensed statement of financial position follows:Cash P100, 000 Liabilities P750, 000Other Assets 1, 800, 000 Rodriguez, Loan 60, 000Reyes, Loan 50, 000Ong, Capital 420, 000Rodriguez, Capital 315, 000Pamittan, Capital 205, 000Reyes, Capital 100, 000Total P1, 900,000P1, 900,000The non-cash assets realized P800, 000, resulting to a loss of P1, 000,000. All the partners are solvent, and can contribute any additional cash tocover any deficiency. In the process of liquidation, deficiencies will occur andwill require additional investment as follows:a. Pamittan at P7, 500b. Reyes at P50, 000c. Reyes and Pamittan for P50, 000 and P7, 500, respectivelyd. NoneThe statement of financial position of the firm AA, BB and CC immediately before liquidation shows the following: Assets 640,000 Liabilities 240,000 AA, Loan 64,000 AA, Capital 168,000 BB, Capital 120,000 CC, Capital 48,000 Total 640,000 AA, BB and CC share profits 5:3:2 respectively. Certain assets are sold for P440,000. Creditors are paid in full, partners are paid P140,000 and cash of P60,000 is withheld for contingencies. How much cash is to be distributed to AA?Partners Nina, Ricci, and Guess, who share profit and losses in the ratio of 2:2:1, respectively, decided to liquidate. The condensed statement of financial position account balances just prior to the liquidation are: Cash-P 100,000; Other assets-P 400,000; Liabilities - P 140.000: Nina, Loan-P 10,000; Nina, Capital-P45,000: Ricci, Capital -P 105.000; Guess, Capital - P200,000. After paying the llabilities to partnership creditors, cash of P207,500 is available for distribution to partners. Any capital deficiency is made good by the deficient partner, since all three partners are personally solvent. how much would Nina receive in the final settlement of his interest? how much would Guess receive in the final settlement of his interest?

- Partners Nina, Ricci, and Guess, who share profit and losses in the ratio of 2:2:1, respectively, decided to liquidate. The condensed statement of financial position account balances just prior to the liquidation are: Cash-P 100,000; Other assets-P 400,000; Liabilities - P 140.000: Nina, Loan-P 10,000; Nina, Capital-P45,000: Ricci, Capital -P 105.000; Guess, Capital - P200,000. After paying the llabilities to partnership creditors, cash of P207,500 is available for distribution to partners. Any capital deficiency is made good by the deficient partner, since all three partners are personally solvent. How much was the loss on realization? how much would Nina receive in the final settlement of his interest? how much would Ricci receive in the final settlement of his interest?Slick, Tony and Sam partnership began the process of liquidation with the following account balances: Cash 16,000 Non-cash assets 434,000 Liabilities 150,000 Slick, Capital (30%) 80,000 Tony, Capital (20%) 90,000 Sam, Capital (50%) 130,000 Liquidation expenses are expected to be P12,000. After the liquidation expenses of P12,000 had been paid and the non-cash assets sold, Sam had a deficit of P8,000. Assuming all partners are personally insolvent, how much is the final settlement to Tony? P24,000 P34,800 P36,000 P37,200The balance sheet accounts of partners Pacman, Marquez and Mayweather before liquidation are the following: Cash, P360,000; Non-Cash Assets, P1,785,000; Liabilities, P1,000,000; Pacman, Capital (50%), P460,000; Marquez, Capital (30%), P365,000 and Mayweather, Capital (20%), P320,000. On the first month of liquidation, certain assets with a book value of P1,200,000 are sold for P960,000. Liquidation expenses of P30,000 are paid and additional expenses are anticipated. Liabilities are paid amounting to P362,000, and sufficient cash is retained to insure the payment to creditors before making payment to partners. In the first payment of cash to partners, Marquez received P107,000.

- XYZ Partnership begins the liquidation process with the following balance sheet and profit and loss percentages: Cash 280,000 Noncash Assets 300,000 Liabilities 200,000 X Capital (40%) 100,000 Y Capital (30%) 150,000 Z Capital (30%) 130,000 Liquidation expenses are estimated at $50,000. Assume any deficit in a partner’s capital balance will not be repaid. How much is the safe payment that can be made to partner Z (hint: prepare a proposed schedule of liquidation). a. $0 b. $15,000 This is the ans c. $25,000 d. $10,000 i got this e. $5,000Lester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $53,120 Torres 55,790 Hearst 26,560 Total $135,470 In winding up operations during the month of August, noncash assets with a book value of $157,550 are sold for $170,590, and liabilities of $47,430 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $25,350. Required: a. Prepare a statement of LLC liquidation. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency,…Lester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio of 2:2:1, respectively. The members decide to liquidate the limited liability company. The members’ equity prior to liquidation and asset realization on August 1 are as follows: Lester $ 49,000 Torres 61,000 Hearst 27,000 Total $137,000In winding up operations during the month of August, noncash assets with a book value of $146,000 are sold for $158,000, and liabilities of $35,000 are satisfied. Prior to realization, Arcadia Sales has a cash balance of $26,000.a. Prepare a statement of LLC liquidation.b. Provide the journal entry for the final cash distribution to members.c. What is the role of the income- and loss-sharing ratio in liquidating an LLC?