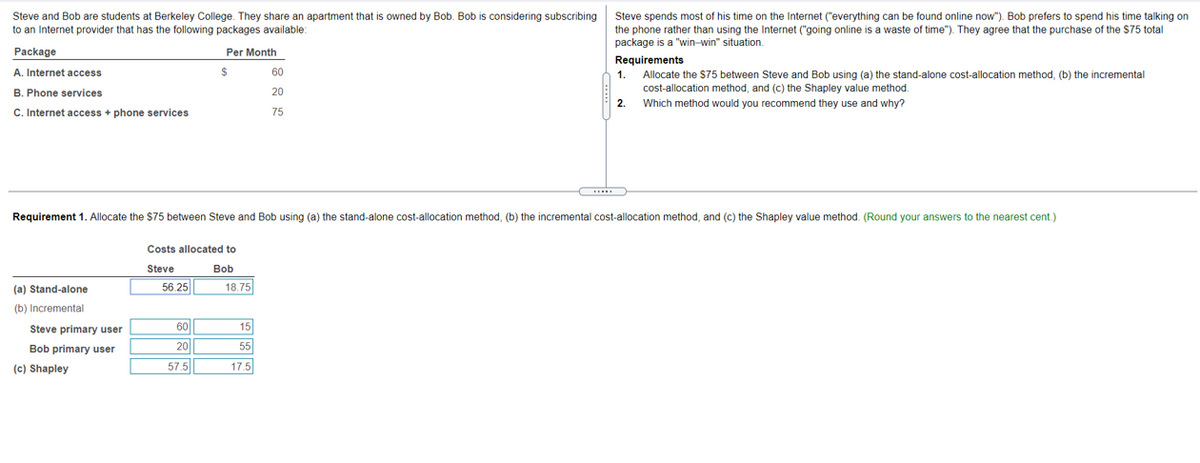

Steve and Bob are students at Berkeley College. They share an apartment that is owned by Bob. Bob is considering subscribing to an Internet provider that has the following packages available: Steve spends most of his time on the Internet ("everything can be found online now"). Bob prefers to spend his time talking on the phone rather than using the Internet ("going online is a waste of time"). They agree that the purchase of the $75 total package is a "win-win" situation. Package Per Month Requirements 1. Allocate the $75 between Steve and Bob using (a) the stand-alone cost-allocation method, (b) the incremental cost-allocation method, and (c) the Shapley value method. Which method would you recommend they use and why? A. Internet access 60 B. Phone services 20 2. C. Internet access + phone services 75

Steve and Bob are students at Berkeley College. They share an apartment that is owned by Bob. Bob is considering subscribing to an Internet provider that has the following packages available: Steve spends most of his time on the Internet ("everything can be found online now"). Bob prefers to spend his time talking on the phone rather than using the Internet ("going online is a waste of time"). They agree that the purchase of the $75 total package is a "win-win" situation. Package Per Month Requirements 1. Allocate the $75 between Steve and Bob using (a) the stand-alone cost-allocation method, (b) the incremental cost-allocation method, and (c) the Shapley value method. Which method would you recommend they use and why? A. Internet access 60 B. Phone services 20 2. C. Internet access + phone services 75

Chapter9: Obtaining Affordable Housing

Section: Chapter Questions

Problem 1FPC

Related questions

Question

Transcribed Image Text:Steve and Bob are students at Berkeley College. They share an apartment that is owned by Bob. Bob is considering subscribing

to an Internet provider that has the following packages available:

Steve spends most of his time on the Internet ("everything can be found online now"). Bob prefers to spend his time talking on

the phone rather than using the Internet ("going online is a waste of time"). They agree that the purchase of the $75 total

package is a "win-win" situation.

Package

Per Month

Requirements

A. Internet access

2$

60

1.

Allocate the $75 between Steve and Bob using (a) the stand-alone cost-allocation method, (b) the incremental

cost-allocation method, and (c) the Shapley value method.

Which method would you recommend they use and why?

B. Phone services

20

2.

C. Internet access

phone services

75

Requirement 1. Allocate the $75 between Steve and Bob using (a) the stand-alone cost-allocation method, (b) the incremental cost-allocation method, and (c) the Shapley value method. (Round your answers to the nearest cent.)

Costs allocated to

Steve

Bob

(a) Stand-alone

56.25

18.75

(b) Incremental

Steve primary user

60

15

Bob primary user

20

55

(c) Shapley

57.5||

17.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT