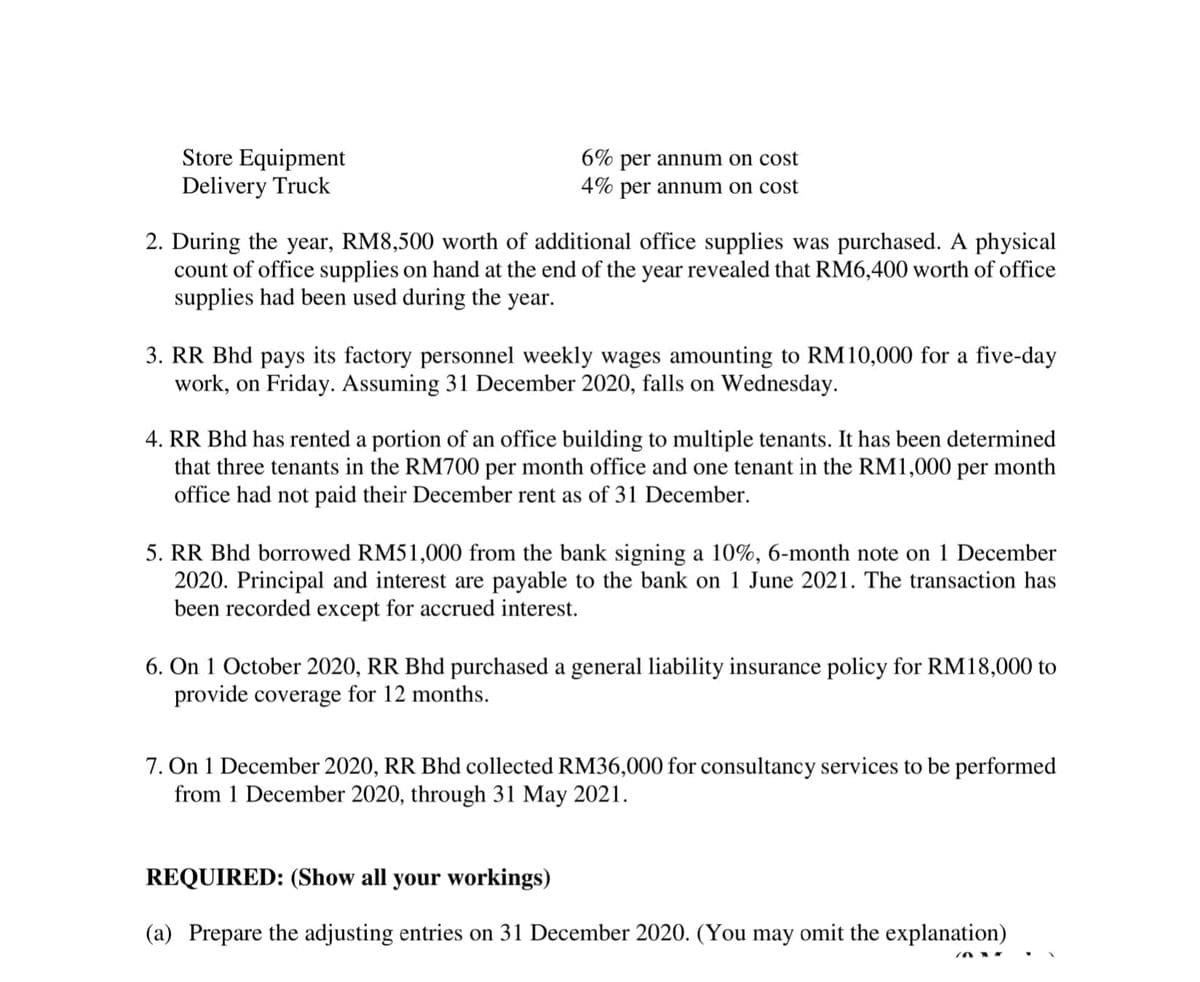

Store Equipment Delivery Truck 6% per annum on cost 4% per annum on cost 2. During the year, RM8,500 worth of additional office supplies was purchased. A physical count of office supplies on hand at the end of the year revealed that RM6,400 worth of office supplies had been used during the year. 3. RR Bhd pays its factory personnel weekly wages amounting to RM10,000 for a five-day work, on Friday. Assuming 31 December 2020, falls on Wednesday. 4. RR Bhd has rented a portion of an office building to multiple tenants. It has been determined that three tenants in the RM700 per month office and one tenant in the RM1,000 per month office had not paid their December rent as of 31 December. 5. RR Bhd borrowed RM51,000 from the bank signing a 10%, 6-month note on 1 December 2020. Principal and interest are payable to the bank on 1 June 2021. The transaction has been recorded except for accrued interest. 6. On 1 October 2020, RR Bhd purchased a general liability insurance policy for RM18,000 to provide coverage for 12 months. 7. On 1 December 2020, RR Bhd collected RM36,000 for consultancy services to be performed from 1 December 2020, through 31 May 2021. REQUIRED: (Show all your workings) (a) Prepare the adjusting entries on 31 December 2020. (You may omit the explanation)

Store Equipment Delivery Truck 6% per annum on cost 4% per annum on cost 2. During the year, RM8,500 worth of additional office supplies was purchased. A physical count of office supplies on hand at the end of the year revealed that RM6,400 worth of office supplies had been used during the year. 3. RR Bhd pays its factory personnel weekly wages amounting to RM10,000 for a five-day work, on Friday. Assuming 31 December 2020, falls on Wednesday. 4. RR Bhd has rented a portion of an office building to multiple tenants. It has been determined that three tenants in the RM700 per month office and one tenant in the RM1,000 per month office had not paid their December rent as of 31 December. 5. RR Bhd borrowed RM51,000 from the bank signing a 10%, 6-month note on 1 December 2020. Principal and interest are payable to the bank on 1 June 2021. The transaction has been recorded except for accrued interest. 6. On 1 October 2020, RR Bhd purchased a general liability insurance policy for RM18,000 to provide coverage for 12 months. 7. On 1 December 2020, RR Bhd collected RM36,000 for consultancy services to be performed from 1 December 2020, through 31 May 2021. REQUIRED: (Show all your workings) (a) Prepare the adjusting entries on 31 December 2020. (You may omit the explanation)

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.5BPR: Adjusting entries and adjusted trial balances Reece Financial Services Co., which specializes in...

Related questions

Question

Transcribed Image Text:Store Equipment

Delivery Truck

6% per annum on cost

4% per annum on cost

2. During the year, RM8,500 worth of additional office supplies was purchased. A physical

count of office supplies on hand at the end of the year revealed that RM6,400 worth of office

supplies had been used during the year.

3. RR Bhd pays its factory personnel weekly wages amounting to RM10,000 for a five-day

work, on Friday. Assuming 31 December 2020, falls on Wednesday.

4. RR Bhd has rented a portion of an office building to multiple tenants. It has been determined

that three tenants in the RM700 per month office and one tenant in the RM1,000 per month

office had not paid their December rent as of 31 December.

5. RR Bhd borrowed RM51,000 from the bank signing a 10%, 6-month note on 1 December

2020. Principal and interest are payable to the bank on 1 June 2021. The transaction has

been recorded except for accrued interest.

6. On 1 October 2020, RR Bhd purchased a general liability insurance policy for RM18,000 to

provide coverage for 12 months.

7. On 1 December 2020, RR Bhd collected RM36,000 for consultancy services to be performed

from 1 December 2020, through 31 May 2021.

REQUIRED: (Show all your workings)

(a) Prepare the adjusting entries on 31 December 2020. (You may omit the explanation)

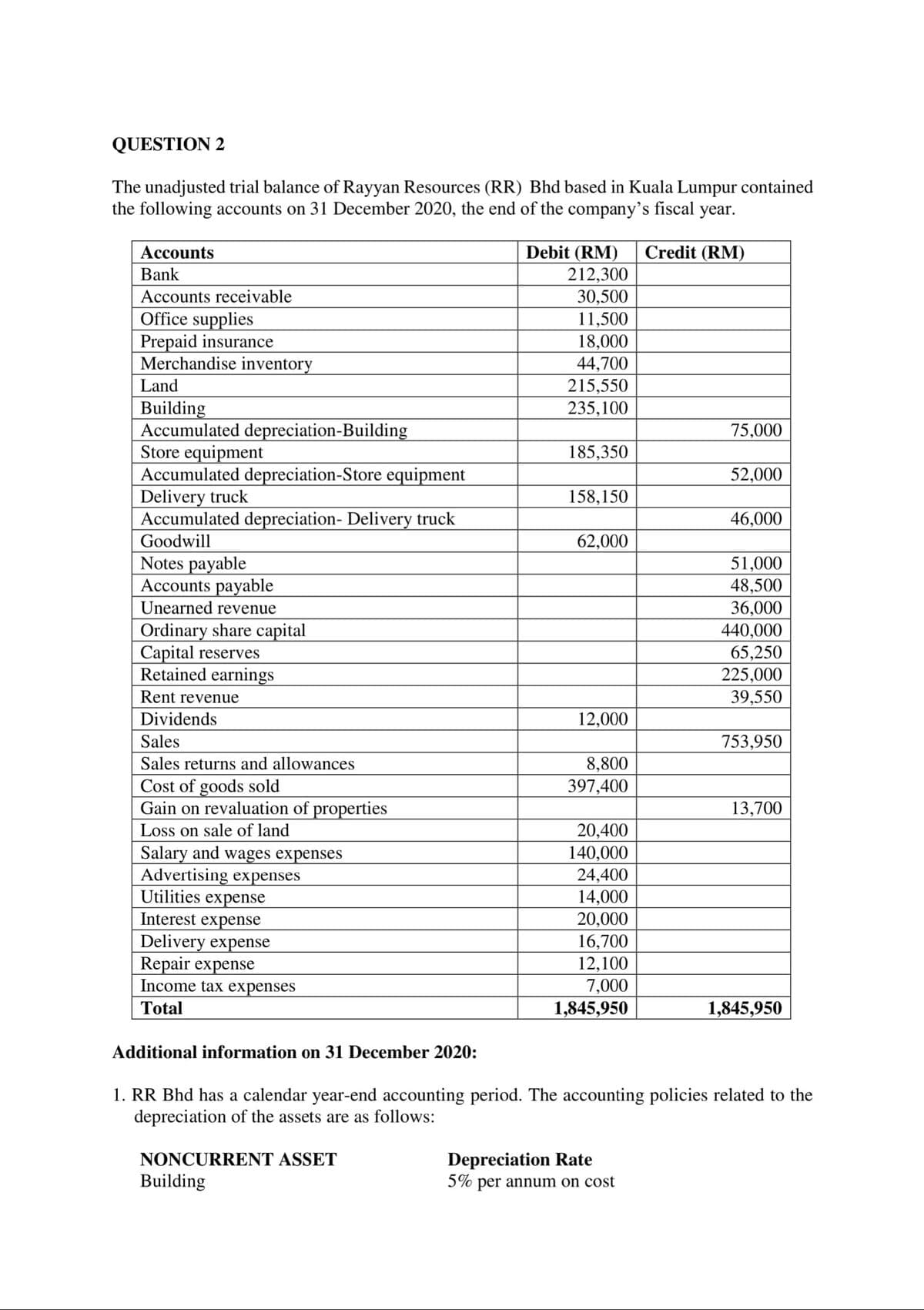

Transcribed Image Text:QUESTION 2

The unadjusted trial balance of Rayyan Resources (RR) Bhd based in Kuala Lumpur contained

the following accounts on 31 December 2020, the end of the company's fiscal year.

Debit (RM)

212,300

30,500

Accounts

Credit (RM)

Bank

Accounts receivable

Office supplies

Prepaid insurance

Merchandise inventory

11,500

18,000

44,700

215,550

235,100

Land

Building

Accumulated depreciation-Building

Store equipment

Accumulated depreciation-Store equipment

Delivery truck

Accumulated depreciation- Delivery truck

75,000

185,350

52,000

158,150

46,000

Goodwill

62,000

Notes payable

Accounts payable

Unearned revenue

51,000

48,500

36,000

440,000

65,250

Ordinary share capital

Capital reserves

Retained earnings

225,000

Rent revenue

39,550

Dividends

12,000

Sales

753,950

8,800

397,400

Sales returns and allowances

Cost of goods sold

Gain on revaluation of properties

13,700

Loss on sale of land

20,400

Salary and wages expenses

Advertising expenses

Utilities expense

Interest expense

Delivery expense

Repair expense

Income tax expenses

140,000

24,400

14,000

20,000

16,700

12,100

7,000

1,845,950

Total

1,845,950

Additional information on 31 December 2020:

1. RR Bhd has a calendar year-end accounting period. The accounting policies related to the

depreciation of the assets are as follows:

Depreciation Rate

5% per annum on cost

NONCURRENT ASSET

Building

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,