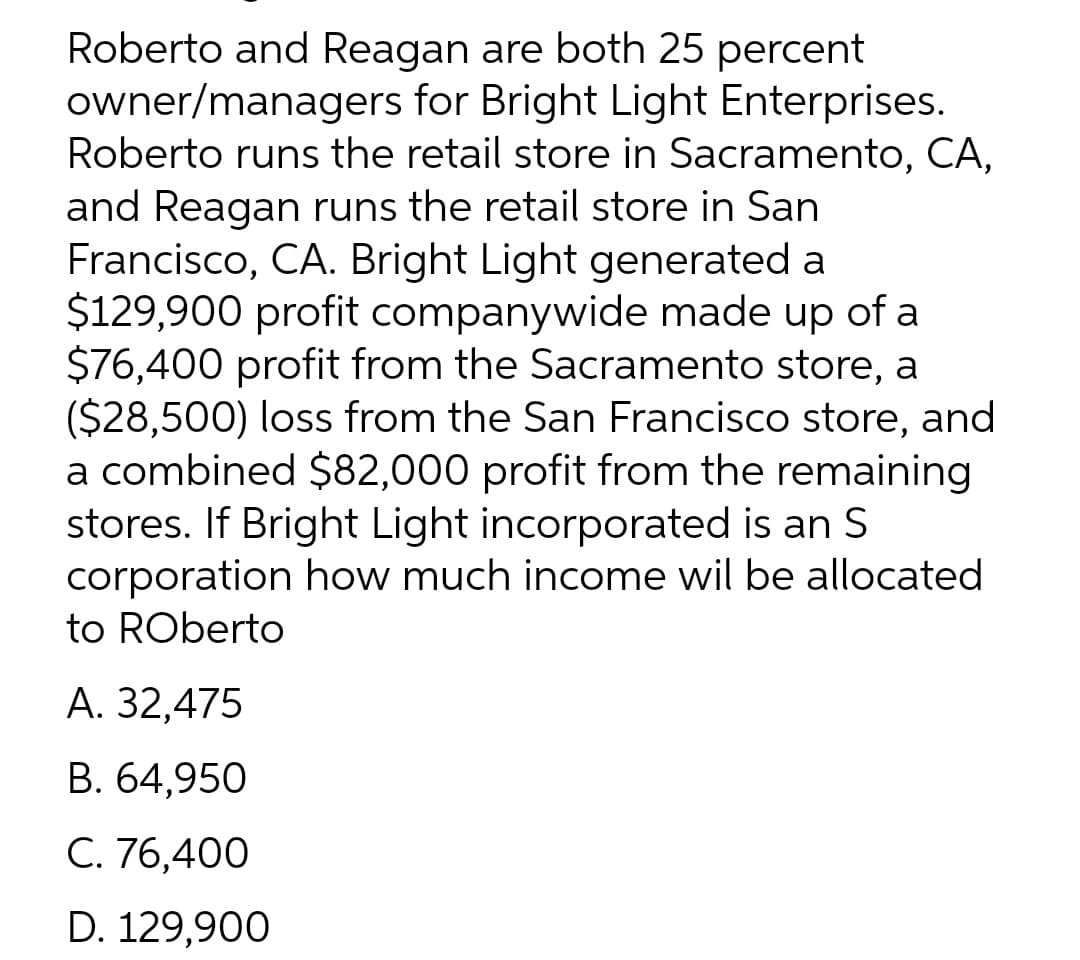

stores. If Bright Light incorporated is an S corporation how much income wil be allocated to Roberto A. 32,475 B. 64,950 C. 76,400 D. 129,900

Q: 13. Define the terms revenues and expenses.

A: Accounting- Accounting is the practice of keeping track of all financial transactions in a business.…

Q: Ali Mamat Enterprise Trial Balance as at 31 December 2019 Particulars Sales Purchases Salaries Motor…

A: Introduction: Balance sheet: All assets and liabilities are shown in Balance sheet. It tells the net…

Q: Kong operate a distribution firm with a margin of 1 / 3. At the end of May he…

A: The following information given in the question: 1. Firm with a margin of 1 / 3 2. Sales of…

Q: Jan. Issued 1,000 shares of Common Stock, $2 par for $12 per share. Record the journal entry.

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: Abacus Ltd undertook the following transactions during May 2022. Purchased $18,480 inventory; terms…

A: The journal entry which records the financial events within a continuous accounting period is called…

Q: QWE Company provided the following information for the current year: Cash, January 1 - P320,000; Net…

A: The question is related to the Cash Flow Statement. Cash Flow Statement is summary of cash receipts…

Q: journalize these receivable accounts (accounts receivable, notes receivable, or other receiveable on…

A: Particulars Amount. Dr. Amount Cr. 1 Accounts receivable 10,000 To, Cash 10,000…

Q: 1. What is an accrued expense? Give three examples.

A: In accounting there are two basis for showing the expenses one is cash basis that means expenses are…

Q: Accounting 2. James corporation started his business as a sole trader January 1 2015. From the…

A: The last in, first out approach is a method for inventory valuation and management. When there is…

Q: 10 Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000.

A: Introduction: Journal entries: All the business transactions are to be recorded in Journal entries.…

Q: Etemadi Amalgamated, a U.S. manufacturing firm, is considering a new project in Portugal. You are in…

A: Answer Project Value $14.830 Yes, We should Undertake the project

Q: Daily Kneads, Inc., is considering outsourcing one of its many products rather than making it…

A: Make or Buy Decision: The process of deciding whether to produce a product or service in-house or to…

Q: Gordon Miller's job shop has four work areas, A, B, C, and D. Distances in feet between centers of…

A: Total Material handling cost of the layout is calculated by following manner- Total material cost=…

Q: Bitter Company acquired a machinery on April 1, 2019. Cost 1,200,000 120,000 Syears Residual value…

A: Depreciation was an method used to record the machinery value after the wear and tear for every…

Q: 10. Where does unearned revenue appear on the balance sheet?

A: Unearned revenue: Unearned revenue is money which has been received for good and services which…

Q: 9 Ramer and Knox began a partnership by investing $72,000 and $102,000, respectively. The partners…

A: A partnership is a business form in which two or more people agree to engage in business. The…

Q: Multiple Choice O о O O O Restricted retained earnings per share. Earnings per share. Continuing…

A: Introduction:- Shares outstanding means company's stock currently held by all its shareholders.

Q: 8. What is the difference between accumulated depreciation and depreciation expense? A

A: Depreciation expense is the periodic depreciation charge that a business takes against its assetsin…

Q: Key issues to consider when auditing a consolidated account

A:

Q: Compute NOPAT Selected income statement information for 2018 is presented below for Home Depot Inc.…

A: In order to determine the return on net operating assets, the net operating profit after tax are…

Q: Sandra pays $5,000 to the institution in return for the chance to purchase football season tickets.…

A: Sherry donates $5,000 to the university in exchange for the right to purchase tickets for the…

Q: Special domestic companies, such as proprietary educational institutions, are exempt from MCIT if…

A: MCIT covers corporations subject to normal rate of taxation. These corporations can be domestic…

Q: XYZ Company reported net income of P9,000,000 for the current year. Changes occurred in certain…

A: Using indirect method method for cash flow from operating activities, the non cash expenses or…

Q: ILLUSTRATE THE VARIOUS COST CLASSIFICATIONS. (PLEASE INCLUDE PHOTOS OR TEXT FOR THE EXPLANATION)…

A: The cost means the amount paid by the company for purchasing or producing something. The cost is the…

Q: 4/2 Purchased a company automobile for $32,000, with a cash down payment of $1,000 and the remaining…

A: Introduction: Journals: All the business transactions are to be recorded in Journals. Journals are…

Q: Mike Sweet opens a web consulting business called Sweet Consulting and completes the following…

A: Income : Cash received from client on Mar 6 $5900 Amount receivable from client for service…

Q: Problem 8 For each transaction below, tell which account is debited and which account is credited.…

A: Journal- Journalizing is the process by which businesses record their transactions in a systematic…

Q: depreciable assets on January 1, 2019. anowed the following schedule o Accumulated depreciation…

A: Depreciation was an concept of accounting which was used to record value of the machinery after wear…

Q: Independent Exercise - Lakeside Golf Lakeside Gulf was purchased this year by Susan Stoddart. She…

A: T-accounts are prepared to calculate the balances of each particular account opened while preparing…

Q: Produce a table of A-Design's different costs and classify them.

A: Cost classification is the classification which are made by the company so that in can be better…

Q: PLEASE SKIP IF YOU ALREADY ANSWERED. I WILL UPVOTE

A: The question is related to Journal Entries. Journal entries are the first step in Accounting. The…

Q: Rajesh is filing single and he has an adjusted gross income (AGI) of $81,000 for the 2018 tax year.…

A: The tax liability indicates the income tax payable by the taxpayers on the taxable income. The…

Q: I still need a little help this part : Please Journalize and post the adjusting entries. a.…

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred…

Q: Review each event below and determine what would likely be the type of items exchanged in the…

A: Every transaction has dual effect on the books of account. Assets = Liabilities + Stockholders'…

Q: A controlling influence over the investee is based on the investor owning voting stock exceeding:…

A: Significant stake in other company gives the controlling right

Q: Question III Lay-Z-Sofa Inc., whose fiscal year ends on December 31, is in the business of selling…

A: The journal entries in the books of Lay - Z Sofa Inc. under the Allowance method and the specific…

Q: At the beginning of the current year, Relay Company was organized and authorized to issue 100,000…

A: Shareholders equity is the amount that the owner has invested in the business including retained…

Q: An item is originally priced to sell for $85 and is marked down 20%. A customer has a coupon for an…

A: Given that, Original selling price = $85 Marked down = 20% Additional discount (coupon) = 35%

Q: produces lamps and home lighting fixtures. Its most popular product is a brushed aluminum desk lamp.…

A: When plantwide overhead rate is used it is calculated by dividing the total estimated overhead by…

Q: The Raving Storm is a trader in hurricane shutter systems. The firm has provided the following…

A: We have the opening and closing details about the Trader Raving Storm. We have a cash account with…

Q: Polarix is a retailer of ATVs (all-terrain vehicles) and accessories. An income statement for its…

A: The contribution margin is calculated as difference between sales and variable costs.

Q: Which of the following is not one of the tasks undertaken during the phase use of t of the audit? A)…

A: Auditing is an examination of financial data of any entity with a view to express an opinion thereon…

Q: Novak Auto Suplies Balance Sheet December 31, 2020 Cash Prepaid Insurance Accounts Receivable…

A: The balance sheet represents the financial position of the business with assets, liabilities and…

Q: Which of the following is measured at fair value with fair value changes recognized in profit or…

A: Explanation: Held to maturity investments: Investments that are held to maturity are classified at…

Q: Needed: 1. Determine the total financial income that will be recognised over the lease period. 2.…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Current Attempt in Progress Swifty Company developed the following information about its inventories…

A: Given that inventory is to be valued at lower of cost or net realizable value

Q: 3. What amount should be reported as cash balance at year-end? a. 3,400,000 b. 1,600,000 c.…

A: Statement of cash flow (CFS) refers to a financial statement of the company which shows the flows of…

Q: The Tax rates for 2018 is wrong can you fix it?

A: Tax rates are the rates on which are used by the taxpayer in order to compute his or her tax amount…

Q: atistics show that a certain district has been experiencing high death rates lately, mainly due to…

A: Hospital : It is the place where every citizen of the country protect their life from various…

Q: Dmitry had $42,000 of income from wages and $1,550 of taxable interest. Dmitry also made…

A: Taxable income is the income calculated after multiplying the tax rate by the net income and…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Roberto and Reagan are both 25 percent owners/managers for Bright Light Inc. Roberto runs the retail store in Sacramento, CA, and Reagan runs the retail store in San Francisco, CA. Bright Lingt Inc. generated a $127,800 profit company wide made up of a $75,800 profit from the Sacramento store, a ($27,000) loss from the San Francisco store, and a combined $79,000 profit from the remaining stores. If Bright Light is taxed as a partnership and decides that Roberto and Reagan will be allocated 70 percent of his own store's profit with the remaining profits allocated pro rata among all the owners, how much income will be allocated to Reagan? Multiple Choice ___ ($25,140.00) ___ ($18, 900.00) ___ $4,510.00 ___ $20,630.00Roberto and Reagan are both 25-percent owner or managers for Bright Light Incorporated. Roberto runs the retail store in Sacramento, California, and Reagan runs the retail store in San Francisco, California. Bright Light generated a $125,000 profit companywide made up of a $75,000 profit from the Sacramento store, a ($25,000) loss from the San Francisco store, and a combined $75,000 profit from the remaining stores. If Bright Light is taxed as a partnership and it is decided that both Roberto and Reagan will be allocated 70 percent of his own store's profit, with the remaining profits allocated pro rata among all the owners, how much income will be allocated to Reagan in total? Multiple Choice ($25,000) ($17,500) $5,000 $20,000Sidney and Gertrude own 40% of Bearcave Bookstore, an S corporation. The remaining 60% is owned by their son Boris. Sidney and Gertrude do not participate in operating or managing the store, and they invested $19,000 in the business when it opened in 2017. The bookstore reported the following net income (loss) for the years 2017 through 2020: 2017 2018 2019 2020 $(24,000) $(14,000) $(12,000) $5,000 a. Complete the table below to determine how much Sidney and Gertrude have at risk in Bearcave at the end of each year (2017–2020)? Note: Enter negative amounts beginning with a minus (-) sign. If a amount is zero, enter "0". 2017 2018 2019 2020 Investment/Beginning Amount at-risk $fill in the blank 683706031051064_1 $fill in the blank 683706031051064_2 $fill in the blank 683706031051064_3 $fill in the blank 683706031051064_4 Share of income (loss) fill in the blank 683706031051064_5 fill in the blank 683706031051064_6 fill…

- Peter, Brian and Marc, three brothers, were co-owners of Bug-Zappers Inc. They each owned 1,000 shares in the business. Their adjusted cost base was $22 per share. After several years of success, their stock had increased in value to $34 per share, and they decided to execute a cross-purchase buy-sell agreement. In that agreement, they specified a fixed purchase price of $30 per share. This year, Marc died. At the time of his death, his shares were worth $40 each. Peter and Brian purchased his shares from his estate in accordance with the buy-sell agreement. What amount of taxable capital gain will be reported on Marc's final tax return?Joe, June, and Jim—coworkers—decide that they want to start their own business. Joe has $200,000 to contribute, June has equipment valued at $100,000 (basis = $90,000), and Jim has real estate suitable for the business valued at $200,000 (basis = $110,000). Joe and Jim are each to receive 40 percent of the corporate stock, and June is to receive 20 percent. Joe and June transfer title to their property to the corporation immediately. When Jim tries to transfer title to the real estate to the corporation, several legal errors in the title are discovered, and he is unable to transfer title until the errors are corrected. Correcting the errors takes more than 14 months. In the meantime, the corporation begins operating, renting the building from Jim. In the 15th month, Jim is able to transfer title and receive his stock. Is Jim eligible to use the nonrecognition provisions of Section 351 on this transfer?Mickey, Mickayla, and Taylor are starting a new business (MMT). To get the business started, Mickey is contributing $215,000 for a 40 percent ownership interest, Mickayla is contributing a building with a value of $215,000 and a tax basis of $153,750 for a 40 percent ownership interest, and Taylor is contributing legal services for a 20 percent ownership interest. What amount of gain is each owner required to recognize under each of the following alternative situations? [Hint: Look at IRC §351 and §721.] A. MMT is formed as a C corporation. B. MMT is formed as an S corporation. C. MMT is formed as an LLC.

- Bedrock Inc. is owned equally by Barney Rubble and his wife Betty, each of whom hold 500 shares in the company. Betty wants to reduce her ownership in the company, and it was decided that the company will redeem 250 of her shares for $32,600 per share on December 31 of this year. Betty’s income tax basis in each share is $9,750. Bedrock has current E&P of $10,290,000 and accumulated E&P of $50,380,000 a. What is the amount and character (capital gain or dividend) recognized by Betty as a result of the stock redemption, assuming only the “substantially disproportionate with respect to the shareholder” test is applied? b. What is Betty’s income tax basis in the remaining 250 shares she owns in the company? c. Assuming the company did not make any dividend distributions this year, by what amount does Bedrock reduce its E&P as a result of the redemption? d. Can Betty argue that the redemption is “not essentially equivalent to a dividend” and should be treated as an exchange?At her death, Chow owned 55% of the stock in Finch Corporation, with the balance held by family members. In the past five years, Finch has earned average net profits of $1,710,000, and on the date of Chow's death, the book value of its stock is $4,275,000. An appropriate rate of return for Finch’s business is in is 10.55%. If required, round your intermediate computations to the nearest dollar. a. If goodwill exists, the total value of Finch stock isWhat value would the IRS argue that the stock Chow owned should be included in her estate?Don and Joe went into business together as equal co-owners. Joe had a lot of money but no business sense and Don had the “know how”. Don and Joe each invested $10,000 and Joe loaned the business $90,000. Chase loaned the business another $100,000 after Joe and Don agreed to guarantee the loan. In the first year, as is typical, the business struggled and incurred ordinary operating income of $50,000, excluding the payment promised to Don of $65,000 annually for his labor. The business earned interest income of $2,000, a short term capital loss of $4,000, and made qualified charitable contributions of $1,000. In the second year of business ordinary operating income was $32,000. including the promised amount for Don’s labor. The business earned $1,200 in interest income and incurred a $1,500 capital gain and paid $2,500 in qualified charitable contributions. Joe was repaid $10,000 for his loan and Chase received $3,000 in principal payments. An equal distribution of $4,000 was made to…