Strum Corp. has maintained a defined benefit pension plan for its employees for a number of years. For Year 4, current service cost was $37.000 and interest on the projected benefit obligation was S18,000, Strum's retum on plan assets, actual and estimated, was $8,000. On December 31, Year 4, Strum Corp. contributed $30,000 to its pension plan. Strum's Year 4 pension expense was: O $63,000 O SA7,000 O 555,000 O $30,000

Q: During the current year, Vander Esch Industries contributed $150,000 to its defined benefit pension…

A: Defined benefit pension plans are plans that are made for payment of retirement benefits to the…

Q: At the end of the current period, Agler Inc. had a projected benefit obligation of $400,000 and…

A:

Q: At the beginning of the current year, the memorandum records of OPPA Co's defined benefit plan…

A: Defined benefit obligation is a measurement of present values to determine liabilities for future…

Q: What is the interest cost for 2023? b. What is the projected benefit obligation on December 31,…

A:

Q: CBA Co. has established a defined benefit pension plan for its employees. Annual payments under the…

A: Defined benefit obligation can be computed as follows

Q: At the end of the current year, Top Co. has a defined benefit obligation of £335,000 and pension…

A: Pension Fund The purpose of creating the pension fund is to some of the small portion of amount…

Q: Blossom, Inc. has a defined-benefit pension plan covering its 50 employees. Blossom agrees to amend…

A: Pension indicates the amount that the employer added to the pension plans of its employees during…

Q: Louie Company has.a defined benefit pension plan. On December 31 (the end of the fiscal year), the…

A: Calculation of service cost from PBO report. Particulars Amount Ending PBO 110000 Add:…

Q: The following information relates to the defined benefit pension plan for the employees of a…

A: Given: Projected benefit obligation on 12/31/20 =$300000Fair value of plan assets on…

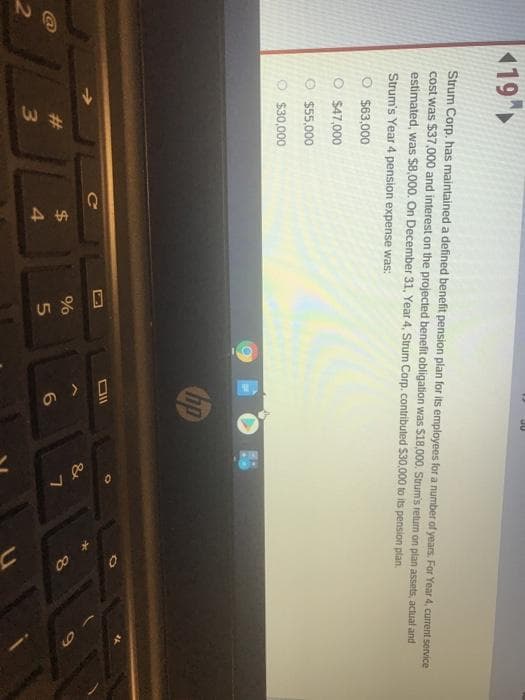

Q: Strum Corp. has maintained a defined benefit pension plan for its employees for a number of years.…

A: Pension is defined as the fixed value delivered to an individual usually after retirement at a…

Q: Gruber Enterprises started its defined benefit pension plan on January 1, Year 1. By the beginning…

A: Fair market value It is the price, an asset would be sold in an open market when certain covenants…

Q: Lawrence Company has a defined benefit pension plan. On December 31 of the current year (the end of…

A: Given the following information: Ending PBO: $115,000 Benefits paid to retirees: $15,000 Interest…

Q: The following information relate to the defined benefit pension plan of Edward Corp. in relation to…

A: Interest cost = Defined benefit obligation x discount rate = 3000000 x 6% = P180,000

Q: Ridley Corporation is a manufacturing company in the Caribbean. The company sponsors a defined…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: At the start of the year,Boy had the following balances in its pension benefit memo records: Fair…

A: Interest costs = Accrued benefit obligations x Discount rate = 3,200,000 x 9% = 288,000

Q: For the current year, Clark Company has the following information. Beginning plan assets was $1,000,…

A: Defined Pension Obligation Defined pension obligation which is described as implemented scheme to…

Q: Ivanhoe, Inc. has a defined-benefit pension plan covering its 50 employees. Ivanhoe agrees to amend…

A: Number of service years =50+40+30+20+10 = 150

Q: 300,000. The employee is expected to retire in 10 years and the salary increases are expected to…

A: The calculation is given as,

Q: Anna Co. sponsors a defined benefit pension plan. For the current year ended December 31, the…

A: Expected return on plan assets = Beginning Fair value of plan assets x Yield on bonds issued by the…

Q: A corporation provides a defined benefit pension plan to its employees; the settlement rate is 8%…

A: Defined Pension Benefit For Calculating the defined benefit plan first to calculate the total…

Q: Company A has established a defined benefit plan for the employee. Annual payments under the plan…

A: Current service cost (CSO) refers to the increase in the PV (Present Value) of the defined benefit…

Q: At the end of the current period, Oxford Ltd. has a defined benefit obligation of $195,000 and…

A: Compute the amount related to its pension plan will be reported on the company's statement of…

Q: The following information is given about a funded defined benefit plan of ROYCE Company. On January…

A: The present value of net defined obligation is the present value of the post retirement defined…

Q: K Company amends its defined pension plan on January 1, 2016, resulting in P420,000 of past service…

A: Past service cost seems to be the adjustment within the current value of the defined benefit…

Q: Lewis Industries adopted a defined benefit pension plan on January 1, 2016. By making the provisions…

A: Compute the Projected benefit obligation (PBO) as of December 31, 2016.

Q: On January 1 of the current reporting year, Coda Company's projected benefit obligation was…

A: Particulars Amounts ($) PBO on January 1 $30,00,000 Add: Service cost during the year $8,75,000…

Q: Fukushima Company provides its employees with vacation benefits and a defined contribution pension…

A: a) Prepare journal entry to record vacation pay expense.

Q: The following information relate to the defined benefit pension plan of Edward Corp. in relation to…

A: Defined Benefit Cost: It is the benefit ahead of time payable to employee which is calculated based…

Q: Harvey Hotels has provided a defined benefit pension plan for its employees for several years. At…

A: Pension expense for the Year = Service costs + Interest costs + Amortization of prior service cost -…

Q: The following information is given about a funded defined benefit plan of Royce Company. On January…

A: In this question, there are multiple sub-parts but we solved only the first three sub-parts as per…

Q: oriander Co. (CC), a public company, has had a defined benefit pension plan for 30 years. Two years…

A:

Q: Jessie Co. sponsors a defined benefit pension plan. For the current year ended December 31, the…

A: Unrealized holding profits or losses on available for sale assets, as well as foreign currency…

Q: At the end of the current period, Oxford Ltd. has a defined benefit obligation of $195,000 and…

A: Pension plan: This is the plan devised by corporations to pay the employees an income after their…

Q: Louie Company has a defined benefit pension plan. On December 31 (the end of the facal year), the…

A: solution formula used interest cost =PBO at beginning of the year * discount rate service cost…

Q: paid were $45,000. The amount of accumulated OCI-gains amortized in 2021 is $_________. (If there…

A: The accumulated depreciation is deducted out of the purchase value of a company in order to arrive…

Q: You gathered the following information related to Ashley Company's the defined benefit plan for the…

A: step 1: calculation of beginning funded status =beginning plan assets – beginning PBO…

Q: Jones Manufacturing Inc. sponsored a defined benefit pension plan effective 1 January 20X7. The…

A: The pension plan is the retirement benefit plan for employees’ retirement. All the contributions are…

Q: You gathered the following information related to Ashley Company’s the defined benefit plan for the…

A: Defined benefit cost for the year = (Ending Present value of obligation + Benefits paid - Beginning…

Q: The trustee for the Bronson Corporation defined benefit pension plan sent a report to the CEO with…

A: Computation of the ending balance of plan assets : Formula : Ending Balance plan assets = (…

Q: The following information for Blossom Enterprises is given below: December 31, 2021 Assets…

A: Given the following information: Plan assets (at fair value): $840,000 Accumulated benefit…

Q: mber Company has 120 employees who are expected to receive benefits under the company's…

A: On a straight line basis, depreciation and amortization, or the process of expensing an asset over a…

Q: At the end of the current year, Joshua Co. has a defined benefit obligation of $335,000 and pension…

A: Joshua Co. would report a pension asset of $10,000 ($345,000 – $335,000).

Q: Sheridan Company has 160 employees who are expected to receive benefits under the company's…

A: Average remaining service life per of the employee Formula = Expected future years of…

Q: ABC put up a qualified retirement plan approved by the BIR. It appointed B Corp. to administer the…

A: 1. The first-year pension expenditure is equal to the total of previous years plus the current…

Q: At the end of the current year, Kennedy Co. has a defined benefit obligation of $335,000 and pension…

A: Difference between defined benefit obligation and fair value of plan assets is reported on balance…

Q: On January 1, 20X1, Cello Co. established a defined benefit pension plan for its estimated the…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- #13On January 1, 2020, Shaina company had a projected benefit obligation of 2,500,000 and apension fund with a fair value of 2,300,000. The entity provided the following informationrelated to the pension plan during the current year:Current service cost 300,000Actual return on the pension fund 62,500Benefits paid to retirees 275,000Contribution to the pension fund 262,500Discount rate 9%Expected return on pension fund 10%What is the pension expense for the current year? The answer is 318,000 pls provide the correct solution for this14 Fajardo Company provided the following pension plan information: Projected benefit obligation – January 1, 2021 3,500,000 Fair value of plan assets – January 1, 2021 2,800,000 Pension benefits paid during the year 250,000 Current service cost for 2021 1,750,000 Past service cost for 2021 425,000 Actual return on plan assets 180,000 Contribution to the plan 1,500,000 Actuarial loss due to change in assumption on PBO 200,000 Discount or settlement rate 10% What is the fair value of plan assets on December 31, 2021? Group of answer choices 4,050,000 4,480,000 4,300,000 4,230,000 PreviousNext6) The following facts apply to the pension plan of Trudy Borke Inc. for the year 20X1: Plan assets, January 1 20X1 $490,000Projected benefit obligation January 1 20X1 490,000Settlement rate 8.5%Annual pension service cost 40,000Contributions (funding) 30,000Actual return on plan assets 49,700Benefits paid to retirees 33,400 What is the pension expense for 20X1?

- The following data are for the pension plan for the employees of Sandhill Company. 1/1/20 12/31/20 12/31/21 Accumulated benefit obligation $ 5100000 $ 5200000 $ 6980000 Projected benefit obligation 5530000 5680000 7410000 Plan assets (at fair value) 4610000 5900000 6640000 AOCL – net loss 0 958000 1080000 Settlement rate (for year) 10% 10% Expected rate of return (for year) 9% 6% Sandhill’s contribution was $840000 in 2021 and benefits paid were $763000. Sandhill estimates that the average remaining service life is 15 years.The actual return on plan assets in 2021 was: 480000 663000 740000 56300030. Midland Company follows GAAP for its external financial reporting whereas Bailey Company follows IFRS for its external financial reporting. The remaining service lives of employees at both firms is estimated to be 10 years. The following information is available for each company at December 31, 2021 related to their respective defined-benefit pension plans. Midland Bailey Net of pension assets and liabilities $110,000 $140,000 Prior service cost (after amortization, if any) $230,000 $175,000 What is the amount of Prior Service Cost recognized by each company on its balance sheet at December 31, 2021? Midland Bailey $230,000 $175,000 $-0- $175,000 $-0- $-0- d. $230,000 $-018 Fajardo Company provided the following pension plan information: Projected benefit obligation – January 1, 2021 3,500,000 Fair value of plan assets – January 1, 2021 2,800,000 Pension benefits paid during the year 250,000 Current service cost for 2021 1,750,000 Past service cost for 2021 425,000 Actual return on plan assets 180,000 Contribution to the plan 1,500,000 Actuarial loss due to change in assumption on PBO 200,000 Discount or settlement rate 10% What amount should be reported as accrued benefit cost on December 31, 2021? Group of answer choices 1,045,000 1,750,000 1,745,000 700,000

- The following data are for the pension plan for the employees of Wildhorse Company. 1/1/20 12/31/20 12/31/21 Accumulated benefit obligation $ 5900000 $ 6100000 $ 7700000 Projected benefit obligation 6300000 6500000 8300000 Plan assets (at fair value) 5500000 6900000 7500000 AOCL – net loss 0 1041000 1090000 Settlement rate (for year) 10% 10% Expected rate of return (for year) 7% 7% Wildhorse’s contribution was $930000 in 2021 and benefits paid were $840000. Wildhorse estimates that the average remaining service life is 10 years.The corridor for 2021 was $690000. The amount of AOCI-net loss amortized in 2021 was $35100. $104100. $109000. $41100.J The following information relates to the defined benefit pension plan for the Nicola Company for the year ending December 31, 2020. Defined benefit obligation, January 1 P4,600,000 Defined benefit obligation, Dec. 31 4,729,000 Fair value of plan assets, January 1 5,035,000 Fair value of plan assets, Dec. 31 5,565,000 Expected return on plan assets 450,000 Employer contributions 425,000 Benefits paid to retirees 390,000 Settlement rate 10% Service cost for the year would be Group of answer choices P94,000 P59,000 P390,000 P129,000The following information related to Company DDD’s pension plan: Plan asset, January 1, 20x8 P950,000 Defined benefit obligation, January 1, 20x8 1,000,000 Average remaining working life of employees at January 1, 20x8 10 years Service cost for 20x8 90,000 Discount rate at January 1, 20x8 10% Expected return on plan asset at January 1, 20x8 100,000 Remeasurement loss arising in 20x8 15,000 Past service cost 30,000 Vesting period for past service cost 2 years What amount of defined benefit cost should be recognized during 20x8?

- 5. You gathered the following information related to Ashley Company’s the defined benefit plan for the current year ended December 31: Fair value of plan assets: P2,100 million at January 1, and P2,300 million at December 31 Present value of obligation to provide benefits: P2,200 million at January 1, and P2,600 million at December 31 Contributions paid to the fund: P80 million Benefits paid to retired employees: P50 million The defined benefit cost for the year is Group of answer choices P250 million P280 million P200 million P120 million3) U.S. Metallurgical Inc. reported the following balances in its financial statements and disclosure notes at December 31, 2020. Plan assets $580,000 Projected benefit obligation 500,000 U.S.M.’s actuary determined that 2021 service cost is $78,000. Both the expected and actual rate of return on plan assets are 10%. The interest (discount) rate is 5%. U.S.M. contributed $138,000 to the pension fund at the end of 2021, and retirees were paid $62,000 from plan assets. (Enter your answers in thousands (i.e., 10,000 should be entered as 10).) Required: What is the pension expense at the end of 2021? What is the projected benefit obligation at the end of 2021? What is the plan assets balance at the end of 2021? What is the net pension asset or net pension liability at the end of 2021? Prepare journal entries to record the (a) pension expense, (b) funding of plan assets, and (c) retiree benefit payments.The following data are for the pension plan for the employees of Lockett Company. 1/1/14 12/31/14 12/31/15 Accumulated benefit obligation $2,500,000 $2,600,000 $3,400,000 Projected benefit obligation 2,700,000 2,800,000 3,700,000 Plan assets (at fair value) 2,300,000 3,000,000 3,300,000 AOCL – net loss -0 580,000 500,000 Settlement rate (for year) 10% 9% Expected rate of return (for year) 8% 7% Lockett’s contribution was $420,000 in 2015 and benefits paid were $275,000. Lockett estimates that the average remaining service life is 20 years. The actual return on plan assets in 2015 was $300,000. $255,000. $200,000. $155,000.