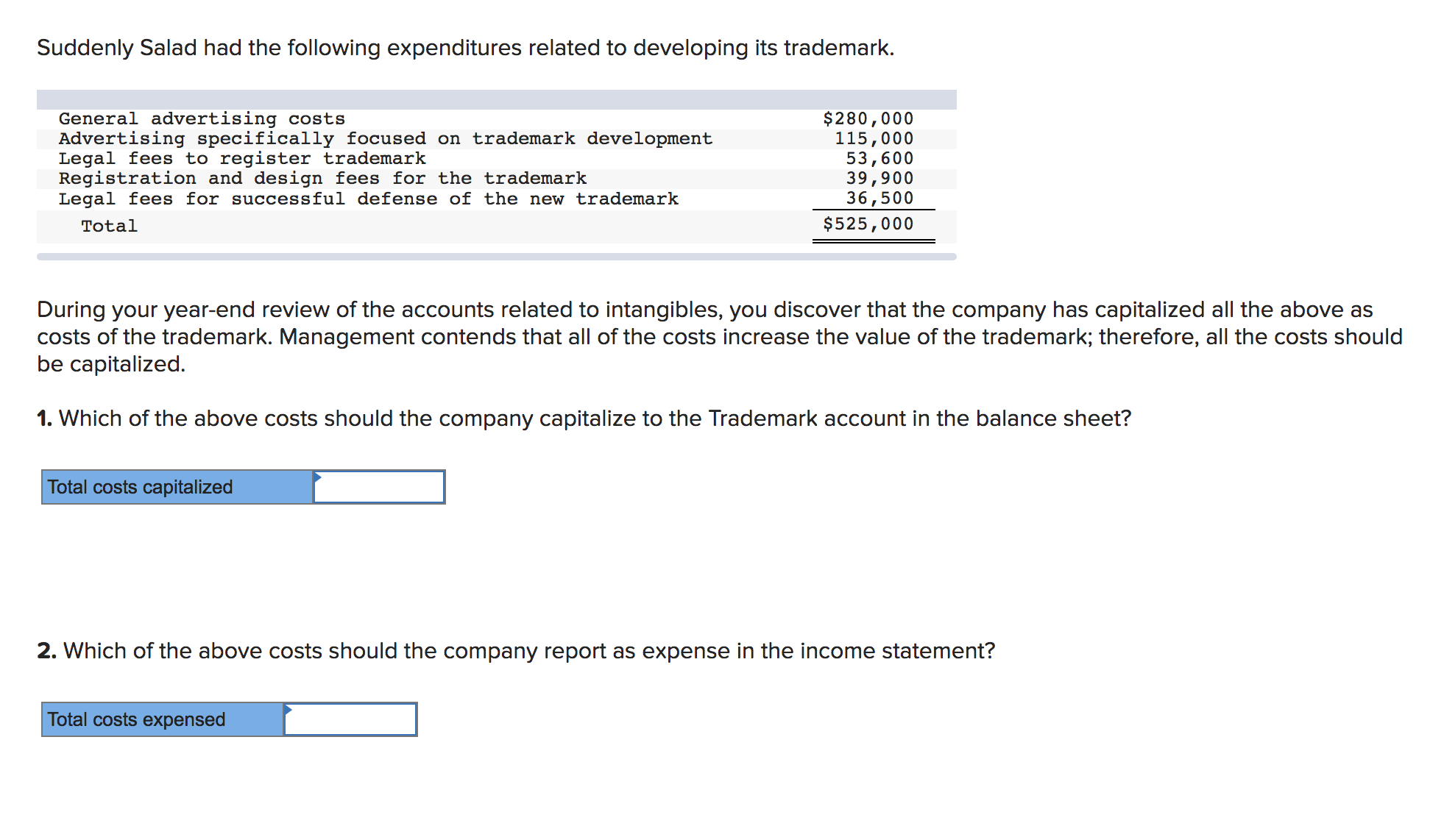

Suddenly Salad had the following expenditures related to developing its trademark. General advertising costs Advertising specifically focused on trademark development Legal fees to register trademark Registration and design fees for the trademark Legal fees for successful defense of the new trademark $280,000 115,000 53,600 39,900 36,500 $525,000 Total During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should be capitalized. 1. Which of the above costs should the company capitalize to the Trademark account in the balance sheet? Total costs capitalized 2. Which of the above costs should the company report as expense in the income statement? Total costs expensed

Suddenly Salad had the following expenditures related to developing its trademark. General advertising costs Advertising specifically focused on trademark development Legal fees to register trademark Registration and design fees for the trademark Legal fees for successful defense of the new trademark $280,000 115,000 53,600 39,900 36,500 $525,000 Total During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should be capitalized. 1. Which of the above costs should the company capitalize to the Trademark account in the balance sheet? Total costs capitalized 2. Which of the above costs should the company report as expense in the income statement? Total costs expensed

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 13E

Related questions

Question

Please Help. Chapter 7 Accounting Question

Transcribed Image Text:Suddenly Salad had the following expenditures related to developing its trademark.

General advertising costs

Advertising specifically focused on trademark development

Legal fees to register trademark

Registration and design fees for the trademark

Legal fees for successful defense of the new trademark

$280,000

115,000

53,600

39,900

36,500

$525,000

Total

During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as

costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should

be capitalized.

1. Which of the above costs should the company capitalize to the Trademark account in the balance sheet?

Total costs capitalized

2. Which of the above costs should the company report as expense in the income statement?

Total costs expensed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning