Summary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data from the current year-end balance sheets Data from the current year’s income statement Assets Sales $ 780,000 $ 883,200 Cash $ 19,000 $ 37,000 Cost of goods sold 589,100 644,500 Accounts receivable, net 37,400 54,400 Interest expense 8,000 12,000 Merchandise inventory 84,340 136,500 Income tax expense 14,992 24,383 Prepaid expenses 5,800 7,350 Net income 167,908 202,317 Plant assets, net 370,000 310,400 Basic earnings per share 4.66 4.68 Total assets $ 516,540 $ 545,650 Cash dividends per share 3.72 3.99 Liabilities and Equity Beginning-of-year balance sheet data Current liabilities $ 67,340 $ 97,300 Accounts receivable, net $ 28,800 $ 50,200 Long-term notes payable 86,800 111,000 Merchandise inventory 59,600 113,400 Common stock, $5 par value 180,000 216,000 Total assets 438,000 392,500 Retained earnings 182,400 121,350 Common stock, $5 par value 180,000 216,000 Total liabilities and equity $ 516,540 $ 545,650 Retained earnings 148,412 91,401 Required: 2a. Price Earn Ratio 2a. Div Yield Req 2B **Please answer the following question: Identify which company’s stock you would recommend as the better investment. Answer- The better Investment: (Barco Company/Kyan Company) Please choose one company for the answer to Req 2B***

Summary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data from the current year-end balance sheets Data from the current year’s income statement Assets Sales $ 780,000 $ 883,200 Cash $ 19,000 $ 37,000 Cost of goods sold 589,100 644,500 Accounts receivable, net 37,400 54,400 Interest expense 8,000 12,000 Merchandise inventory 84,340 136,500 Income tax expense 14,992 24,383 Prepaid expenses 5,800 7,350 Net income 167,908 202,317 Plant assets, net 370,000 310,400 Basic earnings per share 4.66 4.68 Total assets $ 516,540 $ 545,650 Cash dividends per share 3.72 3.99 Liabilities and Equity Beginning-of-year balance sheet data Current liabilities $ 67,340 $ 97,300 Accounts receivable, net $ 28,800 $ 50,200 Long-term notes payable 86,800 111,000 Merchandise inventory 59,600 113,400 Common stock, $5 par value 180,000 216,000 Total assets 438,000 392,500 Retained earnings 182,400 121,350 Common stock, $5 par value 180,000 216,000 Total liabilities and equity $ 516,540 $ 545,650 Retained earnings 148,412 91,401 Required: 2a. Price Earn Ratio 2a. Div Yield Req 2B **Please answer the following question: Identify which company’s stock you would recommend as the better investment. Answer- The better Investment: (Barco Company/Kyan Company) Please choose one company for the answer to Req 2B***

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 54E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Summary information from the financial statements of two companies competing in the same industry follows.

| Barco Company | Kyan Company | Barco Company | Kyan Company | ||

| Data from the current year-end balance sheets | Data from the current year’s income statement | ||||

| Assets | Sales | $ 780,000 | $ 883,200 | ||

| Cash | $ 19,000 | $ 37,000 | Cost of goods sold | 589,100 | 644,500 |

| 37,400 | 54,400 | Interest expense | 8,000 | 12,000 | |

| Merchandise inventory | 84,340 | 136,500 | Income tax expense | 14,992 | 24,383 |

| Prepaid expenses | 5,800 | 7,350 | Net income | 167,908 | 202,317 |

| Plant assets, net | 370,000 | 310,400 | Basic earnings per share | 4.66 | 4.68 |

| Total assets | $ 516,540 | $ 545,650 | Cash dividends per share | 3.72 | 3.99 |

| Liabilities and Equity | Beginning-of-year balance sheet data | ||||

| Current liabilities | $ 67,340 | $ 97,300 | Accounts receivable, net | $ 28,800 | $ 50,200 |

| Long-term notes payable | 86,800 | 111,000 | Merchandise inventory | 59,600 | 113,400 |

| Common stock, $5 par value | 180,000 | 216,000 | Total assets | 438,000 | 392,500 |

| 182,400 | 121,350 | Common stock, $5 par value | 180,000 | 216,000 | |

| Total liabilities and equity | $ 516,540 | $ 545,650 | Retained earnings | 148,412 | 91,401 |

Required:

2a. Price Earn Ratio

2a. Div Yield

Req 2B **Please answer the following question: Identify which company’s stock you would recommend as the better investment. Answer- The better Investment: (Barco Company/Kyan Company) Please choose one company for the answer to Req 2B***

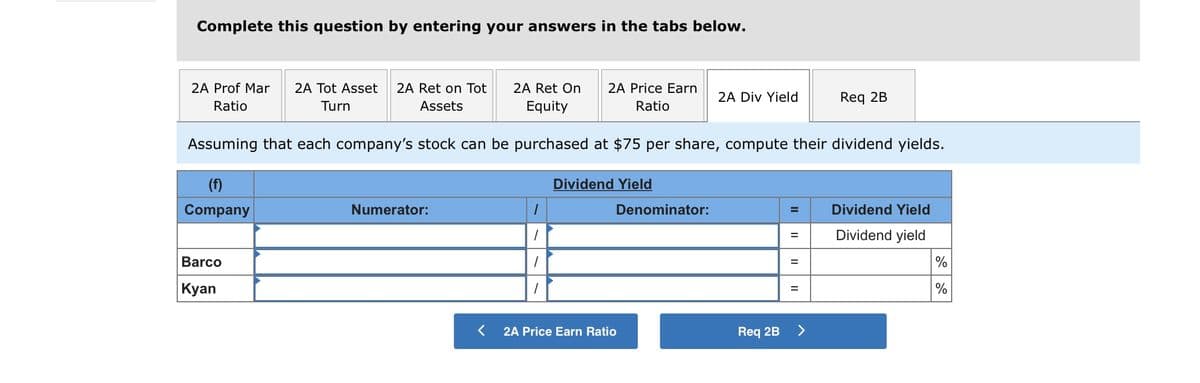

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

2A Prof Mar

2A Tot Asset

2A Ret on Tot

2A Ret On

2A Price Earn

2A Div Yield

Req 2B

Ratio

Turn

Assets

Equity

Ratio

Assuming that each company's stock can be purchased at $75 per share, compute their dividend yields.

(f)

Dividend Yield

Company

Numerator:

Denominator:

Dividend Yield

Dividend yield

Barco

Кyan

2A Price Earn Ratio

Req 2B

<>

II

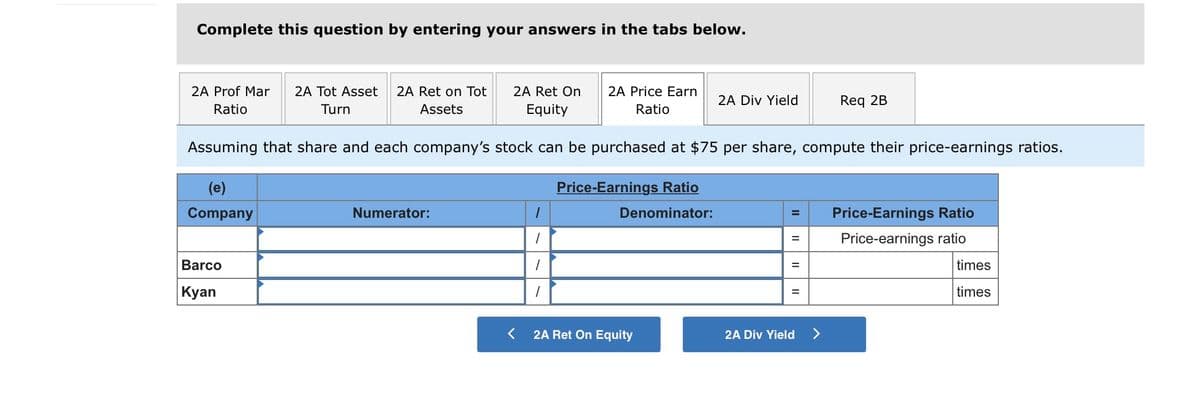

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

2A Prof Mar

2A Ret on Tot

2A Ret On

Equity

2A Tot Asset

2A Price Earn

2A Div Yield

Req 2B

Ratio

Turn

Assets

Ratio

Assuming that share and each company's stock can be purchased at $75 per share, compute their price-earnings ratios.

(e)

Price-Earnings Ratio

Company

Numerator:

Denominator:

Price-Earnings Ratio

Price-earnings ratio

Barco

times

%3D

| Кyan

times

2A Ret On Equity

2A Div Yield

<>

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,