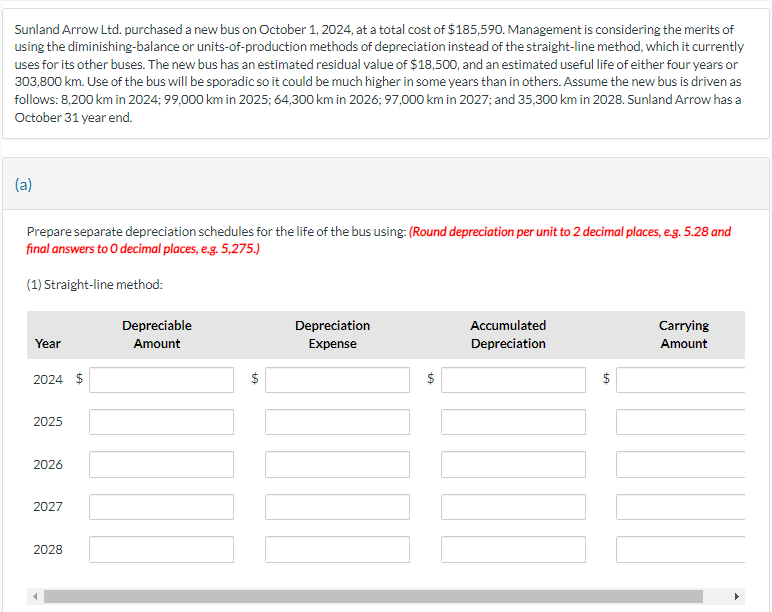

Sunland Arrow Ltd. purchased a new bus on October 1, 2024, at a total cost of $185,590. Management is considering the merits of using the diminishing-balance or units-of-production methods of depreciation instead of the straight-line method, which it currently uses for its other buses. The new bus has an estimated residual value of $18,500, and an estimated useful life of either four years or 303,800 km. Use of the bus will be sporadic so it could be much higher in some years than in others. Assume the new bus is driven as follows: 8,200 km in 2024; 99,000 km in 2025; 64,300 km in 2026; 97,000 km in 2027; and 35,300 km in 2028. Sunland Arrow has a October 31 year end. (a) Prepare separate depreciation schedules for the life of the bus using: (Round depreciation per unit to 2 decimal places, e.g. 5.28 and final answers to O decimal places, e.g. 5,275.) (1) Straight-line method: Year 2024 $ 2025 2026 2027 2028 Depreciable Amount +A $ Depreciation Expense 19 $ Accumulated Depreciation $ Carrying Amount

Sunland Arrow Ltd. purchased a new bus on October 1, 2024, at a total cost of $185,590. Management is considering the merits of using the diminishing-balance or units-of-production methods of depreciation instead of the straight-line method, which it currently uses for its other buses. The new bus has an estimated residual value of $18,500, and an estimated useful life of either four years or 303,800 km. Use of the bus will be sporadic so it could be much higher in some years than in others. Assume the new bus is driven as follows: 8,200 km in 2024; 99,000 km in 2025; 64,300 km in 2026; 97,000 km in 2027; and 35,300 km in 2028. Sunland Arrow has a October 31 year end. (a) Prepare separate depreciation schedules for the life of the bus using: (Round depreciation per unit to 2 decimal places, e.g. 5.28 and final answers to O decimal places, e.g. 5,275.) (1) Straight-line method: Year 2024 $ 2025 2026 2027 2028 Depreciable Amount +A $ Depreciation Expense 19 $ Accumulated Depreciation $ Carrying Amount

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PA: Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value...

Related questions

Question

Transcribed Image Text:Sunland Arrow Ltd. purchased a new bus on October 1, 2024, at a total cost of $185,590. Management is considering the merits of

using the diminishing-balance or units-of-production methods of depreciation instead of the straight-line method, which it currently

uses for its other buses. The new bus has an estimated residual value of $18,500, and an estimated useful life of either four years or

303,800 km. Use of the bus will be sporadic so it could be much higher in some years than in others. Assume the new bus is driven as

follows: 8,200 km in 2024; 99,000 km in 2025; 64,300 km in 2026; 97,000 km in 2027; and 35,300 km in 2028. Sunland Arrow has a

October 31 year end.

(a)

Prepare separate depreciation schedules for the life of the bus using: (Round depreciation per unit to 2 decimal places, e.g. 5.28 and

final answers to O decimal places, e.g. 5,275.)

(1) Straight-line method:

Year

2024 $

2025

2026

2027

2028

Depreciable

Amount

tA

Depreciation

Expense

$

Accumulated

Depreciation

LA

Carrying

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT