Supporting Calculations-Weighted Average Method Laboratories, Inc., produces one of its products in two successive departments. All mnaterials are added at the beginning of the Patterson uses the weighted average method for process costing. January 1, 2019, Inventory account balances are as follows: Materials inventory Work in process-Department 1 (3.000 units. 30% complete) $30.000 Direct material Conversion costs 4560 10.640 ork in process-Department 2 (3.550 units, 40 complete) 43439 Brshed goods inventory (2.000 units S16) 32.000 During January, the following transactions occurred: 1. Purchased material on account, $90,000. 2. Placed $84,000 of material into process in Department 1. This $84,000 represents 24.000 units of materials. 3. Distributed total payroll costs: $108,116 of direct labor to Departrment 1, 562,700 of direct labor to Department 2, and $51,000 of indirect labor to Manufacturing Overhead. 4. Incurred other actual manufacturing overhead costs, 581,000. (Credit Other Accounts) 5. Applied overhead to the two processing departments: $88,000 to Department 1 and $43,900 to Department 2. 6. Transferred 25,000 completed units from Department 1 to Department 2. The 2,000 units remaining in Department 1 were 20% completed with respect to conversion costs. 7. Transferred 26,000 completed units from Department 2 to finished goods inventory. The 2.550 units remaining in Department 2 were 70% completed with respect to conversion costs. 8. Sold 20,000 units on account at $27 per unit. Patterson uses weighted average inventory costing procedures for the finished goods inventory. Part A Part B Part C Part D b. Prepare a product cost report (with its supporting calculations) for Department 1. Round aver age cost per equivalent unit to two decimal.places. Use rounded answers for subsequent calculations Round other answers to the nearest whole Patterson Laboratories Inc. Department low of Unis and Equivalent Units Calculations january 2019 Equvalent nits Conversion Cost SMork Direct Materiale SWork Dene Done 25.000 100 25.000 Conplete/Transferred (rversory 25.000 2.000 2000 25.400 27.000 27000

Supporting Calculations-Weighted Average Method Laboratories, Inc., produces one of its products in two successive departments. All mnaterials are added at the beginning of the Patterson uses the weighted average method for process costing. January 1, 2019, Inventory account balances are as follows: Materials inventory Work in process-Department 1 (3.000 units. 30% complete) $30.000 Direct material Conversion costs 4560 10.640 ork in process-Department 2 (3.550 units, 40 complete) 43439 Brshed goods inventory (2.000 units S16) 32.000 During January, the following transactions occurred: 1. Purchased material on account, $90,000. 2. Placed $84,000 of material into process in Department 1. This $84,000 represents 24.000 units of materials. 3. Distributed total payroll costs: $108,116 of direct labor to Departrment 1, 562,700 of direct labor to Department 2, and $51,000 of indirect labor to Manufacturing Overhead. 4. Incurred other actual manufacturing overhead costs, 581,000. (Credit Other Accounts) 5. Applied overhead to the two processing departments: $88,000 to Department 1 and $43,900 to Department 2. 6. Transferred 25,000 completed units from Department 1 to Department 2. The 2,000 units remaining in Department 1 were 20% completed with respect to conversion costs. 7. Transferred 26,000 completed units from Department 2 to finished goods inventory. The 2.550 units remaining in Department 2 were 70% completed with respect to conversion costs. 8. Sold 20,000 units on account at $27 per unit. Patterson uses weighted average inventory costing procedures for the finished goods inventory. Part A Part B Part C Part D b. Prepare a product cost report (with its supporting calculations) for Department 1. Round aver age cost per equivalent unit to two decimal.places. Use rounded answers for subsequent calculations Round other answers to the nearest whole Patterson Laboratories Inc. Department low of Unis and Equivalent Units Calculations january 2019 Equvalent nits Conversion Cost SMork Direct Materiale SWork Dene Done 25.000 100 25.000 Conplete/Transferred (rversory 25.000 2.000 2000 25.400 27.000 27000

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter2: Enterprise System

Section: Chapter Questions

Problem 3P: Conduct research on an ERP package, such as Microsoft Dynamics GP or Microsoft Dynamics NAV, for...

Related questions

Question

How can I prepare a product cost report (with it's supporting calculations) for department 1. Round average cost per equivalent unit to two decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number.

Transcribed Image Text:14

XXX

%24

%24

%24

%24

%23

art A

Part B

Part C

Part D

repare a product cost report (with its supporting calculations) for Department 1.

und average cost per equivalent unit to two decimal places. Use rounded answers for subsequent calculations. a

Patterson Laboratories, Inc. Department 1

Flow of Units and Equivalent Units Calculations, January 2019

Equivalent Units

% Work

Direct

% Work

Conversion

Done

Materials

Done

Costs

Complete/Transferred

25,000

100 %

A 000's

0000

000

25,400

Ending Inventory

A 000

Total

000'2

Product Cost Report

Direct

Conversion

Materials

Costs

Beginning Inventory

Current

Total Costs to Account For

Sx0

+Total Equivalent Units

Average cost / Equivalent unit (round 2 decimal places)

Complete/Transferred:

Direct Materials

Conversion costs

Cost of Goods Manufactured

Ending Inventory:

Direct Materials

Conversion costs

Cost of Ending Inventory

Total Costs Allocated

Determine the balances remaining in the Materials Inventory account, in each work in process account, and in the Finished Goods Inventory ae

Check

You have correctly selected 94.

Partially correct

Marks for this submission: 0.60/1.00.

f3

f4

f5

f2

DDI

esc

2.

3.

Transcribed Image Text:student handout 1063-2002-07 X

PEE

M2: MBC Problems Ch. 3 & 4

https://mybusinesscourse.com/platform/mod/quiz/attempt.php?attempt3D5990916&cmid%3D3284148page=3&scrollpos=1182#q4

M2 Business Analysis Case EYK X+

E BusinessCourse

A Return to course

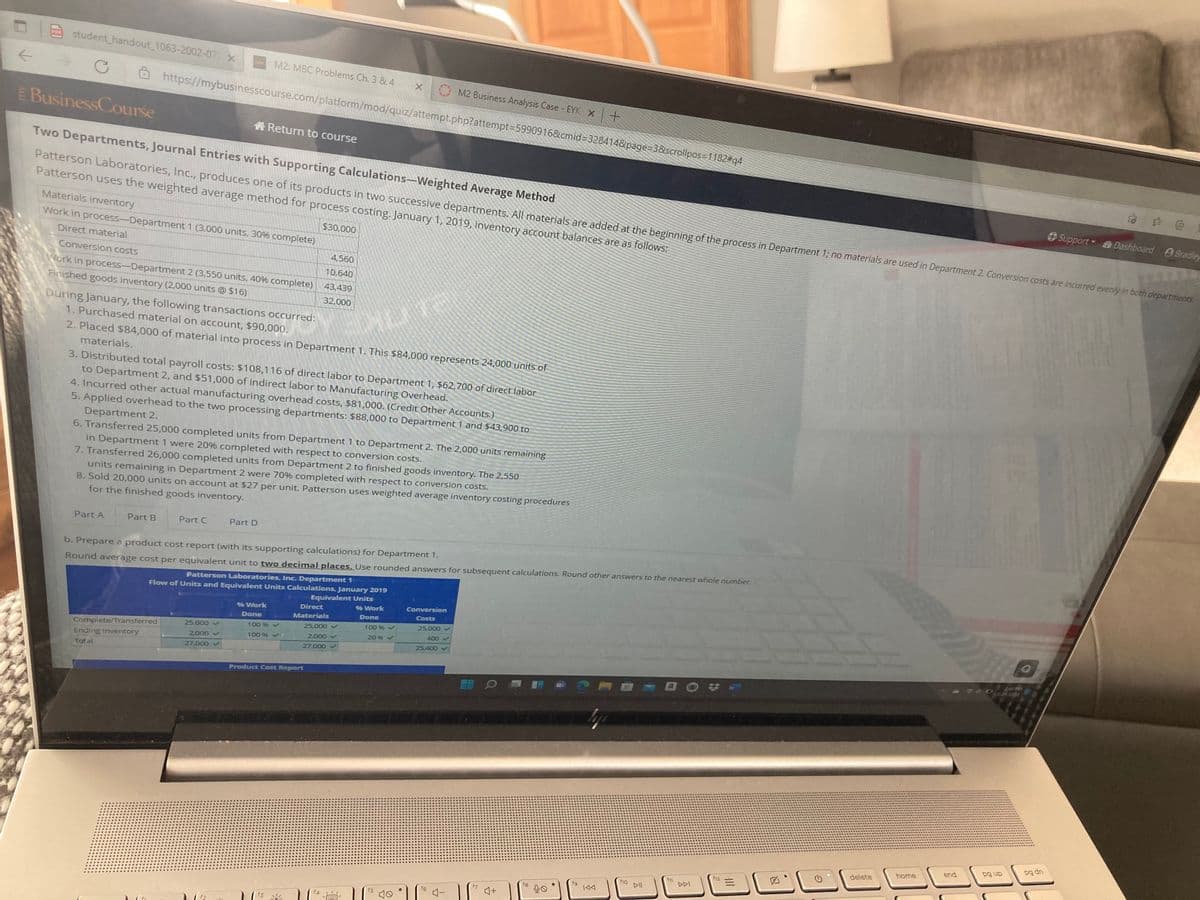

Two Departments, Journal Entries with Supporting Calculations-Weighted Average Method

Patterson Laboratories, Inc., produces one of its products in two successive departments. All materials are added at the beginning of the process in Department 1; no materials are used in Department 2. Conversion costs are incurred evenly in both departments.

Patterson uses the weighted average method for process costing. January 1, 2019, inventory account balances are as follows:

Materials inventory

Support Dashboard Bradley

Work in process-Department 1 (3,000 units, 30% complete)

$30,000

Direct material

Conversion costs

4,560

10,640

Work in process-Department 2 (3,550 units, 40% complete) 43,439

Finished goods inventory (2.000 units @ $16)

32,000

During January, the following transactions occurred:

1. Purchased material on account, $90,000.

2. Placed $84,000 of material into process in Department 1. This $84,000 represents 24,000 units of

materials.

3. Distributed total payroll costs: $108,116 of direct labor to Department 1, $62,700 of direct labor

to Department 2, and $51,000 of indirect labor to Manufacturing Overhead.

4. Incurred other actual manufacturing overhead costs, $81,000. (Credit Other Accounts.)

5. Applied overhead to the two processing departments: $88,000 to Department 1 and $43,900 to

Department 2.

6. Transferred 25,000 completed units from Department 1 to Department 2. The 2,000 units remaining

in Department 1 were 20% completed with respect to conversion costs.

7. Transferred 26,000 completed units from Department 2 to finished goods inventory. The 2,550

units remaining in Department 2 were 70% completed with respect to conversion costs.

8. Sold 20,000 units on account at $27 per unit. Patterson uses weighted average inventory costing procedures

for the finished goods inventory.

Part A

Part B

Part C

Part D

b. Prepare a product cost report (with its supporting calculations) for Department 1.

Round average cost per equivalent unit to two decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number.

Patterson Laboratories, Inc. Department 1

Flow of Units and Equivalent Units Calculations, January 2019

Equivalent Units

9% Work

Conversion

% Work

Direct

Materials

Done

Costs

Done

100 96

25,000

100 9%

25,000

Complete/Transferred

Ending Inventory

25,000

20 %

400

2.000

100 %

2,000

25,400

27,000

27,000

Total

Product Cost Report

pg dn

end

pg up

home

delete

f12

f10

DII

fn

DDI

fg9

144

f7

f6

f5

f4

f3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning