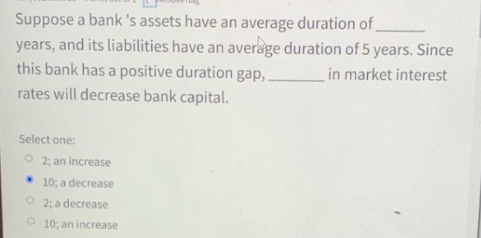

Suppose a bank 's assets have an average duration of years, and its liabilities have an average duration of 5 years. Since this bank has a positive duration gap, in market interest rates will decrease bank capital. Select one: O 2; an increase • 10: a decrease O 2; a decrease 10; an increase

Q: On January 1, 2020, Rama Company had 20,000 treasury shares of P100 par value that had been…

A: Treasury stocks are repurchased shares of the company. The firm can reissue these stocks at a…

Q: Alpha Security Ltd commenced operations on 1 July 2021. By the end of the first year of operations,…

A: Provision for doubtful debts account is a provision created for those customers, whose receipt is…

Q: Baskin Promotions, Inc. sells T-shirts decorated for a variety of concert performers. The company…

A: A performance report summarizes the outcome of an activity or the work of a person. The report may…

Q: An increase in interest income recognized for the period on a lease agreement will have the effect…

A: The amount of interest received during a certain time period is referred to as interest income. It…

Q: Required information [The following information applies to the questions displayed below.] Ciolino…

A: The cost of goods manufactured includes the costs incurred to complete the goods during the period.

Q: Determine the consolidated balances which Peris would present on their consolidated balance sheet…

A: When there are two companies, in which one company acquires other company then consolidated…

Q: On January 1, 2021, Beauty Company sold a machine with a cost of P500,000 and accumulated…

A:

Q: Company provdes the following ABC costing information: Total Costs Activity-cost drivers itles…

A: Activity Based Costing is a method identifying activities and then assigning indirect cost and…

Q: ve mentio

A: The journal entries are given as,

Q: Suppose Lion Cage Multinational floated 5000 bonds on January 1, 2020 with a par value of 1500 at…

A: An investor's obligation to a borrower is represented by a bond, which is a structured security…

Q: Ralston Dairy gathered this data about the two products that it produces: Current Sales Estimated…

A: Lets understand the basics. When there is requirement to choose between sale currently or sale after…

Q: Highland company provided the following information on December 31, 2018: Cash 2,000,000 Trade and…

A: Statement of Financial position includes: Assets accounts Liabilities accounts Equity accounts As…

Q: On January 1, 2021, Tee Company sold a machine with a cost of P500,000 and a carrying amount of…

A: • Non-current assets are those assets which are to be received after a period of 12 months from the…

Q: GinnyCo has pretax book and taxable income of $400,000 and reports a s100,000 income tax payable in…

A: Tax provision refers to the reporting year aggregate income tax expenses and it involves the foreign…

Q: In the statement of cash flows, it is necessary to break down the change in shareholders' equity…

A: Cash flow statement is the statement showing cash inflows and outflows of a particular entity. It is…

Q: On 31 May 20X2 the bank statement of Harrison Ltd showed a balance of £26,500. As part of the bank…

A: Bank reconciliation is a statement to identify and document the differences between balance as per…

Q: THE CLIENT HAD A BALANCE OF 80,000 FOR EQUIPMENT AND 20,000 FOR ACCUMULATED DEPRECIATION AT THE…

A: Accumulated depreciation is a contra asset account and is the sum total of depreciation expense…

Q: When should a reversal of a goodwill impairment be recognised? a) © Immediately b) At…

A: Goodwill Impairment: Accounting charges are referred to as goodwill impairment when the carrying…

Q: Difference between Financial Accounting Standards Board and International Accounting Standards…

A: The Financial Accounting Standards Board was established to create reporting guidelines. It is one…

Q: Sales (20,000 units @ 60 per unit) $1,200,000 Less: Variable cost 20,000@ $45 900,000 Contribution…

A: Formulas: Increase in net operating income % = (Expected net operating income - Current net…

Q: the beasts, Trough Brewery bought a bottler two years ago for $220,000, with a useful life of six…

A: Depreciation Calculation Old Machine Depreciation Schedule Year Depreciation Base Remaining…

Q: For each of the following transactions indicate whether the cash flow classification is a) an…

A: A cash flow statement indicates cash inflow and cash outflow information of a particular time…

Q: Lincoln Corporation used the following data to evaluate their current operating system. The company…

A: static-budget variance of revenue = Actual revenue - Budget revenue

Q: A. The first costs of an equipment is P 65, 000 and a salvage value of P 3, 000 at the end of its 6…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: 2. Accounts receivable arising from trade transactions amounted to $62,000 and $78,000 at the…

A: Increase in accounts receivable = $78,000 - $62,000 = $16,000

Q: Tiger Drug Store carries a variety of health and beauty aids, including 500-count bottles of…

A: A product purchasing budget is a plan that reflects the total predicted costs or item inventory…

Q: On 30 June 2023, the end of the current reporting period, Master Ltd decided, using the information…

A: Depreciation charged in two previous years = 100000/10 = 10000 each year WDV = 80000 Depreciation =…

Q: ry 1, 2020, the Pacita Corp equity securities for P2,000,000. ssion, taxes and other transacti…

A: Marketable securities are valued at fair value at the end of the accounting year . The difference…

Q: Puritan Apparels is a clothing retailer. Unit costs associated with one of its products, Product DCF…

A: Indirect Non-manufacturing Cost in above question = Sales Commission.

Q: he company issued 2,500, P125 par ordinary shares for an outstanding bank loan ofP350,000. On this…

A: Share premium is the amount paid in excess of par value of shares. Share premium = Number of shares…

Q: 99) Hesterman Corporation makes one product and has provided the following help prepare the master…

A: Calculation of Number of units of Finished Goods to be produced during May May Units…

Q: a different technologies acturing. Determine the mpanys MARR = 14.5%. B. C 900

A: Given as,

Q: Show a five-year financial projection. Financial projection should reflect the impact of the…

A: Answer:- Financial projection meaning:- A financial projection depicts a company's predicted…

Q: Sales (20,000 units @ 60 per unit) $1,200,000 Less: Variable cost 20,000@ $45 900,000 Contribution…

A: Operating leverage indicates the ability of the business to manage the fixed and variable costs to…

Q: Shangrila designated the Crossing shares as At Fair Value Shangrila bought shares of Crossing, Inc.…

A: Number of bonus shares issued = 5000 shares x 20% = 1000 shares

Q: 9. Company O has outstanding accounts receivables of $1,650,000 at year-end. During the year,…

A: Allowance for bad debts is made to estimate and write off the account receivable. It is made to…

Q: Problem 1. The ledger of COVID19 Co. as of December 31, 2019 includes the followi Assets Cash 10,000…

A: A current asset is a stability item that is either cash, a cash equivalent, or may be turned into…

Q: For a sole trader, which accounts are generally involved in closing entries? Why are these accounts…

A: A sole trader, often called as a sole proprietorship, is a simple business structure in which one…

Q: make - journal entries - T accounts - financial statement - worksheet

A:

Q: Currently, a three-year Treasury note pays 10.0%. Assuming that your tax rate is 15%, what is the…

A: For tax free municipal bond, interest rate should be equal to the after tax interest rate of…

Q: If the total cost function is y = 6,300 + 2X, calculate the variable cost for 4,400 units. OA.…

A: The question is related to Total Cost Function whic is Y = a + bx Where a = Fixed Cost b =…

Q: An unqualified opinion: a) is given when there is a conflict of interest. b) is one made without…

A: Introduction:- The followingtypes of auditor opinions are as follows under:- Unqualified opinion.…

Q: QUESTION 1 Below are the statements of Financial Position for Grace Ltd as at 31 December, 2009 and…

A: Cash Flow Statement- A cash flow statement is an important component of the company's financial…

Q: Create a Ledger.

A: Ledger is a principal book that contains all the accounts such as Assets Accounts, Liabilities…

Q: Prepare a Journal Entries for Accounts Receivables.

A: There are two methods of writing off bad debts, one is the direct method where the bad debts are…

Q: uses 34,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are:…

A: Introduction:- The following basic information as follows under:- Currently total cost to make the…

Q: On January 1, 2021, Roy Company sold a machine with a cost of P500,000 and carrying value of…

A: Cumulative present value of 14% for 3 years = 2.322

Q: d. What is the Year-1 imputed interest expense? Do not round intermediate calculations. Round your…

A: As Given that (HPB) Company need a $80,000 compressed air. Although the compressor's economic…

Q: On 31 May 20X2 the bank statement of Harrison Ltd showed a balance of £26,500. As part of the bank…

A: Ideally cash balance as per cashbook and bank balance as per bank statement must reconcile with each…

Q: It is possible to replace a used machine with book value of $380,000 and remaining useful life five…

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Suppose SBD Bank has RSA of $150m and RSL of $140m. If interest rates rise by 1 percent on both RSAs and RSLs, what would be the expected annual change in net interest income (ΔNII) based on $GAP? Show your work. ( How a commercial bank’s value would be affected by an increase in economic growth?You are analyzing how interest rates affect the equity value of a bank using a duration analysis. After examining the balance sheet of the bank, you noticed that the value of its total assets and liabilities are $400M and $360M, respectively. You also determined that the duration gap of the bank is equal to 4.0 years. Using a duration analysis, you would like to predict the response of the bank’s equity value (in percentage terms) to a 0.1 percent increase in the market interest rate. You decided to assume that a one percentage point change in the rate is approximately equal to a one percent change in the rate. Following this approach, determine the percentage response of the bank’s equity to this change in the market interest rate. Group of answer choices -0.4% -4.0% 0.4% -3.6% -0.1%Suppose that you are the manager of a bank that has $15 million of fixed-rate assets, $30 million of rate-sensitive assets, $25 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis LOADING... for the bank, and show what will happen to bank profits if interest rates rise by 5 percentage points. The change in bank profits is $nothing million.

- Assuming that the average duration of First National Bank's $100 million assets is five years, while the average duration of its $80 million liabilities is three years, then a 5 percentage point increase in interest rates will cause the net worth of First National to increase by $ (put a negative sign if it is a decrease) million dollars.Suppose Bank A has $35 million in rate-sensitive assets, $70 million in fixed rate assets, $70 million in rate sensitive liabilities, and $35 million in fixed rate liabilities and equity capital. Calculate the change in Bank A’s profit as a result of an increase in market interest rates of 2 percentage points.Suppose Bank A has $35 million in rate-sensitive assets, $70 million in fixed rate assets, $70 million in rate sensitive liabilities, and $35 million in fixed rate liabilities and equity capital. If you had believed that rates were going to rise by 2 percentage points (before it actually happened), explain how (if at all) you could have altered Bank A’s balance sheet and changed its interest rate risk exposure to improve its subsequent profit performance.

- If a bank maintains $10 billion in assets with an ROA of 3%, what would happen to the ROE if the leverage ratio fell from 6% to 4% because of an increase in the use of borrowings?You manage a bank that has $500 million of fixed-rate assets, $600 million of rate-sensitive assets, $1000 million of fixed-rate liabilities, and $100 million of rate-sensitive liabilities. A. Do a gap analysis and show what will happen to bank profits if interest rates rise by 4%. Show your work. B. What happens to the bank’s profits if interest rates fall by 7%?A bank has an average asset duration of 5 years and an average liability duration of 3 years.This bank has total assets of $500 million and total liabilities of $250 million. Currently,market interest rates are 10 percent. If interest rates fall by 2 percent (to 8 percent), what isthis bank's change in net worth?6A. Net worth will decrease by $31.81 million.B. Net worth will increase by $31.81 million.C. Net worth will increase by $27.27 million.D. Net worth will decrease by $27.27 million.

- Suppose you are the manager of a bank that has$15 million of fixed-rate assets, $30 million of ratesensitive assets, $25 million of fixed-rate liabilities,and $20 million of rate-sensitive liabilities. Conduct agap analysis for the bank, and show what will happento bank profits if interest rates rise by 5 percentagepoints. What actions could you take to reduce thebank’s interest-rate risk?assume that the average duration of first national bank's assets is four years, while the average duration of its liabilities is three years. Assuming that its assets equal its liabilities, then a 5 percentage point increase in interest rates will cause the net worth of first national to increase by ___% (put a negative sign if it is a decrease) of the total original asset value.Suppose that a 1 percent increase in the (annual) interest rate leads to a 3.9 percent drop in the equity value of the bank. The ratio Debt/Assets=0.85 for this bank. Using a duration analysis, you estimated the effective duration gap for the bank implied by these numbers. You assumed that a one percent change in the rate is approximately the same as a one percentage point change in the rate. This implied duration gap is: Group of answer choices 0.59 years 3.32 years 0.17 years 2.73 years 4.59 years