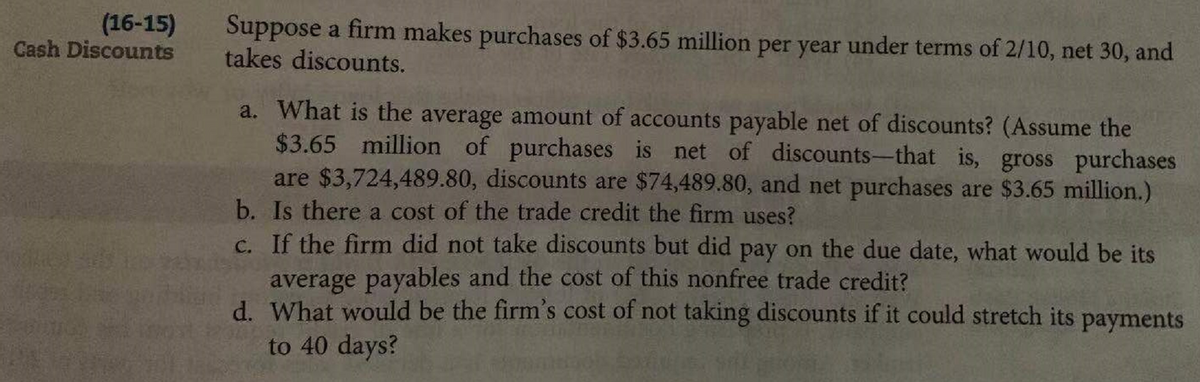

Suppose a firm makes purchases of $3.65 million per year under terms of 2/10, net 30, and takes discounts. a. What is the average amount of accounts payable net of discounts? (Assume the $3.65 million of purchases is net of discounts-that is, gross purchases are $3,724,489.80, discounts are $74,489.80, and net purchases are $3.65 million.) b. Is there a cost of the trade credit the firm uses? c. If the firm did not take discounts but did pay on the due date, what would be its average pavables and the cost of this nonfree trade credit?

Suppose a firm makes purchases of $3.65 million per year under terms of 2/10, net 30, and takes discounts. a. What is the average amount of accounts payable net of discounts? (Assume the $3.65 million of purchases is net of discounts-that is, gross purchases are $3,724,489.80, discounts are $74,489.80, and net purchases are $3.65 million.) b. Is there a cost of the trade credit the firm uses? c. If the firm did not take discounts but did pay on the due date, what would be its average pavables and the cost of this nonfree trade credit?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 15P: Suppose a firm makes purchases of $3.65 million per year under terms of 2/10, net 30, and takes...

Related questions

Question

100%

Practice Pack

Would you only answer the last question please Thank you !

Transcribed Image Text:(16-15)

Cash Discounts

Suppose a firm makes purchases of $3.65 million per year under terms of 2/10, net 30, and

takes discounts.

a. What is the average amount of accounts payable net of discounts? (Assume the

$3.65 million of purchases is net of discounts-that is, gross purchases

are $3,724,489.80, discounts are $74,489.80, and net purchases are $3.65 million.)

b. Is there a cost of the trade credit the firm uses?

c. If the firm did not take discounts but did pay on the due date, what would be its

average payables and the cost of this nonfree trade credit?

d. What would be the firm's cost of not taking discounts if it could stretch its payments

to 40 days?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning