Suppose a firm relies exclusively on the payback method when making capital budgeting decisions, and it sets a 4-year payback regardless of economic conditions. Other things held constant, which of the following statements is most likely to be true? O t will accept too many long-term projects and reject too many short-term projects (as judged by the NPV). O The firm will accept too many projects in all economic states because a 4-year payback is too low. O The firm will accept too few projects in all economic states because a 4-year payback is too high. O f the 4-year payback results in accepting just the right set of projects under average economic conditions, then this payback will result in too few long-term projects when the economy is weak. O It will accept too many short-term projects and reject too many long-term projects (as judged by the NPV).

Suppose a firm relies exclusively on the payback method when making capital budgeting decisions, and it sets a 4-year payback regardless of economic conditions. Other things held constant, which of the following statements is most likely to be true? O t will accept too many long-term projects and reject too many short-term projects (as judged by the NPV). O The firm will accept too many projects in all economic states because a 4-year payback is too low. O The firm will accept too few projects in all economic states because a 4-year payback is too high. O f the 4-year payback results in accepting just the right set of projects under average economic conditions, then this payback will result in too few long-term projects when the economy is weak. O It will accept too many short-term projects and reject too many long-term projects (as judged by the NPV).

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3TP: Would you rather have $7,500 today or at the end of 20 years after it has been invested at 15%?...

Related questions

Question

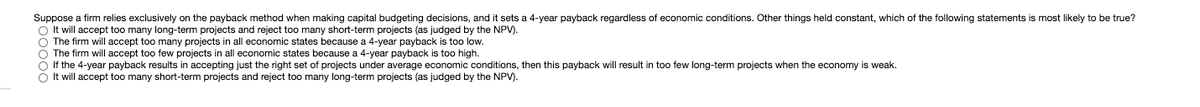

Transcribed Image Text:Suppose a firm relies exclusively on the payback method when making capital budgeting decisions, and it sets a 4-year payback regardless of economic conditions. Other things held constant, which of the following statements is most likely to be true?

O It will accept too many long-term projects and reject too many short-term projects (as judged by the NPV).

O The firm will accept too many projects in all economic states because a 4-year payback is too low.

O The firm will accept too few projects in all economic states because a 4-year payback is too high.

O If the 4-year payback results in accepting just the right set of projects under average economic conditions, then this payback will result in too few long-term projects when the economy is weak.

O It will accept too many short-term projects and reject too many long-term projects (as judged by the NPV).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning