Suppose dean is a dealer in antique painting and had held the painting for sale before the contribution. What is deans charitable contribution deduction for the painting in this situatio

Q: Barb Company has provided information on intangible assets as follows: A patent was purchased from…

A: Intangible Assets: The assets that are not physical in nature, and add value to business in the…

Q: Can someone please help? Thank you. John and Susan are discussing the various audit sampling…

A: There is a connection between standard deviation and classical variables sampling, but it is not as…

Q: Skysong Company is a multiproduct firm. Presented below is information concerning one of its…

A: Inventory Valuation Method - FIFO Method - Under FIFO Method company uses inventory that was…

Q: DEMISE LAUREL, a resident of Canada and a Canadian citizen as well, died last June 30, 2021 leaving…

A: As per tax rules in Canada , Gross Estate is the value of a person's estate at the time of…

Q: (Algo) Montague (age 15) is claimed as a dependent... Semon (age 15) is claimed as a dependent by…

A: In the taxation law, the government gives deductions to their taxpayers such as standard deductions,…

Q: Linda, who files as a single taxpayer, had AGI of $280,000 for 2022. She incurred the following…

A: Allowable deductions are confined to revenue expenditure wholly and exclusively incurred in the…

Q: 1. What would be the depreciation amount for the car sold on Sep 1 ?

A: Depreciation: It is the reduction in value of assets over it's useful life. Depreciation on assets…

Q: Roquan, a single taxpayer, is an attorney and practices as a sole proprietor. This year, Roquan had…

A: The deduction for qualified business income amount to the lesser of: 20% of the qualified business…

Q: May 2 Purchase 27,000 units at $62.00 Aug. 9 Sale 22,500 units Oct. 20 Purchase 10,500 units at…

A: Answer :Weighted average cost per unit = Total cost / Total units Cost of good sold = Total cost -…

Q: St. Mark's Hospital contains 500 beds. The occupancy rate varies between 60% and 90% per month, but…

A: High-low method: It is a way to figure out how much something costs to produce. It is a technique…

Q: LO 4-6 Exercise 4-13A Multistep income statement In Year 1, Kim Company sold land for $80,000 cash.…

A: Introduction: - Income statement shows company's income and expenses over a period of time.…

Q: When calculating diluted EPS, which of the following, if dilutive, would cause the weighted average…

A: Diluted earnings per share assumes that all convertible securities would be converted, since all…

Q: On January 1, 20X1, Merchant Co. sold a tractor to Swanson Inc. and simultaneously leased it back…

A: A sale-leaseback transaction involves the seller selling an asset that they previously held to…

Q: The question doesnt speak to motor cars. Where did this info come from for A-Town?

A: Adjusting journal entries are those journal entries which are prepared at the year end to match the…

Q: Task 3 Mr. Omar, an Environmental Compliance Officer uses Environmental Cost Accounting method:…

A: Formula: Percentage of residual wastegate=Input weightage-Output weightage+Scrapped weightageInput…

Q: Problem 5-24A (Algo) Effect of inventory errors on financial statements LO 5-3 The following income…

A: Inventory: Inventory is reported at the balance sheet of the company at its closing calculated…

Q: (b) Journalize the transactions. Do not E3-7 This information relates to Crofoot Real Estate Agency.…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Use the following information to answer questions 7 - 8. A 5-year 5% A-rated corporate bond's yield…

A: It has been provided: Face value (FV) = 1,000 Interest rate (Rate) = 6% Time period (NPER) = 5 years…

Q: At the beginning of the year, paid-in capital was $164 and retained earnings were $94. During the…

A: Income Statement :— It is one of the financial statement that shows profitability of company during…

Q: Misstatements in the financial statements can result from errors or fraud and may consist of any of…

A: EXPLANATION:- A misstatement causes the financial statements to be not in accordance with the…

Q: River, Inc., has two producing departments. Each producing department is held responsible for a…

A: Cost allocation gives vital data regarding cost consumption to management, which they may utilise to…

Q: On March 1, 2020, Peggy's Cafe acquired equipment for $220.000. The estimated life of the equipment…

A: Activity-based depreciation method is also called a unit-of-production method. Depreciation is…

Q: Octogon, Inc. has three operating departments: Cutting, Assembling, and Finishing. The data below…

A: The total maintenace cost is allocated on the basis of area occupied. Each department is allocated…

Q: taxes

A: Taxes are compulsory obligations on those who earn over and above the specified limit. All entities…

Q: An all-equity firm will spend $1,500,000 to expand the business. It has $100,000 in cash, can borrow…

A: Solution We are provided with the following information Expansion Cost = $ 1,500,000 Financing with…

Q: Define the following factors that affect the determination of sample size: a) Acceptable sampling…

A: There are a number of factors that affect the determination of sample size for an audit. These…

Q: A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires…

A: Business organization prepares the cash budget so as to know whether they have enough cash balance…

Q: The Taylors have purchased a $310,000 house. They made an initial down payment of $40,000 and…

A: The process of progressively lowering an account balance over the course of time is referred to as…

Q: (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: On December 31, Year 1, Cardinal Company bought some new equipment that cost $25,000 and signed a…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: Assume you are given the following abbreviated financial statement. ($ in millions) Current…

A: Ratios are defined as one of the most important factors used by investors in shaping their financial…

Q: A manufactured product has the following information for June. Standard Quantity and Cost 7 pounds…

A: Direct Labour Rate Variance :— It is the difference between standard cost for actual output (SH×SR)…

Q: Can you please describe contingent liabilities and how to account for and/or report

A: Contingent liabilities are defined as liabilities that occur in the future. These liabilities are…

Q: On the 30 January 2020, a retailer received an invoice worth RM17 500 including transportation cost…

A: If a customer buys in bulk, the supplier will give them a trade discount. If the consumer pays the…

Q: Helpful plc is a finance company. It purchased computer equipment for R78 500 and leased it to…

A: Lease is kind of arrangement where the owner of equipment give right to use the equipment by payment…

Q: Indicate (by choosing the appropriate letter) whether each of the following would be reported in the…

A: As per IFRS 1, An asset is classified as current if it is Cash and cash equivalent or 1.It is…

Q: You have decided to leave your CPA firm. Using the AICPA rules as a guide, answer the following…

A: CPAs are the certified public accountants. It is designated which gets associated to an individual…

Q: If prices are rising and a company is using LIFO, large purchases of inventory near the end of the…

A: If prices are rising and a company is using LIFO, large purchases of inventory near the end of the…

Q: Nickleson Company had an unadjusted cash balance of $7,750 as of May 31. The company's bank…

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with…

Q: Prepare a sales budget including a column for each year in and a column for the total. The budgets…

A: The budgeting process allows an organization to establish and create budgets for a certain time…

Q: Care Manufacturers produces two products; Pureline and Furline. Both products use raw material…

A: Units Produced for the Year Pureline Furline Budgeted Sales for the year 20,000 16,000…

Q: 1. Which is correct concerning capitalization of borrowing cost? If the borrowing is directly…

A: Introduction:- Borrowing costs are capitalized as a part of the cost of the qualifying asset only…

Q: Suppose that deans objective with the donation to the museum was to finance expansion of the…

A: Charity: Charity can be defined as the offering of financial or non-financial help to the needy. The…

Q: Requirement 1. Suppose Parisian Cuisine's processor charges a 6% fee and deposits sales net of the…

A: Journal entry A journal entry is the act of keeping or making records of any economic or…

Q: John sold a house during 2022. He owned the home, and used it as his primary residence, for the past…

A: When you buy any assets than prices goes up or down. Now when you prices goes up and you sell assets…

Q: The credit manager of Montour Fuel has gathered the following information about the company's…

A: Journal entry is the procedure for initially documenting commercial transactions in the books of…

Q: ent who was married at the time of his/her death will have a gross estate composed of His/her…

A: Person who died than there is need to calculate the gross estate so that can be transferred to legal…

Q: You recently attended your five year college reunion. At the main reception, you encountered an old…

A: An audit consists of a review or inspection of several books of accounts carried out by an auditor,…

Q: BE6-4 Bassing Company uses a periodic inventory system and has these account balances: chases,…

A: NET PURCHASE Net Purchase is Computed By Deducting Purchase Discount & Purchase return &…

Q: Discuss the evaluation of the two divisions compared to each other, using the performance measures…

A: Return on investment provides a measure of efficiency, margin represents the ratio of net operating…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

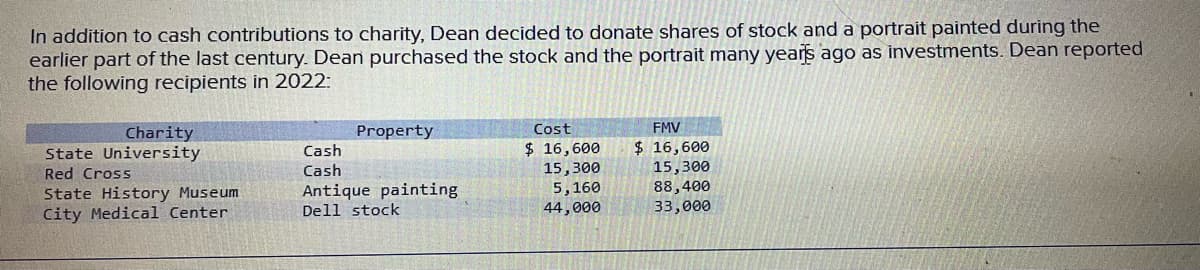

- On December 27, 2019, Roberta purchased four tickets to a charity ball sponsored by the city of San Diego for the benefit of underprivileged children. Each ticket cost 200 and had a fair market value of 35. On the same day as the purchase, Roberta gave the tickets to the minister of her church for personal use by his family. At the time of the gift of the tickets, Roberta pledged 4,000 to the building fund of her church. The pledge was satisfied by a check dated December 31, 2019, but not mailed until January 3, 2020. a. Presuming that Roberta is a cash basis and calendar year taxpayer, how much can she deduct as a charitable contribution for 2019? b. Would the amount of the deduction be any different if Roberta was an accrual basis taxpayer? Explain.In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait painted during the earlier part of the last century. Dean purchased the stock and the portrait many years ago as investments. Dean reported the following recipients in 2022: Charity Property Cost FMV State University Cash $ 15,200 $ 15,200 Red Cross Cash 14,600 14,600 State History Museum Painting 5,020 82,800 City Medical Center Dell stock 30,000 19,000 a. Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions. b. Assume that Dean's AGI this year is $160,000. Determine Dean's itemized deduction for his charitable contributions this year and any carryover. c. Suppose Dean is a dealer in antique paintings and had held the painting for sale before the contribution. What is Dean's charitable contribution deduction for the painting in this situation (ignoring AGI limitations)? d. Suppose that…In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait painted during the earlier part of the last century. Dean purchased the stock and the portrait many years ago as investments. Dean reported the following recipients in 2021: Charity Property Cost FMV State University Cash $ 16,400 $ 16,400 Red Cross Cash 15,200 15,200 State History Museum Antique painting 5,140 87,600 City Medical Center Dell stock 42,000 31,000 Problem 6-49 Part-a (Algo) answers needed for all parts a, b c, and d a. Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions. b. Assume that Dean’s AGI this year is $220,000. Determine Dean’s itemized deduction for his charitable contributions this year and any carryover. c. Suppose Dean is a dealer in antique paintings and had held the painting for sale before the…

- Which of the following is a specific legacy? Choose the correct.a. The gift of all remaining estate property to a charity.b. The gift of $44,000 cash from a specified source.c. The gift of $44,000 cash.d. The gift of 1,000 shares of stock in IBM.Which of the following is a specific legacy? The gift of all remaining estate property to a charity. The gift of $44,000 cash from a specified source. The gift of $44,000 cash. The gift of 1,000 shares of stock in IBM.James Albemarle created a trust fund at the beginning of 2016. The income from this fund will go to his son Edward. When Edward reaches the age of 25, the principal of the fund will be conveyed to United Charities of Cleveland. Mr. Albemarle specified that 75 percent of trustee fees are to be paid from principal. Terry Jones, CPA, is the trustee. Prepare all necessary journal entries for the trust to record the following transactions: James Albemarle transferred cash of $300,000, stocks worth $200,000, and rental property valued at $150,000 to the trustee of this fund. Immediately invested cash of $260,000 in bonds issued by the U.S. government. Commissions of $3,000 are paid on this transaction. Incurred permanent repairs of $7,000 so that the property can be rented. Payment is made immediately. Received dividends of $4,000. Of this amount, $1,000 had been declared prior to the creation of the trust fund. Paid insurance expense of $2,000 on the rental property. Received rental income…

- James Albemarle created a trust fund at the beginning of 2016. The income from this fund will go to his son Edward. When Edward reaches the age of 25, the principal of the fund will be conveyed to United Charities of Cleveland. Mr. Albemarle specified that 75 percent of trustee fees are to be paid from principal. Terry Jones, CPA, is the trustee.Prepare all necessary journal entries for the trust to record the following transactions:a. James Albemarle transferred cash of $300,000, stocks worth $200,000, and rental property valued at $150,000 to the trustee of this fund.b. Immediately invested cash of $260,000 in bonds issued by the U.S. government. Commissions of $3,000 are paid on this transaction.c. Incurred permanent repairs of $7,000 so that the property can be rented. Payment is made immediately.d. Received dividends of $4,000. Of this amount, $1,000 had been declared prior to the creation of the trust fund.e. Paid insurance expense of $2,000 on the rental property.f. Received…In 2022, Ian and Isabella donated Stock A to a public charity. Stock A had a fair market value of $80,000, and Ian and Isabella purchased Stock A many years ago for $1,000. What is Ian and Isabella's 2022 charitable contribution deduction (after application of the limitation) if, in 2022, Ian and Isabella had gross income of $110,000 and adjusted gross income of $100,000? Enter your answer as a positive number.Mark's will contains the following dispositive provisions. $10,000 to the American Cancer Society. $5,000 to the Pastor of my church. $4,000 to my cousin Vinny who has extensive medical issues. $4,000 to Grave Robbers, a nonprofit cemetery association. $3,000 to the First Presbyterian Church in London, England. What is the amount of the charitable deduction available to Mark's estate? Group of answer choices $10,000. $13,000. $17,000. $21,000. $26,000.

- [The following information applies to the questions displayed below.] Calvin reviewed his canceled checks and receipts this year (2023) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Item Cost FMV Hobbs Medical Center IBM stock $ 8,200 $ 54,000 State Museum Antique painting 6, 600 3,960 A needy family Food and clothes 720 430 United Way Cash 40,000 40,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances. Note: Leave no answer blank. Enter zero if applicable. b. Calvin's AGI is $260,000, but the State Museum told Calvin that it plans to sell the painting.Gabby’s records contain the following information for 2020: 1. Donated stock having a fair market value of $3,600 to a qualified charitable organization. She acquired the stock five months previously at a cost of $2,400. 2. Paid $700 to a church so her daughter can attend summer camp. 3. Donated a stock having a fair market value of $ 2,000 to a qualified organization. She acquired the stock 10 years ago for $ 8,000. 4. Donated $ 50 to the Democratic National Political Party. 5. Drove 600 miles in her personal auto directly related to services she performed for her church. 6. Gabby spent 100 hours of volunteer time on # 4 above. She makes $ 25 per hour. How much is Gabby’s charitable contribution deduction? a. $ 11,652b. $ 10,534c. $ 10,484d. $ 4,484e. $ 4,450When Jacob Kohler died unmarried in 2015, he left an estate valued at 7,900,000. His trust directed distribution as follows: $19,000 to the local hospital, $150,000 to his alma mater, and the remainder to his 3 children. Death-related costs and expenses were $15,100 for funeral, $30,000 paid to attorneys, $6,500 paid to accountants, and $35,000 paid to the trustee of his living trust. In addition, debts of $115,000. Calculate the federal estate tax due on his estate.