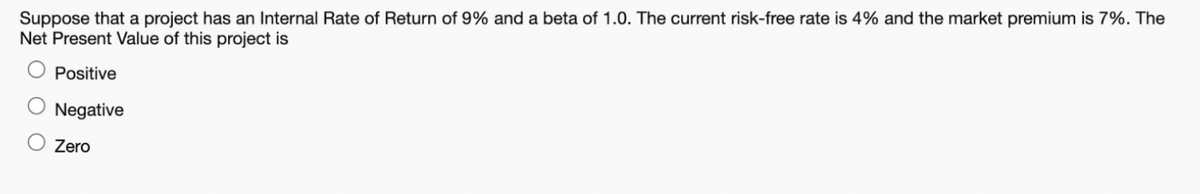

Suppose that a project has an Internal Rate of Return of 9% and a beta of 1.0. The current risk-free rate is 4% and the market premium is 7%. The Net Present Value of this project is O Positive Negative O Zero

Q: a. Calculate the required rate of return for an asset that has a beta of 1.8, given a risk-free rate…

A: Given details are : Risk free rate = 5% Beta = 1.8 Market return = 10% From above details we need to…

Q: A project has a beta of 0.94, the risk-free rate is 3.4%, and the market risk premium is 7.6%. The…

A: Project expected return = Risk free rate + Market risk premium * Project Beta

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: Calculation of Profitability Index (PI):The profitability index (PI) is 1.58.Excel Spreadsheet:

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: Discounted payback period = Year completed + (uncovered portion of the initial investment /…

Q: A project under consideration has an internal rate of return of 13% and a beta of 0.6. The risk-free…

A: Internal rate of return is the rate at which net present value of the project (net present value of…

Q: A project under consideration has an internal rate of return of 14% and a beta of 0.6. The risk-free…

A: Financial statements are statements which states the business activities performed by the company .…

Q: There is one investment and there are two different two probabilities. If the investment is in bust…

A: Given: Bust probability = 50% Expected return in bust = $100 Boom probability = 50% Expected return…

Q: A firm with a WACC of 12% is considering the following projects: Project Beta IRR 10.50% w 0.75 0.90…

A: CAPM model defines a relation between the types of risk namely systematic risk and unsystematic…

Q: Which one of the projects O, M, N, L should be selected? The expected return on the market is 16%…

A: Risk Free Rate = 6% Expected Market Return = 16%

Q: A company has a project with initial investment is $40,000. It will generate $15,000 annually for…

A: Financial management consists of directing, planning, organizing and controlling of financial…

Q: What is Rewind's beta if the risk-free rate is 6 percent?

A: Expected Return: It is the minimum return for the equity share holders for investing in the…

Q: Suppose the current risk-free rate of return is 5 percent and the expected market risk premium is 7…

A: Risk free rate= 5% market risk premium = 7% beta = 2 Market Equity Risk Premium (MRP) = rm − rf…

Q: Your expectations from a one year investment in Wang Computers are as follows:…

A: Given: Given:

Q: The Treasury bill rate is 3.1%, and the expected return on the market portfolio is 10.2%. Use the…

A: According to CAPM model: rate of return =risk free rate+beta ×market return - risk free rate

Q: Serenity Parts is considering a new project. They believe that the project has a beta of 2.00. The…

A: GIVEN, beta = 2rf=1.5%rm=12%

Q: The probability distribution of possible net present values for project X has an expected value of…

A:

Q: A project under consideration has an internal rate of return of 13% and a beta of 0.8. The risk-free…

A: CAPM is the model of valuing the required rate of return an investor wants from a company, It is the…

Q: A project under consideration has an internal rate of return of 14% and a beta of 0.6. The risk-free…

A: Financial statements are statements which states the business activities performed by the company .…

Q: A project under consideration has an internal rate of return of 16% and a beta of 0.9. The risk-free…

A: First we need to calculate required rate of return based on CAPM. The equation is Required rate of…

Q: Suppose you have a project that has a .7 chance of doubling your investment in a year and a .3…

A: According to the information given, P1 = 0.7 (probability of doubling the investment) R1=100%…

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: Payback Period = Years before full recovery + unrecovered cost at the start of the year / cashflow…

Q: A firm is considering a capital investment. The risk premium is 0.04, and it is considered to be…

A: A beta of a stock is the degree of responsiveness to movements in price with changes in the stock…

Q: ABC Corp. has a beta of 0.7. The risk-free rate is 6 percent and the expected return on the market…

A: Beta = 0.7 Risk Free Rate = 6% Expected Return on market = 13% Project Beta = 1.2 Annual Payment =…

Q: The treasury bill rate is 4% and the market risk premium is 6%. A. What are the project costs of…

A: The treasury bill rate is 4% The market risk premium is 6% A) cost of capital for a new venture is…

Q: A company has a project with initial investment is S40,000. It will generate $15,000 annually for…

A: Initial Investment =$ 40,000 Annual Cash flows = $ 15000 Years = 4 Beta = 2.0 Risk Free return(Rf) =…

Q: Currently under consideration is a project with a beta, b of 1.50. At this time, the risk free rate…

A: This question is related to Capital asset pricing model (CAPM), We require to calculate the required…

Q: A project under consideration has an internal rate of return of 18% and a beta of 0.5. The risk-free…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: A project has an expected risky cash flow of RM 200, in year 1. The risk-free rate is 6%, the market…

A: Calculate the expected return as follows: Expected return = Risk free rate + (Beta*(Market rate -…

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: For determining the payback we will compute the cumulative cash flows and for discounted payback we…

Q: A company has a project with initial investment is S40,000. it will generate $15,000 annually for…

A: Financial statements are statements which states the business activities performed by the company .…

Q: A project has an assigned beta of 1.24, the risk-free rate is 3.8%, and the market rate of return is…

A: In the given question we are required to calculate the project's expected rate of return form the…

Q: return

A: Introduction: To calculate the return which is expected by the investors, CAPM or capital asset…

Q: The risk-free rate of a capital-budgeting project a company wants to undergo is 5% and the expected…

A: given, Rf=5% Rm=10% beta =0.3 according to CAPM model: Return =rf+beta×rm-rfwhere,rf=risk free…

Q: Use the basic equation for the capital asset pricing model (CAPM) to find the required return for an…

A: Following is the answer to the question

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: NPV = Present Value of Cash inflow - Present Value of cash outflow

Q: Suppose your firm is considering investing in a project with the cash flows shown below, that the…

A: A method of capital budgeting that helps to evaluate the present worth of cash flow and a series of…

Q: Suppose you have a project that has a 0.8 chance of doubling your investment in a year and a 0.2…

A: Standard deviation of an investment’s returns is used to measure how risky an investment is. If the…

Q: A project under consideration has an internal rate of return of 17% and a beta of 0.5. The risk-free…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts…

Q: A project under consideration has an internal rate of return of 14% and a beta of 0.6. The risk-free…

A: Financial statements are statements which states the business activities performed by the company .…

Q: A project under consideration has an internal rate of return of 18% and a beta of 0.5. The risk-free…

A: Part (a): Calculation of required rate of return on project: Answer: Required rate of return is 12%

Q: A project with an initial cost of GH¢ 10,000 has the following forecasted cash flows. Years Cash…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Father Time asks us what is the expected return on asset A if it has a beta of .75, the expected…

A: In the given question we require to calculate the Expected return on Asset A using the following…

Q: Find the market return for an asset with a required return of 15.996% and a beta of 1.10 when the…

A: Given information: Required return = 15.996% Beta = 1.10 Risk free rate = 9%

Q: The Beta Company produces pneumatic equipment. Its beta is 1.8, the market risk premium is 9.5%, and…

A: Following details are given to us regarding Beta company : Beta = 1.8 Market risk premium (Rm-Rf) =…

Q: Beta of a project. Magellan is adding a project to the company portfolio and has the following…

A: IF CAPM holds good, Expected Return of Project = Risk-free rate + (Expected market - Risk Free…

Q: A project has a beta of 1.24 and the company beta is 1.45. The risk-free rate is 3.8%, and the…

A: Required return for the project = Risk free rate + ( Market rate of return - Risk free rate ) *…

Q: The Treasury bill rate is 2% and the market risk premium is 7%. Project Beta Internal Rate of…

A: Project costs of capital = Risk free rate + beta x Market risk premiumRisk free rate = The Treasury…

Step by step

Solved in 3 steps

- A project under consideration has an internal rate of return of 17% and a beta of 0.5. The risk-free rate is 9% and the expected rate of return on the market portfolio is 17%. A. What is the required rate of return on the project? B. Should the project be accepted? C. What is the required rate of return on the project if the beta is 1.50? D. If projects beta is 1.50, should the project be accepted?A project under consideration has an internal rate of return of 16% and a beta of 0.9. The risk free rate is 6% and the expected rate of return on the market portfolio is 16%. A. What is the required rate of return? B. Should the project be accepted? C. What is the required rate of return on the project if it's beta is 1.90? D. If the projects beta is 1.90 should the project be accepted?A project under consideration has an internal rate of return of 16% and a beta of 0.9. The risk-free rate is 6%, and the expected rate of return on the market portfolio is 16%. a. What is the required rate of return on the project? (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Should the project be accepted? c. What is the required rate of return on the project if its beta is 1.90? (Do not round intermediate calculations. Enter your answer as a whole percent.) d. If the project's beta is 1.90, should the project be accepted?

- A project under consideration has an internal rate of return of 13% and a beta of 0.6. The risk-free rate is 8%, and the expected rate of return on the market portfolio is 13%. a. What is the required rate of return on the project? (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Should the project be accepted? Y/N c. What is the required rate of return on the project if its beta is 1.60? (Do not round intermediate calculations. Enter your answer as a whole percent.) d. If project's beta is 1.60, should the project be accepted? Y/NA project has a forecasted cash flow of $121 in year 1 and $132 in year 2. The interest rate is 8%, the estimated risk premium on the market is 10.25%, and the project has a beta of 0.61. If you use a constant risk-adjusted discount rate, answer the following: What is the PV of the project? What is the certainty-equivalent cash flow in year 1 and year 2? What is the ratio of the certainty-equivalent cash flows to the expected cash?What will be the discounting rate for a project with a 4% risk-free rate and 8% market risk premium when beta for this project is estimated at 1.67?

- The risk free rate is 8 % and the expected return on the market portfolio is 16 %. A firm is considering a project with an estimated beta of 1.3. What is the required rate of return on the project? If the IRR is of the project is 19 %, what is the project alpha?What is the expected risk-free rate of return if asset X, with a beta of 1.5, has an expected return of 20 percent, and the expected market return is 15 percent?What is the required return for asset X if it has a beta of 1.5, the expected market return is 15 percent, and the expected risk-free rate is 5 percent?

- What is the expected return for asset X if it has a beta of 1.5, the expected market return is 15 percent, and the expected risk-free rate is 5 percent?A firm is considering a capital investment. The risk premium is 0.04, and it is considered to be constant through time. Riskless investmentsmay now be purchased to yield 0.06 (6%). If the project’s beta (β) is 1.5, what is the expected return for this investment?Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$7,100 $1,100 $2,300 $1,500 $1,500 $1,300 $1,100 Use the NPV decision rule to evaluate this project. (Negative amount should be indicated by a minus sign. Do not round intermediate