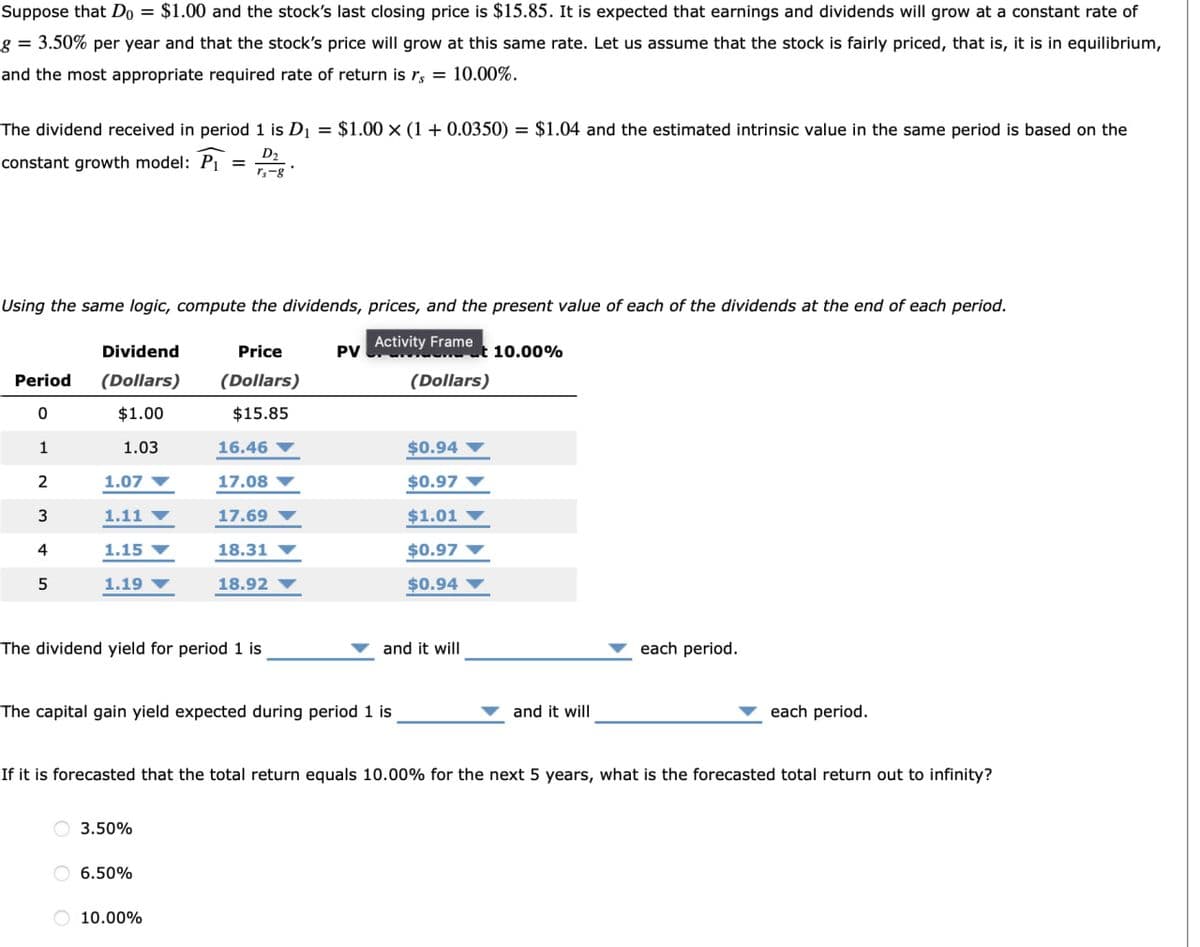

Suppose that Do = $1.00 and the stock's last closing price is $15.85. It is expected that earnings and dividends will grow at a constant rate of g = 3.50% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs = 10.00%. The dividend received in period 1 is D1 = $1.00 × (1+0.0350) = $1.04 and the estimated intrinsic value in the same period is based on the D2 constant growth model: P₁: TS-8 Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. Activity Frame Dividend Price PV t 10.00% Period (Dollars) (Dollars) (Dollars) 0 $1.00 $15.85 1 1.03 16.46 $0.94 2 1.07 17.08 $0.97 3 1.11 17.69 $1.01 4 1.15 18.31 $0.97 5 1.19 18.92 $0.94 The dividend yield for period 1 is and it will The capital gain yield expected during period 1 is and it will each period. each period. If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infinity? 3.50% 6.50% 10.00%

Suppose that Do = $1.00 and the stock's last closing price is $15.85. It is expected that earnings and dividends will grow at a constant rate of g = 3.50% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium, and the most appropriate required rate of return is rs = 10.00%. The dividend received in period 1 is D1 = $1.00 × (1+0.0350) = $1.04 and the estimated intrinsic value in the same period is based on the D2 constant growth model: P₁: TS-8 Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period. Activity Frame Dividend Price PV t 10.00% Period (Dollars) (Dollars) (Dollars) 0 $1.00 $15.85 1 1.03 16.46 $0.94 2 1.07 17.08 $0.97 3 1.11 17.69 $1.01 4 1.15 18.31 $0.97 5 1.19 18.92 $0.94 The dividend yield for period 1 is and it will The capital gain yield expected during period 1 is and it will each period. each period. If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infinity? 3.50% 6.50% 10.00%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 16MC

Related questions

Question

Transcribed Image Text:Suppose that Do = $1.00 and the stock's last closing price is $15.85. It is expected that earnings and dividends will grow at a constant rate of

g = 3.50% per year and that the stock's price will grow at this same rate. Let us assume that the stock is fairly priced, that is, it is in equilibrium,

and the most appropriate required rate of return is rs = 10.00%.

The dividend received in period 1 is D1 = $1.00 × (1+0.0350) = $1.04 and the estimated intrinsic value in the same period is based on the

D2

constant growth model: P₁: TS-8

Using the same logic, compute the dividends, prices, and the present value of each of the dividends at the end of each period.

Activity Frame

Dividend

Price

PV

t 10.00%

Period

(Dollars)

(Dollars)

(Dollars)

0

$1.00

$15.85

1

1.03

16.46

$0.94

2

1.07

17.08

$0.97

3

1.11

17.69

$1.01

4

1.15

18.31

$0.97

5

1.19

18.92

$0.94

The dividend yield for period 1 is

and it will

The capital gain yield expected during period 1 is

and it will

each period.

each period.

If it is forecasted that the total return equals 10.00% for the next 5 years, what is the forecasted total return out to infinity?

3.50%

6.50%

10.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT