Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon rate of 7.0% (annual payments). The yield to maturity on this bond wher was issued was 6.0%. Assuming the yield to maturity remains constant, what is the price of the bond immediately after it makes its first coupon payment? After the first coupon payment, the price of the bond will be $ (Round to the nearest cent.) C Che CO WATE COST SMO Vincen SES Home C 1 Rest Perso

Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon rate of 7.0% (annual payments). The yield to maturity on this bond wher was issued was 6.0%. Assuming the yield to maturity remains constant, what is the price of the bond immediately after it makes its first coupon payment? After the first coupon payment, the price of the bond will be $ (Round to the nearest cent.) C Che CO WATE COST SMO Vincen SES Home C 1 Rest Perso

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 8MC: Suppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for...

Related questions

Question

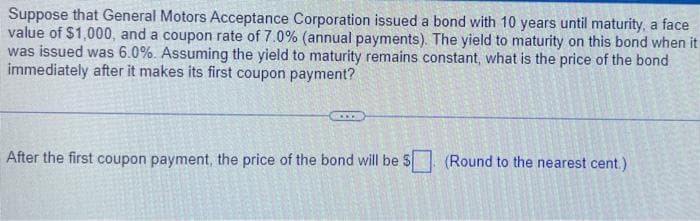

Transcribed Image Text:Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face

value of $1,000, and a coupon rate of 7.0% (annual payments). The yield to maturity on this bond when it

was issued was 6.0%. Assuming the yield to maturity remains constant, what is the price of the bond

immediately after it makes its first coupon payment?

After the first coupon payment, the price of the bond will be $ (Round to the nearest cent.)

#CES20

201

PERS

BERTSH

M

S

PORA

Genersyd

SAPORTE

VES

Se

2

@

L

S

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT