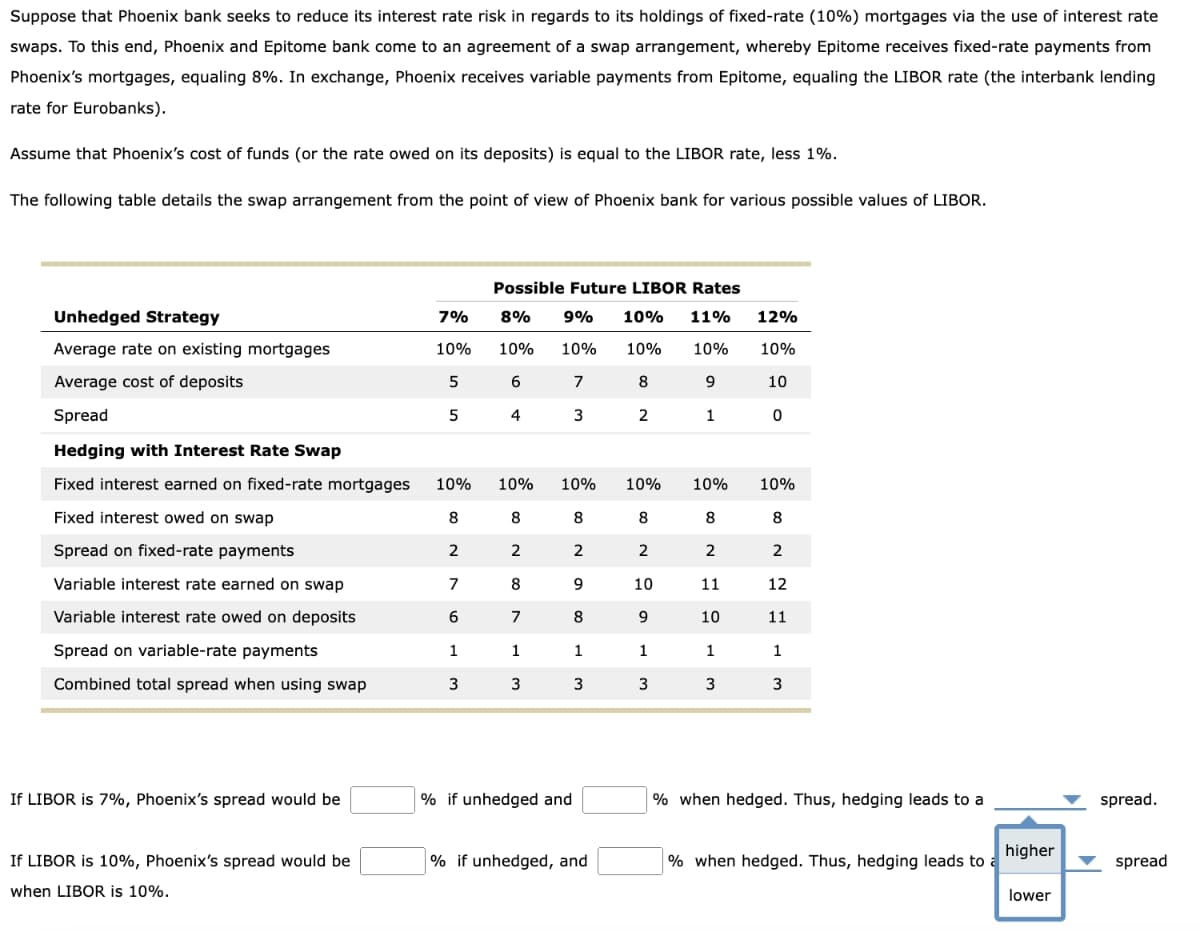

Suppose that Phoenix bank seeks to reduce its interest rate risk in regards to its holdings of fixed-rate (10%) mortgages via the use of interest rate swaps. To this end, Phoenix and Epitome bank come to an agreement of a swap arrangement, whereby Epitome receives fixed-rate payments from Phoenix's mortgages, equaling 8%. In exchange, Phoenix receives variable payments from Epitome, equaling the LIBOR rate (the interbank lending rate for Eurobanks). Assume that Phoenix's cost of funds (or the rate owed on its deposits) is equal to the LIBOR rate, less 1%. The following table details the swap arrangement from the point of view of Phoenix bank for various possible values of LIBOR. Possible Future LIBOR Rates Unhedged Strategy 7% 8% 9% 10% 11% 12% Average rate on existing mortgages 10% 10% 10% 10% 10% 10% Average cost of deposits 5 6 7 8 9 10 Spread 5 4 3 2 1 0 Hedging with Interest Rate Swap Fixed interest earned on fixed-rate mortgages 10% 10% 10% 10% 10% 10% Fixed interest owed on swap 8 8 8 8 8 8 Spread on fixed-rate payments 2 2 2 2 2 2 Variable interest rate earned on swap 7 8 9 10 11 12 Variable interest rate owed on deposits 6 7 8 9 10 11 Spread on variable-rate payments Combined total spread when using swap 1 1 1 1 1 1 3 3 3 3 3 3 If LIBOR is 7%, Phoenix's spread would be % if unhedged and % when hedged. Thus, hedging leads to a spread. higher If LIBOR is 10%, Phoenix's spread would be when LIBOR is 10%. % if unhedged, and % when hedged. Thus, hedging leads to a spread lower

Suppose that Phoenix bank seeks to reduce its interest rate risk in regards to its holdings of fixed-rate (10%) mortgages via the use of interest rate swaps. To this end, Phoenix and Epitome bank come to an agreement of a swap arrangement, whereby Epitome receives fixed-rate payments from Phoenix's mortgages, equaling 8%. In exchange, Phoenix receives variable payments from Epitome, equaling the LIBOR rate (the interbank lending rate for Eurobanks). Assume that Phoenix's cost of funds (or the rate owed on its deposits) is equal to the LIBOR rate, less 1%. The following table details the swap arrangement from the point of view of Phoenix bank for various possible values of LIBOR. Possible Future LIBOR Rates Unhedged Strategy 7% 8% 9% 10% 11% 12% Average rate on existing mortgages 10% 10% 10% 10% 10% 10% Average cost of deposits 5 6 7 8 9 10 Spread 5 4 3 2 1 0 Hedging with Interest Rate Swap Fixed interest earned on fixed-rate mortgages 10% 10% 10% 10% 10% 10% Fixed interest owed on swap 8 8 8 8 8 8 Spread on fixed-rate payments 2 2 2 2 2 2 Variable interest rate earned on swap 7 8 9 10 11 12 Variable interest rate owed on deposits 6 7 8 9 10 11 Spread on variable-rate payments Combined total spread when using swap 1 1 1 1 1 1 3 3 3 3 3 3 If LIBOR is 7%, Phoenix's spread would be % if unhedged and % when hedged. Thus, hedging leads to a spread. higher If LIBOR is 10%, Phoenix's spread would be when LIBOR is 10%. % if unhedged, and % when hedged. Thus, hedging leads to a spread lower

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter24: Enterprise Risk Management

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Suppose that Phoenix bank seeks to reduce its interest rate risk in regards to its holdings of fixed-rate (10%) mortgages via the use of interest rate

swaps. To this end, Phoenix and Epitome bank come to an agreement of a swap arrangement, whereby Epitome receives fixed-rate payments from

Phoenix's mortgages, equaling 8%. In exchange, Phoenix receives variable payments from Epitome, equaling the LIBOR rate (the interbank lending

rate for Eurobanks).

Assume that Phoenix's cost of funds (or the rate owed on its deposits) is equal to the LIBOR rate, less 1%.

The following table details the swap arrangement from the point of view of Phoenix bank for various possible values of LIBOR.

Possible Future LIBOR Rates

Unhedged Strategy

7%

8%

9%

10% 11%

12%

Average rate on existing mortgages

10%

10%

10%

10%

10%

10%

Average cost of deposits

5

6

7

8

9

10

Spread

5

4

3

2

1

0

Hedging with Interest Rate Swap

Fixed interest earned on fixed-rate mortgages

10%

10%

10%

10%

10%

10%

Fixed interest owed on swap

8

8

8

8

8

8

Spread on fixed-rate payments

2

2

2

2

2

2

Variable interest rate earned on swap

7

8

9

10

11

12

Variable interest rate owed on deposits

6

7

8

9

10

11

Spread on variable-rate payments

Combined total spread when using swap

1

1

1

1

1

1

3

3

3

3

3

3

If LIBOR is 7%, Phoenix's spread would be

% if unhedged and

% when hedged. Thus, hedging leads to a

spread.

higher

If LIBOR is 10%, Phoenix's spread would be

when LIBOR is 10%.

% if unhedged, and

% when hedged. Thus, hedging leads to a

spread

lower

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning